Robinhood (HOOD) Stock Market Performance: 6.46% Gain On June 3

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood (HOOD) Stock Soars: 6.46% Jump on June 3rd – What's Driving the Rally?

Robinhood Markets, Inc. (HOOD) experienced a significant surge on June 3rd, closing the day with a remarkable 6.46% gain. This unexpected jump has investors buzzing, prompting questions about the underlying factors fueling this positive momentum. While the broader market showed some gains, Robinhood's performance significantly outpaced the general trend, leaving many wondering what triggered this impressive leap. This article delves into the potential reasons behind this sudden increase and what it might mean for the future of HOOD stock.

Unpacking the June 3rd Rally: Key Potential Factors

Several contributing factors could explain Robinhood's impressive 6.46% gain on June 3rd. While pinpointing the exact cause is difficult, a combination of these elements likely played a role:

-

Positive Market Sentiment: The overall market displayed a positive trend on June 3rd, contributing to a generally upbeat investor sentiment. This broader positive movement likely provided a tailwind for many stocks, including HOOD. [Link to relevant market index performance data]

-

Increased Trading Activity: Any significant increase in trading volume on the Robinhood platform itself could positively impact the stock price. Higher transaction fees directly translate to increased revenue for the company. While official data may lag, anecdotal evidence and market whispers suggest a potential uptick in trading activity around this date.

-

Speculative Trading: It's important to acknowledge the role of speculative trading in influencing stock prices, particularly for volatile stocks like HOOD. Positive news, even if minor, can trigger a buying frenzy among speculative traders, leading to rapid price increases.

-

Strategic Decisions & Future Outlook: While not publicly confirmed, internal strategic decisions or positive developments within the company, potentially related to new product launches, partnerships, or improved financial projections, could have contributed to investor confidence and fueled the price increase. Any whispers of upcoming positive announcements can greatly influence market sentiment.

What Does This Mean for HOOD Investors?

The 6.46% gain is undoubtedly positive news for Robinhood investors, but it's crucial to avoid reading too much into a single day's performance. The stock market is inherently volatile, and short-term fluctuations are common. Long-term investors should focus on the company's overall financial health, strategic direction, and competitive landscape rather than reacting to daily price swings.

Analyzing Robinhood's Long-Term Prospects

Robinhood's long-term success hinges on several factors, including:

-

Competition: The brokerage industry is fiercely competitive, with established players and emerging fintech companies vying for market share. Robinhood needs to continue innovating and adapting to maintain its position.

-

Regulatory Landscape: The regulatory environment for brokerage firms is constantly evolving. Changes in regulations can significantly impact Robinhood's operations and profitability.

-

Financial Performance: Consistent revenue growth, profitability, and effective management of expenses are essential for long-term investor confidence. Investors should carefully monitor the company's quarterly and annual financial reports. [Link to Robinhood's investor relations page]

Conclusion: Cautious Optimism for HOOD

While the 6.46% jump on June 3rd is encouraging, it's essential to maintain a balanced perspective. Investors should conduct thorough due diligence before making any investment decisions and consider consulting with a financial advisor to assess their risk tolerance and investment goals. The long-term outlook for HOOD remains contingent on the factors outlined above. Continued monitoring of the company’s performance and market trends is crucial for making informed investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood (HOOD) Stock Market Performance: 6.46% Gain On June 3. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hype Builds Crowds Gather Outside Jd Sports For The New Air Jordan 110 Drop

Jun 06, 2025

Hype Builds Crowds Gather Outside Jd Sports For The New Air Jordan 110 Drop

Jun 06, 2025 -

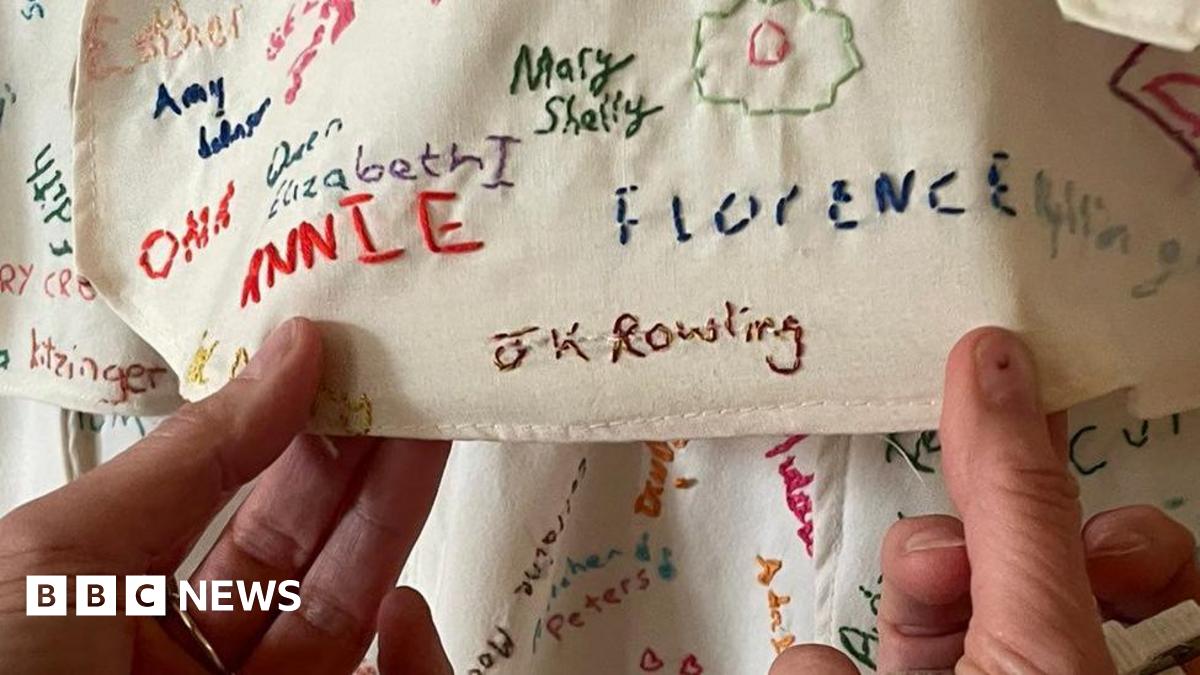

Controversy At Derbyshire National Trust Damaged J K Rowling Artwork Concealed

Jun 06, 2025

Controversy At Derbyshire National Trust Damaged J K Rowling Artwork Concealed

Jun 06, 2025 -

First Date Turns Deadly Wisconsin Man Found Guilty Of Murder Dismemberment

Jun 06, 2025

First Date Turns Deadly Wisconsin Man Found Guilty Of Murder Dismemberment

Jun 06, 2025 -

Analyzing Nvidias Core Weave Profitability Market Share And Future Outlook

Jun 06, 2025

Analyzing Nvidias Core Weave Profitability Market Share And Future Outlook

Jun 06, 2025 -

Avgo Stock Price Prediction Assessing Broadcoms Future Following Earnings

Jun 06, 2025

Avgo Stock Price Prediction Assessing Broadcoms Future Following Earnings

Jun 06, 2025

Latest Posts

-

Cnn Business Ai Ceo Reveals Disturbing Ai Trends

Jun 07, 2025

Cnn Business Ai Ceo Reveals Disturbing Ai Trends

Jun 07, 2025 -

New Video Meghans Pregnancy Celebrated In Heartfelt Dance

Jun 07, 2025

New Video Meghans Pregnancy Celebrated In Heartfelt Dance

Jun 07, 2025 -

Why Is Ibm Stock Underperforming The Market Key Factors To Consider

Jun 07, 2025

Why Is Ibm Stock Underperforming The Market Key Factors To Consider

Jun 07, 2025 -

Internal Rift In Reform Party Over Mps Controversial Burka Ban Proposal

Jun 07, 2025

Internal Rift In Reform Party Over Mps Controversial Burka Ban Proposal

Jun 07, 2025 -

Applied Digital Skyrockets 7 Billion Core Weave Lease Fuels 48 Surge

Jun 07, 2025

Applied Digital Skyrockets 7 Billion Core Weave Lease Fuels 48 Surge

Jun 07, 2025