Recession Risk & Retirement: Preparing Your Savings For A Potential 2025 Tourism Slump

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Recession Risk & Retirement: Preparing Your Savings for a Potential 2025 Tourism Slump

The global economy is facing headwinds, and whispers of a potential recession in 2025 are growing louder. For those nearing retirement or already enjoying their golden years, this uncertainty presents a significant concern, particularly given the vital role tourism plays in many economies and retirement plans. A downturn in the tourism sector could ripple through various investment portfolios, impacting retirement savings significantly. This article explores the potential risks and offers practical strategies to protect your retirement nest egg.

The Tourism Sector: A Vulnerable Giant

The tourism industry, a massive global economic engine, is highly susceptible to economic downturns. Travel is often one of the first discretionary expenses people cut back on during periods of economic instability. A 2025 tourism slump could dramatically impact airline stocks, hotel chains, and related businesses, potentially impacting investment portfolios relying on these sectors. This vulnerability necessitates proactive measures to safeguard retirement savings.

How a Recession Could Affect Your Retirement

A recession, particularly one impacting the tourism sector, could manifest in several ways for retirees:

- Reduced Investment Returns: Falling stock prices in tourism-related companies and overall market volatility can significantly reduce the value of your retirement investments.

- Increased Healthcare Costs: Economic downturns often lead to increased healthcare costs, potentially straining retirement budgets.

- Fixed-Income Challenges: Retirees relying heavily on fixed-income investments may find their purchasing power eroded by inflation if interest rates don't keep pace.

- Job Losses (for those still working): Even those still working part-time to supplement their retirement income face potential job losses during a recession, jeopardizing their savings.

Strategies to Protect Your Retirement Savings

Preparing for a potential 2025 recession requires a multi-pronged approach:

1. Diversify Your Investments: Don't put all your eggs in one basket. Diversifying your investment portfolio across various asset classes (stocks, bonds, real estate, etc.) can mitigate risk. Consider reducing exposure to sectors heavily reliant on tourism.

2. Review Your Retirement Plan: Consult with a financial advisor to review your retirement plan and adjust your asset allocation based on your risk tolerance and time horizon. Consider shifting some assets to more conservative options.

3. Build an Emergency Fund: Having a substantial emergency fund (ideally 3-6 months' worth of living expenses) is crucial to weather any financial storm. This buffer will protect you from unexpected expenses and prevent you from dipping into your retirement savings.

4. Monitor Your Spending: Develop a realistic budget and stick to it. Track your expenses and identify areas where you can potentially cut back. This responsible spending will stretch your retirement funds further.

5. Consider Delaying Retirement (If Possible): If you are still working and approaching retirement age, consider delaying your retirement by a few years to build a stronger financial foundation and weather the potential recession.

6. Explore Part-Time Opportunities: Even after retirement, supplementing your income with part-time work can provide additional financial security during uncertain economic times.

Conclusion: Proactive Planning is Key

While predicting the future is impossible, preparing for potential economic downturns is crucial for a secure retirement. By diversifying your investments, building an emergency fund, and regularly reviewing your financial plan, you can significantly reduce the impact of a potential 2025 tourism slump on your retirement savings. Consult with a qualified financial advisor to create a personalized strategy tailored to your specific circumstances and risk tolerance. Don't wait; proactive planning is your best defense against economic uncertainty.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Recession Risk & Retirement: Preparing Your Savings For A Potential 2025 Tourism Slump. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

I Os 18 4 1 Update What You Need To Know Before Installing

May 26, 2025

I Os 18 4 1 Update What You Need To Know Before Installing

May 26, 2025 -

Rg Live Sunday May 25th Day 1 Review And Analysis

May 26, 2025

Rg Live Sunday May 25th Day 1 Review And Analysis

May 26, 2025 -

Andriy Portnovs Assassination Investigating The Unresolved Case In Ukraine

May 26, 2025

Andriy Portnovs Assassination Investigating The Unresolved Case In Ukraine

May 26, 2025 -

Underwater Explosion Captured Audio Of Titan Subs Catastrophic Implosion

May 26, 2025

Underwater Explosion Captured Audio Of Titan Subs Catastrophic Implosion

May 26, 2025 -

Jeanine Pirro Weighs In Reaction To Tragic Israeli Embassy Deaths

May 26, 2025

Jeanine Pirro Weighs In Reaction To Tragic Israeli Embassy Deaths

May 26, 2025

Latest Posts

-

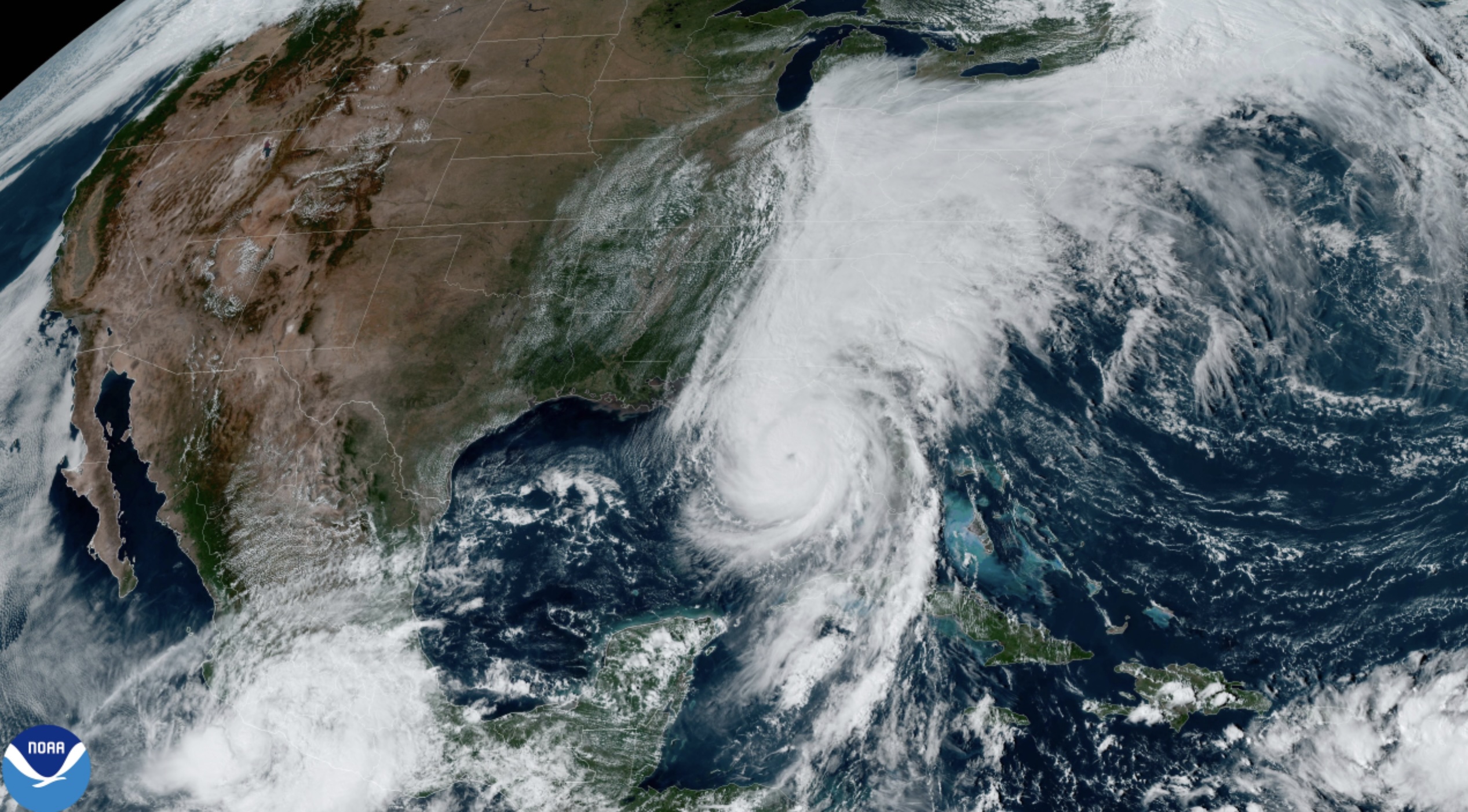

Above Normal Hurricane Season Forecast For The Us What To Expect

May 28, 2025

Above Normal Hurricane Season Forecast For The Us What To Expect

May 28, 2025 -

American Music Awards 2025 Celebrating Musics Biggest Names

May 28, 2025

American Music Awards 2025 Celebrating Musics Biggest Names

May 28, 2025 -

2025 Memorial Tournament Analyzing The Odds And Unveiling Potential Sleeper Picks

May 28, 2025

2025 Memorial Tournament Analyzing The Odds And Unveiling Potential Sleeper Picks

May 28, 2025 -

Major Chemical Plant Explosion In China Casualties And Damage Assessment Ongoing

May 28, 2025

Major Chemical Plant Explosion In China Casualties And Damage Assessment Ongoing

May 28, 2025 -

Chinese Chemical Plant Explosion Authorities Confirm Injuries Launch Investigation

May 28, 2025

Chinese Chemical Plant Explosion Authorities Confirm Injuries Launch Investigation

May 28, 2025