Over $5 Billion Invested In Bitcoin ETFs: Analyzing The Bold Market Bets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Over $5 Billion Invested in Bitcoin ETFs: Analyzing the Bold Market Bets

The cryptocurrency market is buzzing with excitement as investments in Bitcoin exchange-traded funds (ETFs) recently surpassed the $5 billion mark. This significant influx of capital signals a growing institutional confidence in Bitcoin and its potential as a mainstream asset. But what does this monumental investment truly mean for the future of Bitcoin and the broader financial landscape? Let's delve into the details and analyze these bold market bets.

The Rise of Bitcoin ETFs:

The approval of the first Bitcoin futures ETF in the US in 2021 marked a turning point. While not directly investing in Bitcoin itself, these ETFs provided a regulated and accessible entry point for institutional investors hesitant to navigate the complexities of the cryptocurrency market directly. The recent surge in investment reflects a growing comfort level with this asset class and a belief in Bitcoin's long-term potential. This is further evidenced by the increasing number of applications for spot Bitcoin ETFs currently under review by regulatory bodies. The approval of a spot Bitcoin ETF would likely unleash an even greater wave of investment.

Who's Betting Big on Bitcoin?

The $5 billion figure represents investments from a diverse range of players, including:

- Institutional Investors: Large hedge funds, pension funds, and asset management firms are increasingly allocating a portion of their portfolios to Bitcoin, viewing it as a potential hedge against inflation and a diversification strategy.

- High-Net-Worth Individuals (HNWIs): Wealthy individuals are seeking alternative investment opportunities beyond traditional markets, and Bitcoin's perceived potential for high returns is attracting significant interest.

- Retail Investors: While institutional investment dominates the headlines, retail investors continue to participate, driven by both speculation and a belief in Bitcoin's underlying technology, blockchain.

Analyzing the Bold Bets:

The substantial investment in Bitcoin ETFs is a bold move, driven by several factors:

- Inflation Hedge: Many investors see Bitcoin as a potential hedge against inflation, particularly in the face of persistent global economic uncertainty. Its limited supply acts as a deflationary force, potentially preserving purchasing power during inflationary periods.

- Technological Innovation: The underlying blockchain technology powering Bitcoin is considered disruptive and transformative, with potential applications beyond cryptocurrency.

- Increasing Regulatory Clarity: While regulatory uncertainty remains, the gradual acceptance of Bitcoin by regulatory bodies worldwide contributes to increased investor confidence. The ongoing regulatory scrutiny is pushing for greater transparency and accountability within the cryptocurrency market.

Risks and Considerations:

While the outlook seems positive, it's crucial to acknowledge the inherent risks associated with Bitcoin investment:

- Volatility: Bitcoin's price is notoriously volatile, subject to significant swings driven by market sentiment, regulatory changes, and technological developments.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, and unexpected changes could negatively impact investment returns.

- Security Risks: Cryptocurrency exchanges and wallets are susceptible to hacking and theft, posing significant risks to investors.

The Future of Bitcoin ETFs:

The future of Bitcoin ETFs is bright, with significant potential for growth. The continued approval of new ETFs, coupled with increasing institutional adoption, is likely to drive further investment. However, it's crucial for investors to proceed with caution, carefully weighing the potential rewards against the associated risks. Conduct thorough research, understand the technology, and diversify your investment portfolio to mitigate potential losses. Remember to consult with a qualified financial advisor before making any investment decisions.

Call to Action: Stay informed about the latest developments in the cryptocurrency market by following reputable news sources and financial analysts. Understanding the nuances of Bitcoin and its associated risks is crucial for making informed investment decisions. Learn more about [link to a relevant resource, e.g., a reputable financial news website].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Over $5 Billion Invested In Bitcoin ETFs: Analyzing The Bold Market Bets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

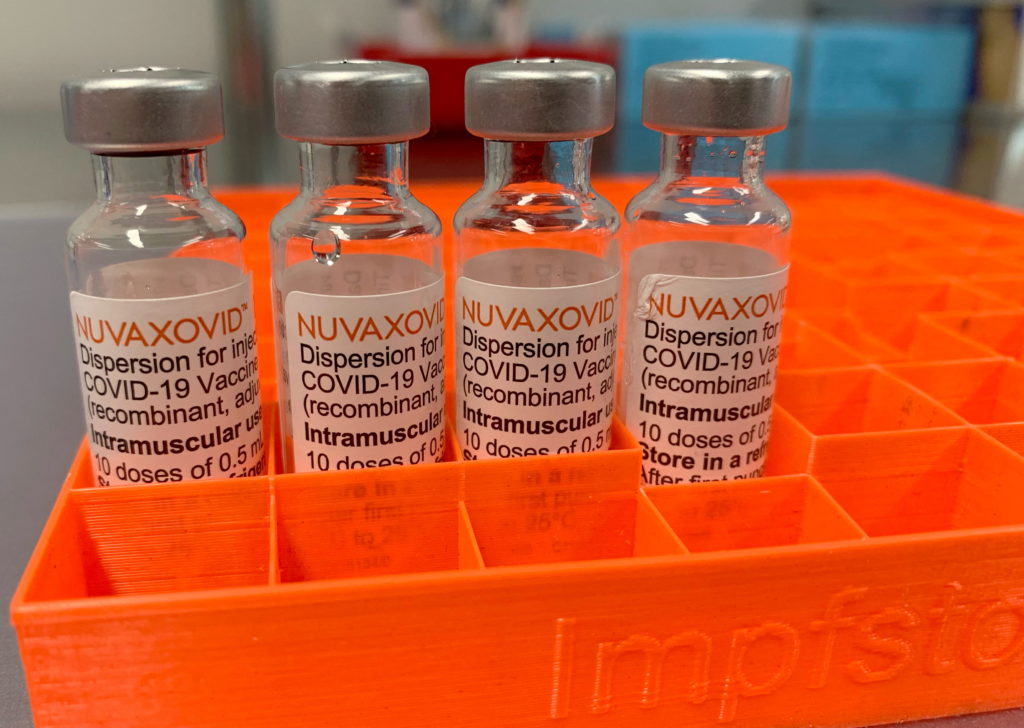

Fda Approves Novavax Covid 19 Vaccine Use Restricted

May 20, 2025

Fda Approves Novavax Covid 19 Vaccine Use Restricted

May 20, 2025 -

Stricter Regulations For Tourists In Bali Addressing Negative Impacts

May 20, 2025

Stricter Regulations For Tourists In Bali Addressing Negative Impacts

May 20, 2025 -

Australian Body Horror Film And Eurovision Upset A Week In Review

May 20, 2025

Australian Body Horror Film And Eurovision Upset A Week In Review

May 20, 2025 -

Co Pilots Medical Emergency Causes 10 Minute Pilotless Lufthansa Flight Full Report

May 20, 2025

Co Pilots Medical Emergency Causes 10 Minute Pilotless Lufthansa Flight Full Report

May 20, 2025 -

Water Voles In Wales A Glitter Based Conservation Effort

May 20, 2025

Water Voles In Wales A Glitter Based Conservation Effort

May 20, 2025

Latest Posts

-

Understanding Femicide Statistics Trends And Prevention Strategies

May 20, 2025

Understanding Femicide Statistics Trends And Prevention Strategies

May 20, 2025 -

A Third Decade Dawns Assessing The Judicial Records Of Justices Alito And Roberts

May 20, 2025

A Third Decade Dawns Assessing The Judicial Records Of Justices Alito And Roberts

May 20, 2025 -

Cyberattack On Legal Aid Exposes Sensitive Client Information

May 20, 2025

Cyberattack On Legal Aid Exposes Sensitive Client Information

May 20, 2025 -

The Plight Of The Water Vole Is Glitter The Answer For Wales

May 20, 2025

The Plight Of The Water Vole Is Glitter The Answer For Wales

May 20, 2025 -

Big Change Incoming New Peaky Blinders Series Officially Confirmed

May 20, 2025

Big Change Incoming New Peaky Blinders Series Officially Confirmed

May 20, 2025