Record Bitcoin ETF Investments: $5 Billion+ And Growing

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Record Bitcoin ETF Investments: $5 Billion+ and Growing – A New Era for Crypto?

The cryptocurrency market is buzzing with excitement as Bitcoin exchange-traded fund (ETF) investments surge past the incredible milestone of $5 billion. This monumental figure signifies a significant shift in the perception and adoption of Bitcoin as a mainstream asset class, attracting both institutional and retail investors alike. The rapid growth indicates a growing confidence in Bitcoin's long-term potential, defying recent market volatility and regulatory uncertainty.

This unprecedented influx of investment demonstrates a clear trend: Bitcoin ETFs are quickly becoming a preferred entry point for investors looking to gain exposure to the cryptocurrency market without the complexities of directly holding Bitcoin. This ease of access, coupled with the regulatory oversight provided by the ETF structure, is a powerful draw for risk-averse investors and institutions hesitant to navigate the often-turbulent world of direct cryptocurrency trading.

What's Driving this Explosive Growth?

Several factors contribute to this record-breaking investment surge:

-

Increased Regulatory Clarity: While regulatory approval processes for Bitcoin ETFs have been lengthy and challenging, recent approvals in major markets like the United States have instilled greater confidence among investors. This clarity significantly reduces the perceived risk associated with investing in Bitcoin.

-

Institutional Adoption: Large financial institutions are increasingly embracing Bitcoin ETFs as a way to diversify their portfolios and gain exposure to this burgeoning asset class. Their significant investments are driving much of the recent growth.

-

Retail Investor Interest: The ease of access through brokerage accounts makes Bitcoin ETFs attractive to everyday investors who may have previously found direct cryptocurrency trading too complex or risky.

-

Inflation Hedge Potential: Many investors see Bitcoin as a potential hedge against inflation, a particularly appealing proposition in the current economic climate. This perception further fuels demand.

The Future of Bitcoin ETFs:

The $5 billion mark is not just a milestone; it's a launchpad. Industry analysts predict continued growth in Bitcoin ETF investments, driven by further regulatory approvals globally and increased institutional adoption. We can expect to see:

-

More ETF Offerings: The success of existing Bitcoin ETFs is likely to encourage the creation of more diversified products, possibly including ETFs tracking other cryptocurrencies or offering leveraged exposure.

-

Increased Liquidity: Higher investment levels translate to increased liquidity in the market, making it easier for investors to buy and sell Bitcoin ETF shares.

-

Price Volatility Impact: While Bitcoin's price remains volatile, the increasing institutional investment through ETFs may act as a stabilizing force, reducing the extent of wild price swings.

Navigating the Bitcoin ETF Landscape:

It's crucial for investors to conduct thorough research before investing in any Bitcoin ETF. Consider factors like:

- Expense Ratio: Compare the fees charged by different ETFs.

- Underlying Assets: Understand how the ETF tracks the Bitcoin price.

- Regulatory Compliance: Ensure the ETF is compliant with relevant regulations in your jurisdiction.

Conclusion:

The surpassing of $5 billion in Bitcoin ETF investments is a landmark achievement, signaling a significant shift in the perception and acceptance of Bitcoin as a legitimate asset class. This explosive growth presents both opportunities and challenges, underscoring the need for investors to proceed with informed decision-making. The future looks bright for Bitcoin ETFs, promising continued growth and potentially further shaping the future of the cryptocurrency market. Stay informed and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Record Bitcoin ETF Investments: $5 Billion+ And Growing. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Us Treasury Yields Dip As Federal Reserve Hints At Single 2025 Rate Cut

May 21, 2025

Us Treasury Yields Dip As Federal Reserve Hints At Single 2025 Rate Cut

May 21, 2025 -

Massive Bitcoin Etf Investment 5 B Influx And Its Market Implications

May 21, 2025

Massive Bitcoin Etf Investment 5 B Influx And Its Market Implications

May 21, 2025 -

Rare St Louis Tornado Leaves Trail Of Destruction Communitys Response

May 21, 2025

Rare St Louis Tornado Leaves Trail Of Destruction Communitys Response

May 21, 2025 -

Driverless Cars Ubers Optimism Vs Uks 2027 Timeline For Autonomous Vehicles

May 21, 2025

Driverless Cars Ubers Optimism Vs Uks 2027 Timeline For Autonomous Vehicles

May 21, 2025 -

Gaza Healthcare Crisis Deepens After Israeli Strike On Key Northern Hospital

May 21, 2025

Gaza Healthcare Crisis Deepens After Israeli Strike On Key Northern Hospital

May 21, 2025

Latest Posts

-

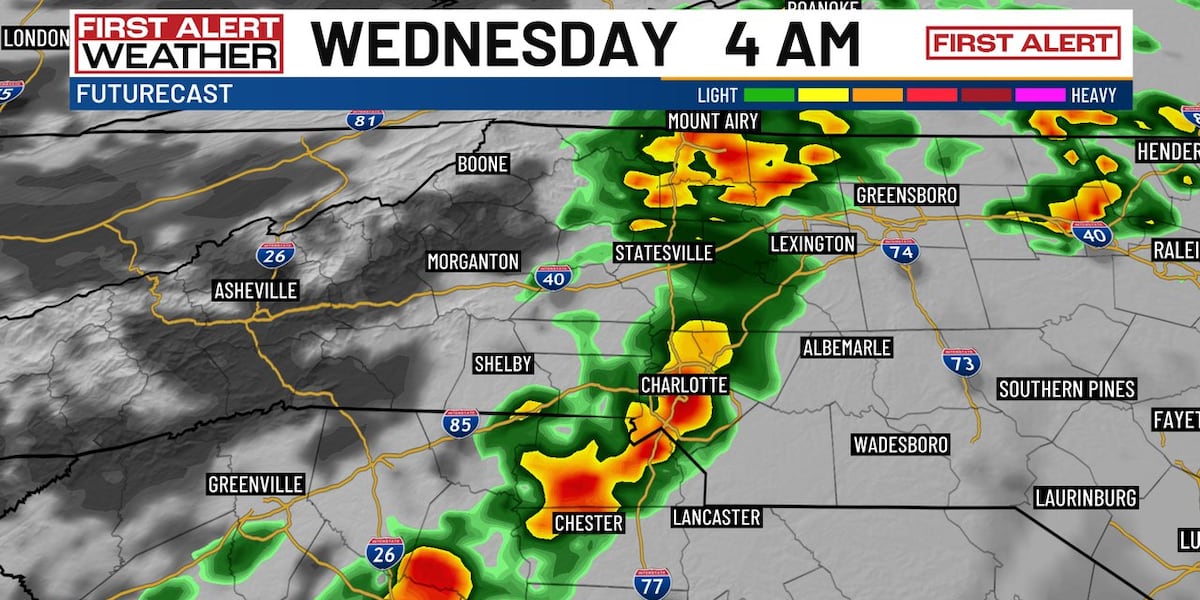

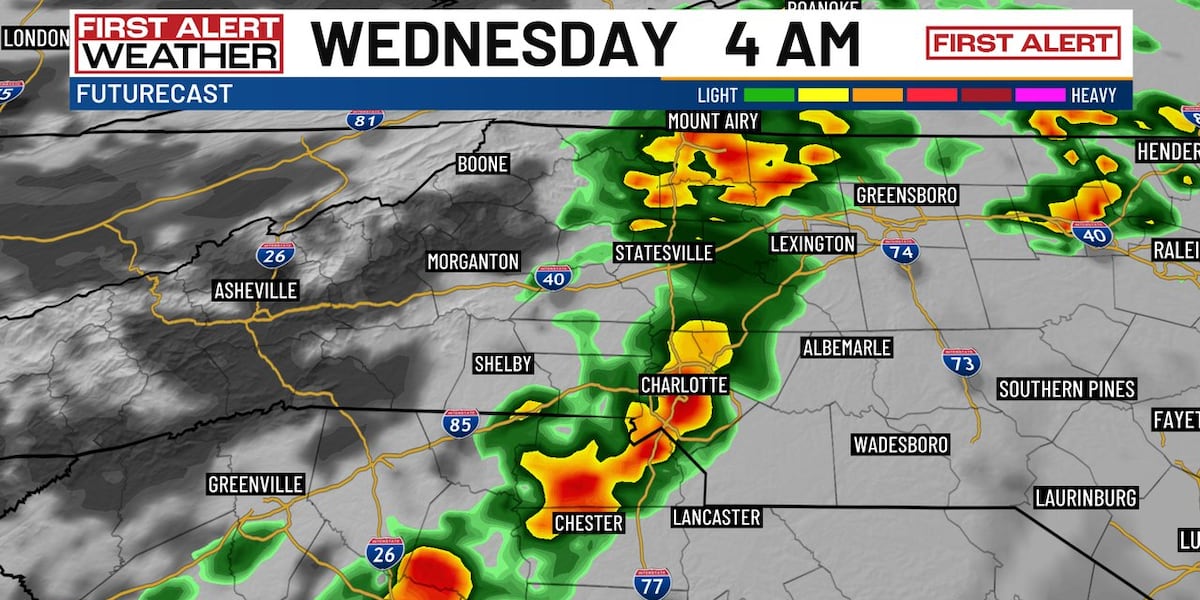

Overnight Storms Expected In Charlotte Prepare For A Temperature Drop

May 21, 2025

Overnight Storms Expected In Charlotte Prepare For A Temperature Drop

May 21, 2025 -

Charlotte Weather Incoming Overnight Storms Bring Cooler Temperatures

May 21, 2025

Charlotte Weather Incoming Overnight Storms Bring Cooler Temperatures

May 21, 2025 -

Tim Dillon On Cnn Unfiltered Views On Politics And The Current Climate

May 21, 2025

Tim Dillon On Cnn Unfiltered Views On Politics And The Current Climate

May 21, 2025 -

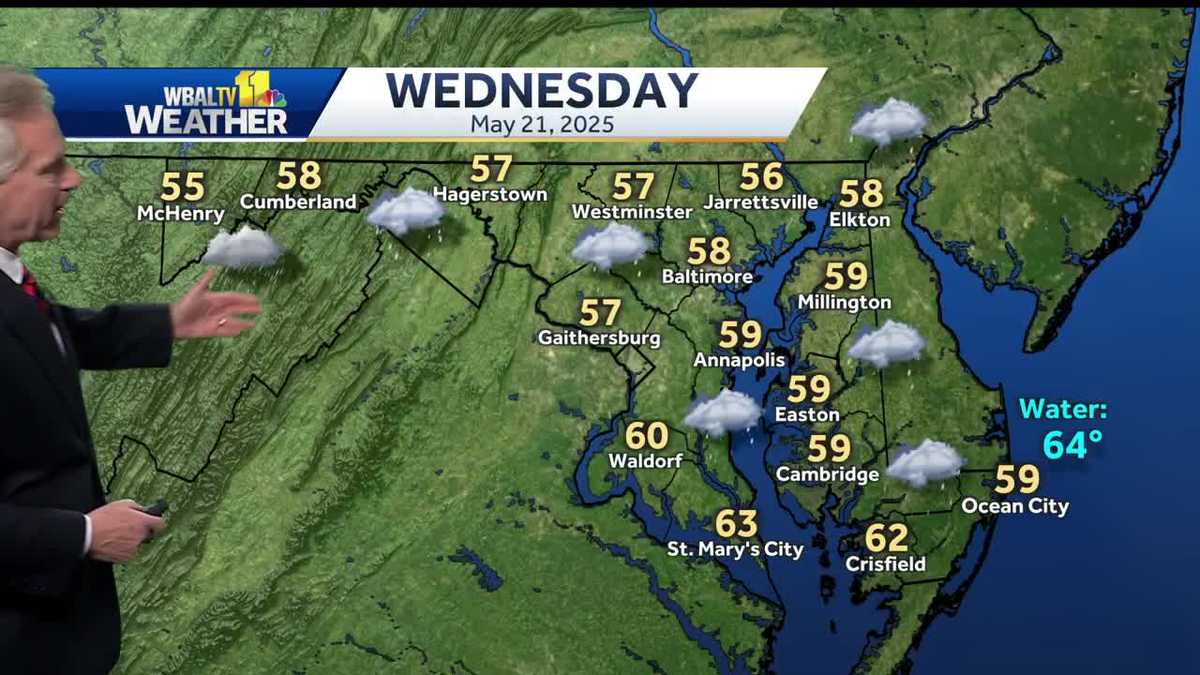

Chilly Rain Expected Across The Region On Wednesday

May 21, 2025

Chilly Rain Expected Across The Region On Wednesday

May 21, 2025 -

Report Reveals Lufthansa Flight Flew Unpiloted After Co Pilots Collapse

May 21, 2025

Report Reveals Lufthansa Flight Flew Unpiloted After Co Pilots Collapse

May 21, 2025