RBA Holds Rates Steady: Awaiting Further Inflation Data In Australia

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

RBA Holds Rates Steady: Awaiting Further Inflation Data in Australia

Australia's central bank, the Reserve Bank of Australia (RBA), has opted to hold the official cash rate steady at 4.1%, marking a pause in its aggressive tightening cycle. This decision, announced on [Date of announcement], comes as the RBA carefully assesses the impact of previous rate hikes and awaits crucial inflation data due later this month. The move has sent ripples through the Australian financial markets, sparking debate about the future direction of monetary policy.

A Strategic Pause, Not a Pivot?

The RBA's decision to maintain the cash rate isn't necessarily a sign that the tightening phase is over. Governor Philip Lowe emphasized the bank's commitment to returning inflation to the 2-3% target range. He highlighted the need for further observation of the economy's response to previous rate increases and the upcoming inflation figures. This suggests a strategic pause to assess the effectiveness of past actions, rather than a complete pivot towards easing monetary policy. The RBA's statement clearly indicates that further rate increases remain a possibility depending on the incoming economic data.

What Factors Influenced the Decision?

Several key factors contributed to the RBA's decision to hold rates:

- Recent Inflation Data: While inflation remains stubbornly high, recent figures showed a slight easing. However, this moderation isn't considered substantial enough to warrant a confident declaration of victory over inflation.

- Impact of Previous Rate Hikes: The full impact of previous interest rate increases is yet to be fully felt across the Australian economy. The RBA wants to observe the lagged effects on household spending and investment before making further decisions.

- Global Economic Uncertainty: The ongoing global economic uncertainty, including concerns about potential recessions in major economies, adds another layer of complexity to the RBA's decision-making process. A global slowdown could impact Australia's economy and influence inflation trajectories.

- Housing Market Slowdown: The Australian housing market has shown signs of cooling, a direct consequence of the RBA's previous rate hikes. This softening of the housing market is a factor the RBA is carefully considering.

What Happens Next? The Importance of Upcoming Data

The RBA's next move hinges heavily on the upcoming inflation data, scheduled for release on [Date of inflation data release]. Economists and market analysts are closely watching this data, as it will provide crucial insights into the effectiveness of past rate hikes and guide the RBA's future policy decisions. A significant upward surprise in inflation could trigger another rate increase, while a further easing could pave the way for a prolonged pause or even potential rate cuts in the future.

Implications for Australian Consumers and Businesses

The RBA's decision to hold rates steady provides some short-term relief for Australian households and businesses grappling with higher borrowing costs. However, the uncertainty surrounding future rate movements persists. Consumers should continue to manage their finances prudently, considering the potential for further rate increases down the line. Businesses need to remain adaptable and monitor economic conditions closely to navigate this period of uncertainty.

In conclusion, the RBA's decision to hold rates is a calculated pause, not a signal of victory over inflation. The upcoming inflation data will be crucial in shaping the future trajectory of monetary policy in Australia. Stay tuned for further updates and analysis as the economic landscape unfolds. For more in-depth analysis, explore resources like the RBA's official website [link to RBA website] and reputable financial news outlets.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on RBA Holds Rates Steady: Awaiting Further Inflation Data In Australia. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rba Holds Rates Steady Await Inflation Data Before Next Move

Jul 09, 2025

Rba Holds Rates Steady Await Inflation Data Before Next Move

Jul 09, 2025 -

Texas Flood Disaster Assessing The Effectiveness Of Emergency Alerts

Jul 09, 2025

Texas Flood Disaster Assessing The Effectiveness Of Emergency Alerts

Jul 09, 2025 -

Neillsville Woman Sentenced For Tampering With Lottery Tickets

Jul 09, 2025

Neillsville Woman Sentenced For Tampering With Lottery Tickets

Jul 09, 2025 -

Texas Floods Failure To Warn Examining The Response

Jul 09, 2025

Texas Floods Failure To Warn Examining The Response

Jul 09, 2025 -

Us Travelers Why Choose Air Canada And Aeroplan

Jul 09, 2025

Us Travelers Why Choose Air Canada And Aeroplan

Jul 09, 2025

Latest Posts

-

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025 -

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025 -

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025 -

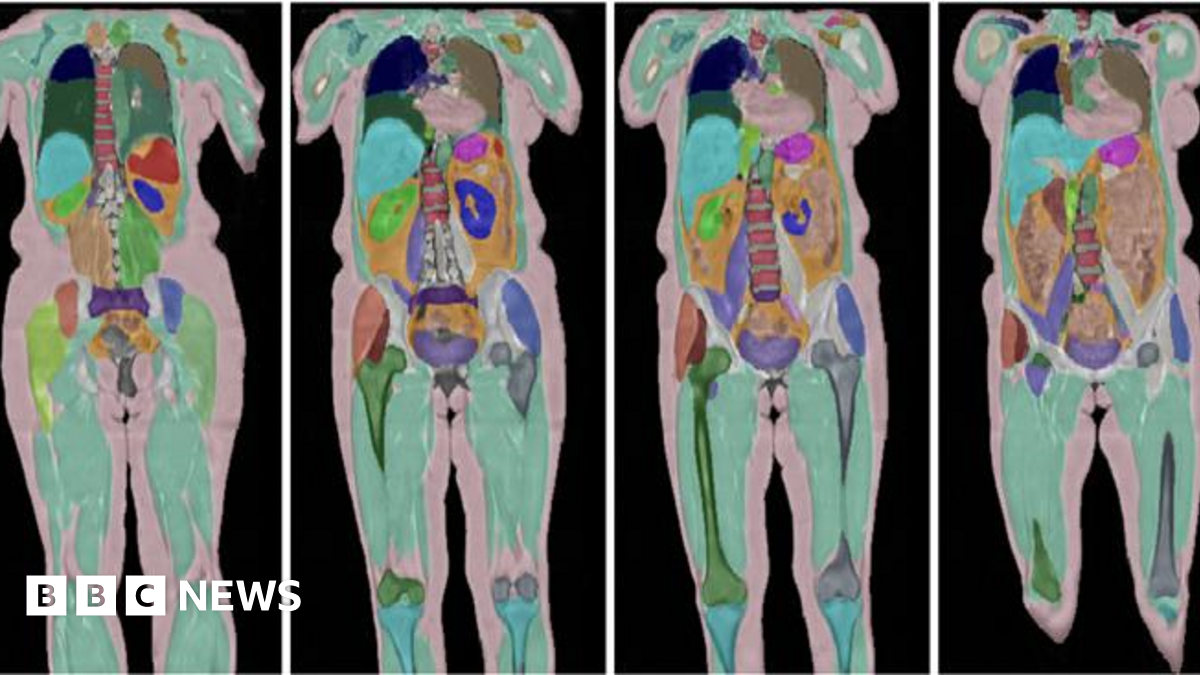

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025 -

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025