Over $5 Billion Invested In Bitcoin ETFs: Driving Forces And Future Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Over $5 Billion Invested in Bitcoin ETFs: Driving Forces and Future Outlook

The world of finance is buzzing. Over $5 billion has already flowed into Bitcoin exchange-traded funds (ETFs), marking a significant milestone for cryptocurrency adoption within traditional financial markets. This surge represents a watershed moment, signaling a growing acceptance of Bitcoin as a legitimate asset class and prompting crucial questions about the driving forces behind this investment boom and what the future holds.

The Irresistible Rise of Bitcoin ETFs:

The launch of the first Bitcoin futures ETF in the US in 2021 opened the floodgates. Previously, investors seeking exposure to Bitcoin often relied on less regulated and more volatile avenues like directly purchasing Bitcoin through exchanges. ETFs, however, offer a more accessible and regulated entry point, attracting a broader range of investors, including institutional players hesitant to navigate the complexities of the cryptocurrency market directly. This increased accessibility is a key factor driving the massive investment.

Driving Forces Behind the $5 Billion Surge:

Several factors have fueled this unprecedented growth in Bitcoin ETF investments:

-

Increased Institutional Adoption: Large financial institutions, initially skeptical, are increasingly incorporating Bitcoin into their portfolios, viewing it as a potential hedge against inflation and a diversifier within traditional asset classes. This institutional interest has lent credibility and stability to the market, encouraging further investment.

-

Regulatory Clarity (in some jurisdictions): While regulatory landscapes still vary significantly across the globe, the approval of Bitcoin futures ETFs in key markets like the US has provided a degree of regulatory clarity, reducing uncertainty and attracting risk-averse investors. However, the ongoing regulatory debate surrounding spot Bitcoin ETFs remains a significant factor.

-

Growing Mainstream Acceptance: The increasing mainstream awareness and acceptance of Bitcoin as a digital asset, fueled by media coverage and technological advancements, has contributed to the growing investor confidence. This positive perception is slowly but surely dismantling the stigma once associated with cryptocurrencies.

-

Inflation Hedge Potential: With global inflation remaining a concern, many investors are seeking alternative assets to protect their purchasing power. Bitcoin, with its limited supply, is often considered a potential hedge against inflation, further driving demand for Bitcoin ETFs.

The Future Outlook: Challenges and Opportunities:

While the current investment figures are impressive, the future outlook for Bitcoin ETFs is not without challenges:

-

Regulatory Uncertainty: The ongoing regulatory debates surrounding spot Bitcoin ETFs, particularly in major markets, create uncertainty and could impact future investment flows. Different jurisdictions have varying approaches, creating a complex regulatory landscape.

-

Market Volatility: Bitcoin's inherent volatility remains a significant risk factor. While ETFs provide a degree of access and security, they are not immune to market fluctuations. Investors need to remain aware of this inherent risk.

-

Competition: The ETF market is competitive, and the emergence of new players and innovative products could influence investment patterns.

Despite these challenges, the future for Bitcoin ETFs appears promising. Continued institutional adoption, increasing regulatory clarity (where possible), and growing mainstream acceptance will likely drive further investment. The $5 billion mark is just the beginning; we can expect to see further substantial growth in the coming years, although the pace may fluctuate depending on market conditions and regulatory developments.

Call to Action: Stay informed about regulatory updates and market trends to make informed investment decisions. Consult with a financial advisor before investing in any cryptocurrency-related products. Understanding the risks involved is crucial.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Over $5 Billion Invested In Bitcoin ETFs: Driving Forces And Future Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lufthansa Flight Operated Without Pilot For 10 Minutes Following Co Pilots Collapse Official Report

May 21, 2025

Lufthansa Flight Operated Without Pilot For 10 Minutes Following Co Pilots Collapse Official Report

May 21, 2025 -

200 Million In Ethereum Funds Investor Confidence Soars After Pectra

May 21, 2025

200 Million In Ethereum Funds Investor Confidence Soars After Pectra

May 21, 2025 -

St Louis Tornado A Communitys Fight For Recovery In The Wake Of Disaster

May 21, 2025

St Louis Tornado A Communitys Fight For Recovery In The Wake Of Disaster

May 21, 2025 -

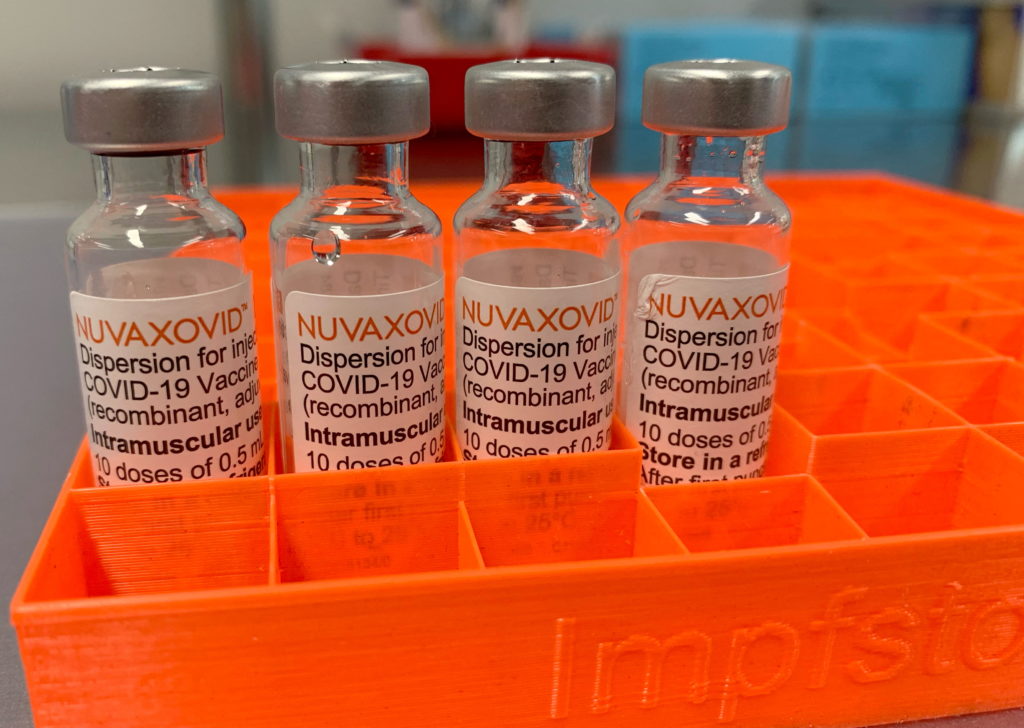

Novavax Covid 19 Vaccine Gets Fda Nod But With Significant Caveats

May 21, 2025

Novavax Covid 19 Vaccine Gets Fda Nod But With Significant Caveats

May 21, 2025 -

Train Strikes Family On Railroad Bridge Two Adults Killed Children Injured

May 21, 2025

Train Strikes Family On Railroad Bridge Two Adults Killed Children Injured

May 21, 2025

Latest Posts

-

Ny Ag Letitia James Trump Lawsuits And Doj Real Estate Fraud Probe Clash

May 21, 2025

Ny Ag Letitia James Trump Lawsuits And Doj Real Estate Fraud Probe Clash

May 21, 2025 -

Netflix Welcomes Sesame Street Following Trump Administration Funding Cuts

May 21, 2025

Netflix Welcomes Sesame Street Following Trump Administration Funding Cuts

May 21, 2025 -

Costa Rican Prison Drug Smuggling Cats Role Revealed

May 21, 2025

Costa Rican Prison Drug Smuggling Cats Role Revealed

May 21, 2025 -

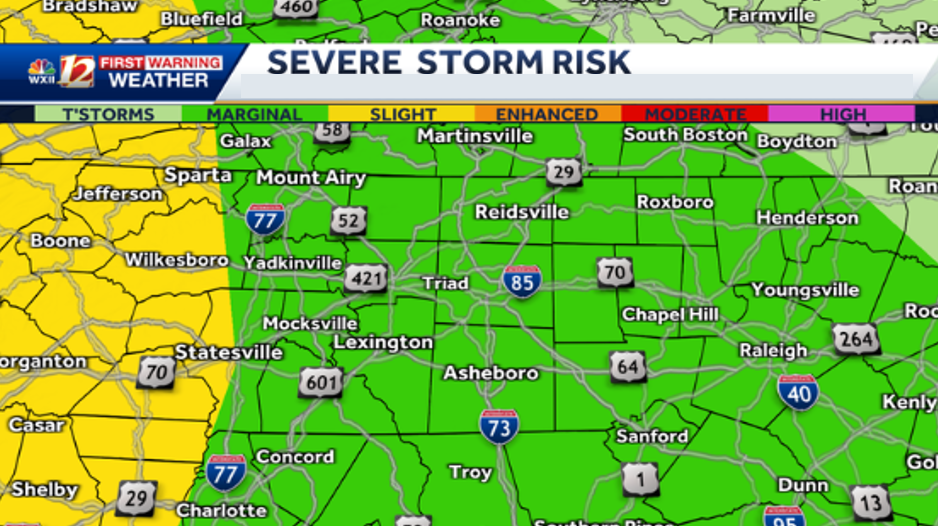

Heavy Rain And Severe Storms Expected Overnight In North Carolina

May 21, 2025

Heavy Rain And Severe Storms Expected Overnight In North Carolina

May 21, 2025 -

No Animal Deaths In Assassins Creed Valhalla Ubisofts Reasoning

May 21, 2025

No Animal Deaths In Assassins Creed Valhalla Ubisofts Reasoning

May 21, 2025