Robinhood Markets (HOOD) Experiences Significant Stock Increase: 6.46% On June 3rd

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Markets (HOOD) Soars: 6.46% Jump Ignites Investor Interest

Robinhood Markets (HOOD), the popular commission-free trading platform, experienced a significant surge in its stock price on June 3rd, closing up 6.46%. This unexpected jump has sparked renewed investor interest and speculation about the future trajectory of the company. The rally comes after a period of relative stagnation and follows several key developments that analysts believe contributed to the positive market sentiment.

Understanding the Rally: Key Factors Behind HOOD's Surge

Several factors likely contributed to Robinhood's impressive 6.46% increase on June 3rd. While pinpointing a single cause is difficult, a confluence of events likely fueled the positive market reaction:

-

Improved Financial Performance: While specific details aren't yet public, market whispers suggest improved quarterly earnings or positive indications regarding future performance might have leaked to key investors. This positive outlook often precedes a stock price increase. Investors are keenly awaiting the official earnings report for confirmation.

-

Increased Trading Volume: A surge in trading activity on the platform itself could also be a contributing factor. Higher trading volume directly impacts Robinhood's revenue, making it an attractive prospect for investors. This increase could be attributed to several factors, including renewed interest in specific sectors or a general increase in market volatility.

-

Positive Regulatory Developments: While not explicitly stated, any positive shifts in the regulatory landscape affecting the brokerage industry could indirectly benefit Robinhood. Less stringent regulations generally lead to increased investor confidence and market activity.

-

Strategic Partnerships and Initiatives: Robinhood has been actively pursuing strategic partnerships and initiatives to expand its offerings and reach new customer segments. Successful implementations of these strategies could signal future growth and attract investors.

Analyzing the Long-Term Outlook for HOOD

While the 6.46% jump is certainly encouraging, investors should approach the situation with caution. This single-day increase doesn't necessarily guarantee continued growth. The long-term outlook for HOOD remains contingent upon several factors, including:

-

Competition: Robinhood faces stiff competition from established players in the brokerage industry, including Fidelity, Schwab, and TD Ameritrade. Maintaining its competitive edge requires continuous innovation and adaptation.

-

Regulatory Scrutiny: The brokerage industry is subject to significant regulatory oversight. Future changes in regulations could significantly impact Robinhood's operations and profitability.

-

Market Volatility: The overall market climate plays a crucial role in the performance of individual stocks. A downturn in the broader market could negatively affect even the most promising companies.

Conclusion: Cautious Optimism for Robinhood Investors

The 6.46% increase in HOOD's stock price on June 3rd is a positive sign, suggesting a renewed confidence in the company's prospects. However, investors should remain vigilant and carefully consider the long-term risks and uncertainties before making any investment decisions. Further analysis of the company's financial reports and market trends is crucial for a comprehensive understanding of HOOD's future potential. Stay tuned for further updates as more information becomes available. Remember to consult with a financial advisor before making any investment decisions.

Keywords: Robinhood, HOOD, stock price, stock market, investment, trading, brokerage, commission-free trading, financial markets, June 3rd, stock increase, market rally, investor interest, regulatory developments, financial performance, competition.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Markets (HOOD) Experiences Significant Stock Increase: 6.46% On June 3rd. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jessie J Shares Personal Health Update Early Stage Breast Cancer Diagnosis

Jun 06, 2025

Jessie J Shares Personal Health Update Early Stage Breast Cancer Diagnosis

Jun 06, 2025 -

Patriot League Adds Villanova Football As Associate Member For 2026 Season

Jun 06, 2025

Patriot League Adds Villanova Football As Associate Member For 2026 Season

Jun 06, 2025 -

Joe Saccos Next Move Leaving Boston For A New Nhl Team

Jun 06, 2025

Joe Saccos Next Move Leaving Boston For A New Nhl Team

Jun 06, 2025 -

Rob Cross Former Darts Champion Banned As Director Due To Tax Issues

Jun 06, 2025

Rob Cross Former Darts Champion Banned As Director Due To Tax Issues

Jun 06, 2025 -

Rise And Fall Of Mike Lindell Harry Entens Cnn Perspective

Jun 06, 2025

Rise And Fall Of Mike Lindell Harry Entens Cnn Perspective

Jun 06, 2025

Latest Posts

-

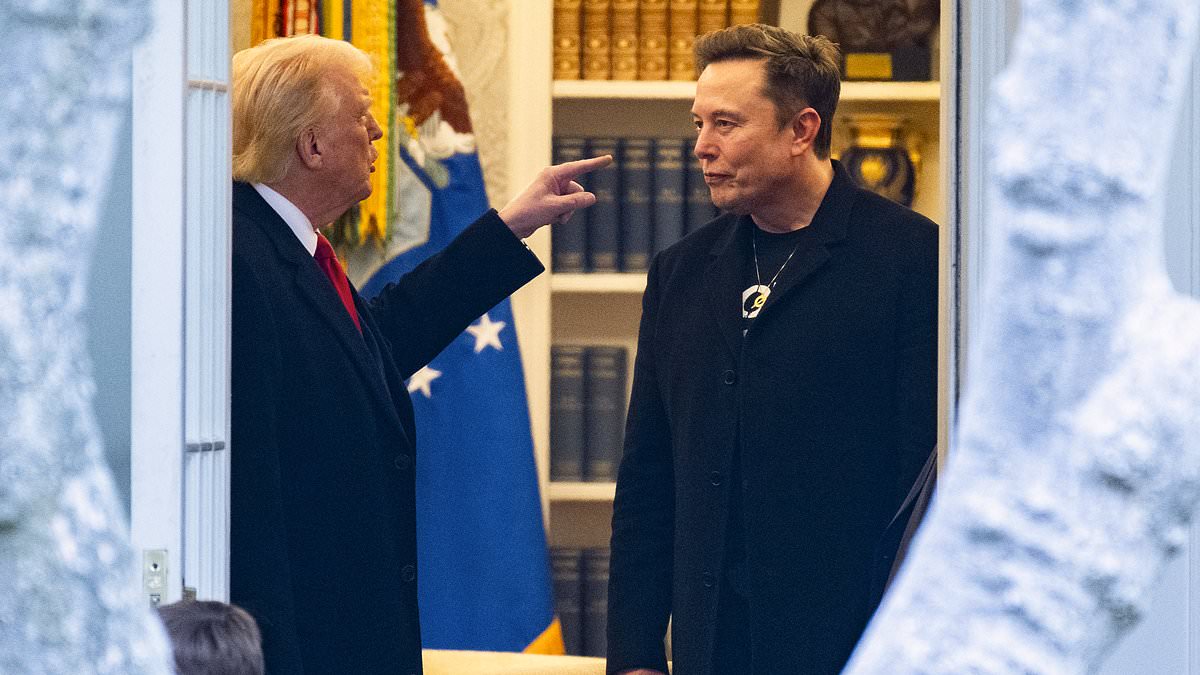

The Trump Musk Rift Uncovering The Influence Of A Powerful Advisor

Jun 06, 2025

The Trump Musk Rift Uncovering The Influence Of A Powerful Advisor

Jun 06, 2025 -

The Truth Behind The Rumors Walton Goggins And Aimee Lou Wood On Their White Lotus Experience

Jun 06, 2025

The Truth Behind The Rumors Walton Goggins And Aimee Lou Wood On Their White Lotus Experience

Jun 06, 2025 -

Significant Diesel Spill Impacts Baltimore Harbor 2 000 Gallons And Rising Concerns

Jun 06, 2025

Significant Diesel Spill Impacts Baltimore Harbor 2 000 Gallons And Rising Concerns

Jun 06, 2025 -

Nhl Playoffs Peter De Boer Out As Dallas Stars Head Coach

Jun 06, 2025

Nhl Playoffs Peter De Boer Out As Dallas Stars Head Coach

Jun 06, 2025 -

Core Weaves 7 Billion Lease Propels Applied Digital Stock 48 Higher

Jun 06, 2025

Core Weaves 7 Billion Lease Propels Applied Digital Stock 48 Higher

Jun 06, 2025