New Jobs Data Fuels Trump's Ire At Powell's Monetary Policy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

New Jobs Data Fuels Trump's Ire at Powell's Monetary Policy

Strong jobs report sparks renewed criticism of Federal Reserve Chair Jerome Powell's interest rate hikes.

The release of unexpectedly robust jobs data for July has reignited former President Donald Trump's criticism of Federal Reserve Chair Jerome Powell's monetary policy. The report, showing a significant increase in non-farm payroll employment, has fueled Trump's long-standing argument that Powell's interest rate hikes are harming the economy and stifling job growth. This latest outburst adds another layer to the ongoing political debate surrounding inflation and the Federal Reserve's role in managing the economy.

A Robust Report, a Renewed Attack

The July jobs report, released by the Bureau of Labor Statistics, revealed a far stronger-than-expected increase in employment. This positive economic indicator, typically celebrated, has instead become a point of contention for Trump, who has consistently blamed Powell for what he perceives as overly aggressive interest rate increases. He argues these increases are unnecessarily slowing economic growth and increasing the risk of a recession, directly contradicting the positive employment figures.

Trump's criticism, voiced through various social media platforms and interviews, accuses Powell of deliberately sabotaging the economy to hurt his political legacy. He alleges the policy is designed to dampen positive economic indicators before the upcoming presidential election, a claim vehemently denied by the Federal Reserve.

The Powell Defense and Economic Context

The Federal Reserve maintains that its interest rate hikes are necessary to combat inflation and bring it down to its target level of 2%. While acknowledging the potential for short-term economic slowdown, Powell and the Fed argue that controlling inflation is crucial for long-term economic stability and sustainable job growth. The current inflation rate, although showing signs of moderation, remains above the Fed's target.

The complexities of monetary policy are often difficult for the public to grasp. Understanding the intricate interplay between interest rates, inflation, unemployment, and economic growth requires a nuanced understanding of macroeconomic principles. While the July jobs report is positive, it doesn't necessarily negate the need for continued caution in managing inflation. Experts point out that sustained high inflation can erode purchasing power and destabilize the economy in the long run.

Political Implications and the Road Ahead

Trump's renewed attacks on Powell carry significant political weight. With the 2024 presidential election looming, the debate over economic policy is expected to intensify. The differing views on the effectiveness of the Federal Reserve's actions will undoubtedly feature prominently in the upcoming election cycle. Trump’s criticism could influence public perception of the Fed's decisions and potentially impact the future direction of monetary policy, depending on the outcome of the election.

Further Reading:

Conclusion:

The strong July jobs report has unexpectedly become a battleground in the ongoing political debate surrounding the Federal Reserve's monetary policy. While the report paints a positive picture of employment, it also fuels the already contentious discussion about inflation and the appropriate course of action for the central bank. The coming months will likely see further debate on this critical issue as the economic landscape continues to evolve.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on New Jobs Data Fuels Trump's Ire At Powell's Monetary Policy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Oklahoma City Thunder Re Signs Josh Giddey Contract Details Revealed

Sep 10, 2025

Oklahoma City Thunder Re Signs Josh Giddey Contract Details Revealed

Sep 10, 2025 -

Charlotte Light Rail Crime Video Of Fatal Stabbing Highlights Safety Concerns For Refugees

Sep 10, 2025

Charlotte Light Rail Crime Video Of Fatal Stabbing Highlights Safety Concerns For Refugees

Sep 10, 2025 -

Bbcs Master Chef Gets New Judging Duo Dent And Haugh Take Over

Sep 10, 2025

Bbcs Master Chef Gets New Judging Duo Dent And Haugh Take Over

Sep 10, 2025 -

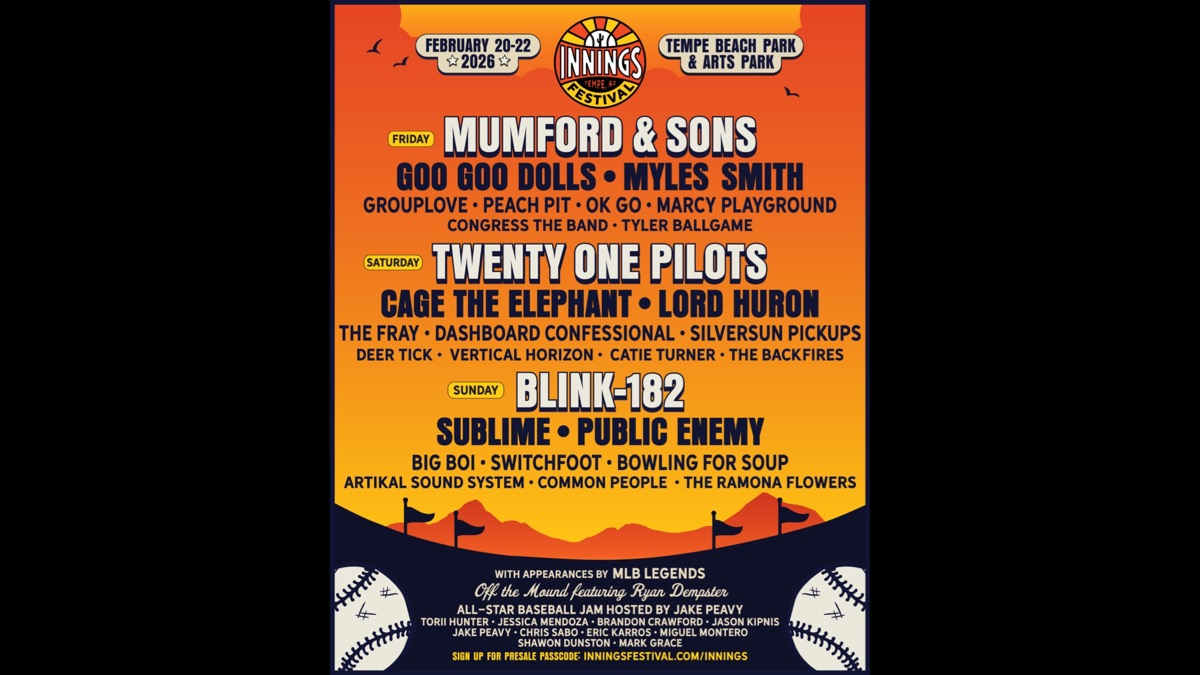

Innings Festival 2026 Get Ready For Blink 182 Twenty One Pilots And Mumford And Sons

Sep 10, 2025

Innings Festival 2026 Get Ready For Blink 182 Twenty One Pilots And Mumford And Sons

Sep 10, 2025 -

New Zealand Father Missing Tom Phillips Four Year Search Unveiled

Sep 10, 2025

New Zealand Father Missing Tom Phillips Four Year Search Unveiled

Sep 10, 2025

Latest Posts

-

Billionaire Ceo Feds Monetary Policy Is A Dangerous Attack

Sep 10, 2025

Billionaire Ceo Feds Monetary Policy Is A Dangerous Attack

Sep 10, 2025 -

Analyzing Tuchels World Cup Game Plan A Focus On Aerial Play

Sep 10, 2025

Analyzing Tuchels World Cup Game Plan A Focus On Aerial Play

Sep 10, 2025 -

Supreme Court To Decide On Trumps Plan For Massive Foreign Aid Cuts

Sep 10, 2025

Supreme Court To Decide On Trumps Plan For Massive Foreign Aid Cuts

Sep 10, 2025 -

World Cup 2023 Deconstructing Thomas Tuchels Playing Style

Sep 10, 2025

World Cup 2023 Deconstructing Thomas Tuchels Playing Style

Sep 10, 2025 -

Usmnt Vs Japan Kickoff Time Live Stream Details And Preview

Sep 10, 2025

Usmnt Vs Japan Kickoff Time Live Stream Details And Preview

Sep 10, 2025