Public Sector Borrowing: April's Results Show Significant Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Public Sector Borrowing Soars in April: A Deeper Dive into the Figures

The UK's public sector borrowing figures for April have been released, revealing a significant increase compared to the same month last year. This unexpected surge has sparked concern amongst economists and raised questions about the government's fiscal strategy. The figures, released by the Office for National Statistics (ONS), paint a worrying picture of the nation's finances and highlight the challenges ahead.

April's Shocking Numbers: A Record High?

April saw public sector net borrowing reach £22.7 billion, a substantial increase compared to the £1.6 billion borrowed in April 2022. This represents the second-highest April borrowing figure on record, second only to the figure recorded during the height of the COVID-19 pandemic. The substantial increase is attributed to a combination of factors, including higher government spending and lower-than-expected tax revenues.

Key Factors Contributing to the Rise:

Several factors contributed to this alarming increase in public sector borrowing:

- Increased Government Spending: Increased spending across various departments, including health and social care, significantly impacted the overall borrowing figure. Pressure on public services continues to drive up expenditure.

- Lower-Than-Expected Tax Revenues: Tax revenues fell short of projections, largely attributed to a slowdown in economic growth and inflationary pressures impacting consumer spending. This decline in tax income directly impacted the government's ability to balance its budget.

- Inflation's Impact: High inflation has increased the cost of government borrowing, making it more expensive for the government to finance its spending. This inflationary environment adds further pressure to already strained public finances.

What This Means for the UK Economy:

The substantial increase in public sector borrowing raises serious concerns about the UK's long-term economic stability. It signals a widening fiscal deficit and potentially points towards the need for further austerity measures or tax increases in the future. This could have significant implications for consumers and businesses alike.

Government Response and Future Outlook:

The government has yet to issue a detailed response to these figures, but it's likely that further announcements and policy adjustments are on the horizon. Economists are divided on the best course of action, with some suggesting targeted spending cuts and others advocating for tax increases to bridge the fiscal gap. The ongoing economic uncertainty makes predicting the future trajectory of public sector borrowing challenging.

Looking Ahead: Analyzing the Implications

The increased public sector borrowing highlights the need for careful financial management and strategic policy decisions. The government will need to carefully balance the need for public services with the need to control borrowing and reduce the national debt. Further analysis of the underlying economic factors driving this increase is crucial for formulating effective and sustainable fiscal policies. The coming months will be critical in determining the government's response and the overall impact on the UK economy. We will continue to monitor the situation and provide updates as they become available. Stay tuned for further analysis and expert commentary on this developing story.

Keywords: Public sector borrowing, UK economy, government spending, tax revenue, inflation, fiscal deficit, national debt, ONS, economic growth, austerity measures, fiscal policy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Public Sector Borrowing: April's Results Show Significant Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Google Veo 3 Ai Video Generator With Audio Integration

May 23, 2025

Google Veo 3 Ai Video Generator With Audio Integration

May 23, 2025 -

Actor George Wendt Iconic Cheers Character Norm Dead At 76

May 23, 2025

Actor George Wendt Iconic Cheers Character Norm Dead At 76

May 23, 2025 -

Ms Rachel And 3 Year Old Gaza Amputee Sing Together A Cnn Story

May 23, 2025

Ms Rachel And 3 Year Old Gaza Amputee Sing Together A Cnn Story

May 23, 2025 -

Are Classic South Park Episodes At Risk Due To Streaming Migration

May 23, 2025

Are Classic South Park Episodes At Risk Due To Streaming Migration

May 23, 2025 -

Gaza Child Double Amputee Sings With You Tube Star Ms Rachel A Heartwarming Story

May 23, 2025

Gaza Child Double Amputee Sings With You Tube Star Ms Rachel A Heartwarming Story

May 23, 2025

Latest Posts

-

New Apple Offer Free Upgrade For All I Phone 13 Users

May 23, 2025

New Apple Offer Free Upgrade For All I Phone 13 Users

May 23, 2025 -

Six Essential I Os 18 5 Setup Steps For I Phone Users

May 23, 2025

Six Essential I Os 18 5 Setup Steps For I Phone Users

May 23, 2025 -

Unveiling The Power Of I Os 18 5 6 Practical Intelligence Features

May 23, 2025

Unveiling The Power Of I Os 18 5 6 Practical Intelligence Features

May 23, 2025 -

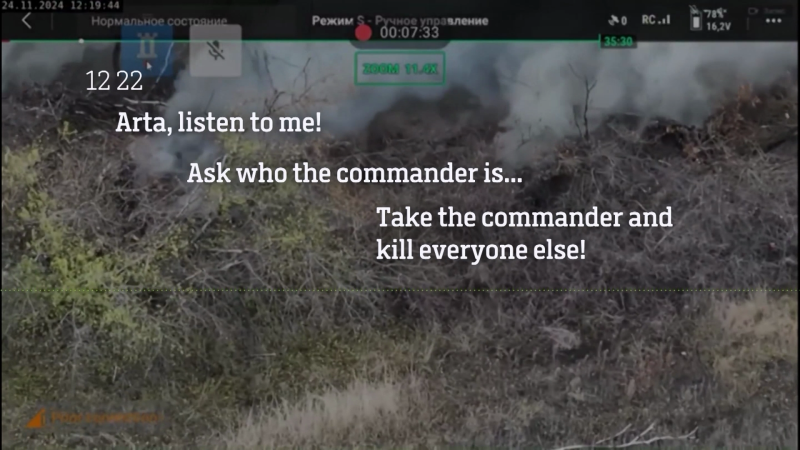

Leaked Russian Radio Transmissions Reveal Brutal Order Kill Everyone Else

May 23, 2025

Leaked Russian Radio Transmissions Reveal Brutal Order Kill Everyone Else

May 23, 2025 -

Analysis Government Borrowing Higher Than Expected In April

May 23, 2025

Analysis Government Borrowing Higher Than Expected In April

May 23, 2025