My Rationale: Keeping Amazon Stock After A 560% Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

My Rationale: Keeping Amazon Stock After a 560% Increase

Has Amazon's meteoric rise left you wondering if it's time to cash in? Many investors are grappling with this very question after witnessing a phenomenal 560% increase in Amazon stock (AMZN) over a period of years. But selling now might be a premature move. This article delves into the reasons why holding onto Amazon stock, despite its impressive gains, remains a viable, even strategic, long-term investment.

The Amazon Empire: More Than Just Online Retail

While Amazon began as an online bookstore, its transformation into a tech behemoth is undeniable. Its current portfolio extends far beyond e-commerce, encompassing:

- Amazon Web Services (AWS): A dominant player in cloud computing, AWS generates substantial revenue and consistently outperforms expectations. Its growth potential remains vast, fueling Amazon's overall valuation.

- Advertising: Amazon's advertising platform is rapidly becoming a major competitor to Google and Facebook, tapping into a massive user base and targeted advertising capabilities.

- Amazon Prime: The subscription service boasts tens of millions of members globally, providing recurring revenue and fostering customer loyalty. This ecosystem drives sales across various Amazon platforms.

- Physical Retail: Whole Foods Market acquisition and expansion of Amazon Go stores demonstrates a strategic move into brick-and-mortar retail, diversifying revenue streams and enhancing customer experience.

Why Hold On to Amazon Stock? Long-Term Growth Potential

The 560% increase is impressive, but it doesn't signal the end of Amazon's growth trajectory. Several factors justify maintaining a long-term position:

- Market Dominance and Brand Recognition: Amazon's brand recognition is unparalleled, giving it a significant competitive advantage across its diverse businesses. This translates to sustained customer loyalty and market share.

- Innovation and Expansion: Amazon consistently invests in research and development, continually expanding its offerings and exploring new markets. This proactive approach ensures its continued relevance and growth.

- Global Reach: Amazon operates globally, providing access to diverse markets and mitigating risks associated with economic downturns in specific regions. This geographical diversification is a key strength.

- Resilience During Economic Uncertainty: While not immune to market fluctuations, Amazon has historically demonstrated resilience during periods of economic uncertainty. Its diverse revenue streams help cushion the impact of external factors.

Considering the Risks: Diversification and Risk Management

While holding Amazon stock offers significant potential, it's crucial to acknowledge the risks:

- Market Volatility: The stock market is inherently volatile. Even strong companies like Amazon can experience price fluctuations.

- Competition: Increasing competition from other tech giants and emerging players poses a potential threat to Amazon's dominance in certain sectors.

- Regulatory Scrutiny: Amazon faces increasing regulatory scrutiny regarding antitrust concerns and labor practices. These challenges could impact its profitability and growth.

A Prudent Strategy: Diversification and Long-Term Vision

The key to successful investing lies in diversification. While maintaining a position in Amazon can be rewarding, it's advisable to diversify your portfolio across various asset classes and sectors to mitigate risk. Holding Amazon stock shouldn't be your sole investment strategy.

Conclusion: Holding onto Amazon stock after a 560% increase isn't necessarily a gamble. Amazon's diverse business model, strong brand recognition, and consistent innovation point towards a promising future. However, a balanced and diversified investment portfolio, combined with a long-term perspective, remains the most prudent approach. Consult with a financial advisor to determine the best investment strategy for your individual circumstances.

Keywords: Amazon stock, AMZN, Amazon investment, stock market, long-term investment, AWS, Amazon Web Services, diversification, investment strategy, risk management, tech stocks, online retail, cloud computing, Amazon Prime.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on My Rationale: Keeping Amazon Stock After A 560% Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Insufficient Compensation Bates Challenges Post Office Payment Offer

May 27, 2025

Insufficient Compensation Bates Challenges Post Office Payment Offer

May 27, 2025 -

Bank Of America Bac Stock Birmingham Capital Management Reduces Holdings

May 27, 2025

Bank Of America Bac Stock Birmingham Capital Management Reduces Holdings

May 27, 2025 -

New Music Explore Sirius Xms Dark Wave Playlist From Slicing Up Eyeballs May 25 2025

May 27, 2025

New Music Explore Sirius Xms Dark Wave Playlist From Slicing Up Eyeballs May 25 2025

May 27, 2025 -

Rising Temperatures Fuel The Spread Of A Dangerous Internal Parasitizing Fungus

May 27, 2025

Rising Temperatures Fuel The Spread Of A Dangerous Internal Parasitizing Fungus

May 27, 2025 -

Two Sigmas Bank Of America Bet 236 55 Million Investment Explained

May 27, 2025

Two Sigmas Bank Of America Bet 236 55 Million Investment Explained

May 27, 2025

Latest Posts

-

Home Heat Pump Installation Made Easy The Power Of Planning

May 30, 2025

Home Heat Pump Installation Made Easy The Power Of Planning

May 30, 2025 -

The Vatican And The Return Of Sacred Indigenous Belongings

May 30, 2025

The Vatican And The Return Of Sacred Indigenous Belongings

May 30, 2025 -

Twelve Year High Sellers Market Intensifies As Buyer Numbers Decline

May 30, 2025

Twelve Year High Sellers Market Intensifies As Buyer Numbers Decline

May 30, 2025 -

Gaza Humanitarian Crisis Raw Emotion At Un As Envoy Speaks Of Children

May 30, 2025

Gaza Humanitarian Crisis Raw Emotion At Un As Envoy Speaks Of Children

May 30, 2025 -

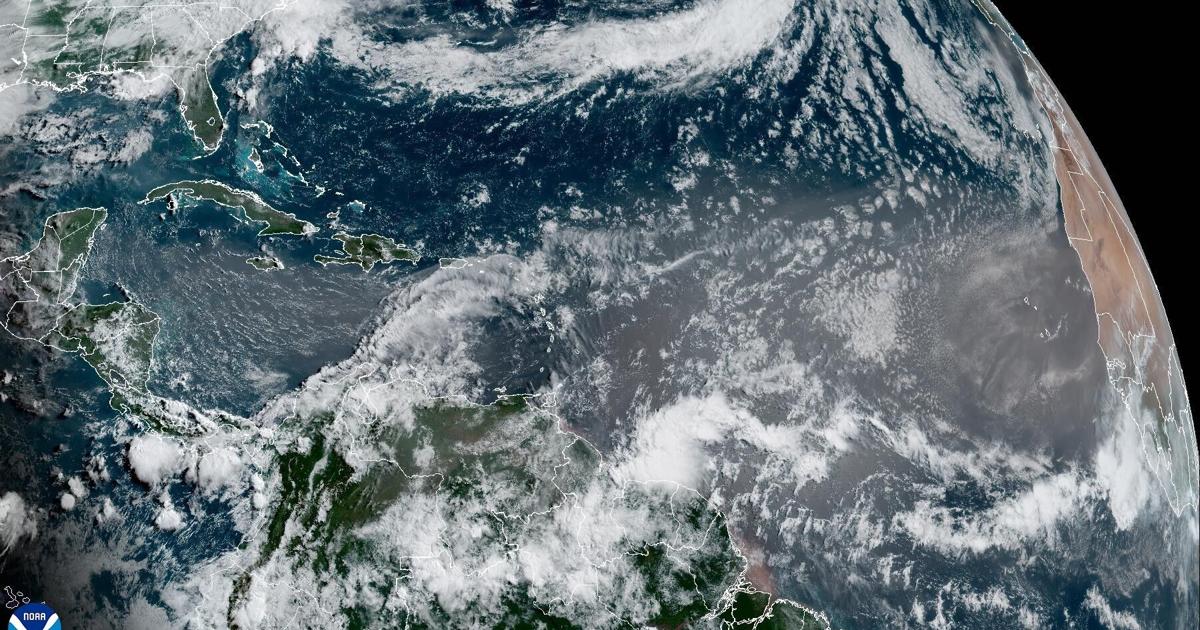

Saharan Dust Cloud To Impact Louisiana Sunset Forecast And Timing

May 30, 2025

Saharan Dust Cloud To Impact Louisiana Sunset Forecast And Timing

May 30, 2025