Over $5 Billion Inflows: Bitcoin ETF Investment Surge Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Over $5 Billion Inflows: Bitcoin ETF Investment Surge Explained

The cryptocurrency market is buzzing with excitement following a massive surge in Bitcoin ETF investments, exceeding a staggering $5 billion in inflows. This unprecedented influx of capital signifies a monumental shift in investor sentiment, marking a potential turning point for Bitcoin's mainstream adoption and solidifying its position as a significant asset class. But what's driving this remarkable surge? Let's delve into the key factors fueling this investment frenzy.

The Rise of Bitcoin ETFs: A Catalyst for Mainstream Adoption

The recent approval of several Bitcoin Exchange-Traded Funds (ETFs) in major markets like the United States has been the primary catalyst for this investment boom. ETFs offer a regulated and accessible pathway for institutional and retail investors to gain exposure to Bitcoin without the complexities of directly purchasing and storing the cryptocurrency. This ease of access is a game-changer, attracting a broader range of investors who were previously hesitant to navigate the often-challenging world of digital asset trading.

Why the Sudden Influx? A Multifaceted Explanation

Several factors contribute to this significant investment inflow:

-

Increased Regulatory Clarity: The approval of Bitcoin ETFs signals a growing acceptance of cryptocurrencies by regulatory bodies. This reduced regulatory uncertainty encourages institutional investors, who often require a clear regulatory framework before committing significant capital, to enter the market.

-

Institutional Investor Confidence: Large institutional investors, including hedge funds and pension funds, are increasingly incorporating Bitcoin into their portfolios. The availability of ETFs provides a comfortable and familiar investment vehicle for these players, further driving up demand.

-

Inflation Hedge Narrative: Bitcoin's limited supply and decentralized nature continue to position it as a potential hedge against inflation. With persistent inflationary pressures globally, investors are seeking alternative assets to preserve their purchasing power, leading to increased demand for Bitcoin.

-

Growing Market Maturity: The cryptocurrency market has matured significantly over the past few years. Improved infrastructure, enhanced security measures, and the emergence of robust custodial solutions have made Bitcoin investment more appealing to risk-averse investors.

Beyond the Numbers: What This Means for the Future

The over $5 billion inflow into Bitcoin ETFs represents more than just a market fluctuation; it's a powerful indicator of a broader trend. This influx of capital could:

- Boost Bitcoin's Price: Increased demand naturally puts upward pressure on the price of Bitcoin. While price volatility remains inherent, this massive inflow suggests a sustained upward trajectory.

- Attract Further Institutional Investment: The success of Bitcoin ETFs could encourage even more institutional investors to allocate capital to the cryptocurrency market.

- Accelerate Mainstream Adoption: The increased accessibility offered by ETFs will likely accelerate Bitcoin's adoption among everyday investors, furthering its mainstream integration.

Looking Ahead: Navigating the Volatility

While the current trend is positive, it's crucial to remember that the cryptocurrency market is inherently volatile. Investors should always conduct thorough research and understand the risks associated with Bitcoin investment before committing capital. Diversification is key to mitigating potential losses.

Further Reading: For more in-depth analysis on Bitcoin ETFs and the cryptocurrency market, you might find these resources helpful: [Link to a reputable financial news source] and [Link to a cryptocurrency analysis website].

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Over $5 Billion Inflows: Bitcoin ETF Investment Surge Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Yahir Y Victor Garcia Dueto Inesperado De Otra Vez En Juego De Voces 2025

May 20, 2025

Yahir Y Victor Garcia Dueto Inesperado De Otra Vez En Juego De Voces 2025

May 20, 2025 -

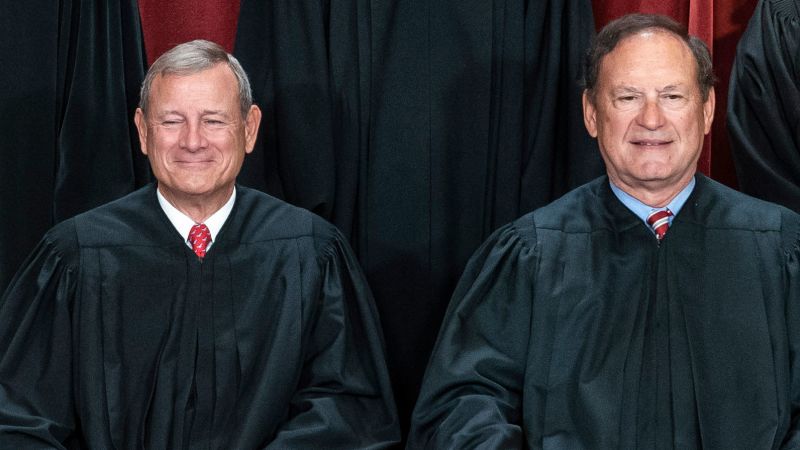

The Enduring Legacy Of Justices Alito And Roberts Three Decades Of Influence

May 20, 2025

The Enduring Legacy Of Justices Alito And Roberts Three Decades Of Influence

May 20, 2025 -

California Mountain Rescue Hiker Tiffany Slaton Recounts Her Survival

May 20, 2025

California Mountain Rescue Hiker Tiffany Slaton Recounts Her Survival

May 20, 2025 -

Tragic Railroad Accident Two Adults Killed Children Injured One Missing

May 20, 2025

Tragic Railroad Accident Two Adults Killed Children Injured One Missing

May 20, 2025 -

Improving Tourist Behavior In Bali A Call For International Support

May 20, 2025

Improving Tourist Behavior In Bali A Call For International Support

May 20, 2025

Latest Posts

-

Three Decades Of Influence A Look At Justices Alito And Roberts

May 20, 2025

Three Decades Of Influence A Look At Justices Alito And Roberts

May 20, 2025 -

Snl Concludes 50th Season With Historic Ratings Success

May 20, 2025

Snl Concludes 50th Season With Historic Ratings Success

May 20, 2025 -

Addressing Bad Tourist Behavior Bali Implements New Regulations

May 20, 2025

Addressing Bad Tourist Behavior Bali Implements New Regulations

May 20, 2025 -

Buy Now Pay Later New Rules Designed To Safeguard Consumers

May 20, 2025

Buy Now Pay Later New Rules Designed To Safeguard Consumers

May 20, 2025 -

Peaky Blinders To Return Creator Reveals Key Changes For Upcoming Season

May 20, 2025

Peaky Blinders To Return Creator Reveals Key Changes For Upcoming Season

May 20, 2025