S&P 500, Dow, Nasdaq Rise: Market Resilience Shown Amidst Moody's Credit Rating Action

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500, Dow, Nasdaq Rise: Market Resilience Shown Amidst Moody's Credit Rating Action

Major US indices defy Moody's downgrade, showcasing investor confidence and market resilience.

Wall Street closed higher on Tuesday, with the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all posting gains. This upward movement comes as a surprise to many, directly following Moody's decision to downgrade the credit ratings of 10 small and midsize US banking companies and issue a negative outlook on the entire US banking system. The market's resilience in the face of this negative news highlights the ongoing strength of the US economy and investor confidence, despite looming concerns.

This unexpected surge contradicts predictions of a potential market downturn following Moody's announcement. The rating agency cited persistent challenges within the banking sector, including higher interest rates and persistent inflation, as reasons for its actions. This decision fueled concerns about the potential for further instability in the financial system. However, the market reacted differently than anticipated, exhibiting a degree of robustness that analysts are now scrambling to explain.

Decoding the Market's Positive Reaction

Several factors likely contributed to the market's positive performance despite Moody's downgrade:

-

Strong Corporate Earnings: The recent surge in positive corporate earnings reports has bolstered investor confidence. Many companies have exceeded expectations, demonstrating underlying economic strength and resilience even amidst macroeconomic headwinds. This positive sentiment has outweighed the concerns raised by Moody's.

-

Resilient Consumer Spending: Despite inflation, consumer spending remains relatively strong, indicating a robust economy capable of weathering economic storms. This continued consumer activity supports the positive outlook many investors maintain.

-

Federal Reserve's Actions: While the Federal Reserve's interest rate hikes contribute to the challenges faced by the banking sector, they also signal the central bank's commitment to controlling inflation. This proactive approach, although potentially disruptive in the short term, is seen by some as a long-term positive for the economy's stability.

-

Selective Downgrade: It's important to note that Moody's downgrade affected only a small segment of the US banking system. The impact on the broader financial landscape is believed by many to be limited, although this remains a point of ongoing debate among financial experts. The focus was on smaller and midsize banks, not the giants that typically anchor the market's confidence.

Looking Ahead: Uncertainty Remains

While Tuesday's market performance was undoubtedly positive, uncertainty remains. The long-term effects of Moody's downgrade and the ongoing economic challenges warrant careful consideration. Investors are advised to maintain a diversified portfolio and stay informed about economic developments. The future trajectory of the market will depend heavily on factors such as inflation rates, interest rate policy, and overall economic growth.

Further Reading:

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions. Market performance is inherently unpredictable, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500, Dow, Nasdaq Rise: Market Resilience Shown Amidst Moody's Credit Rating Action. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mma World Erupts Fan Reactions To Jon Jones Latest Shot At Tom Aspinall

May 20, 2025

Mma World Erupts Fan Reactions To Jon Jones Latest Shot At Tom Aspinall

May 20, 2025 -

Storms Clear Dfw Cold Front Expected Tuesday

May 20, 2025

Storms Clear Dfw Cold Front Expected Tuesday

May 20, 2025 -

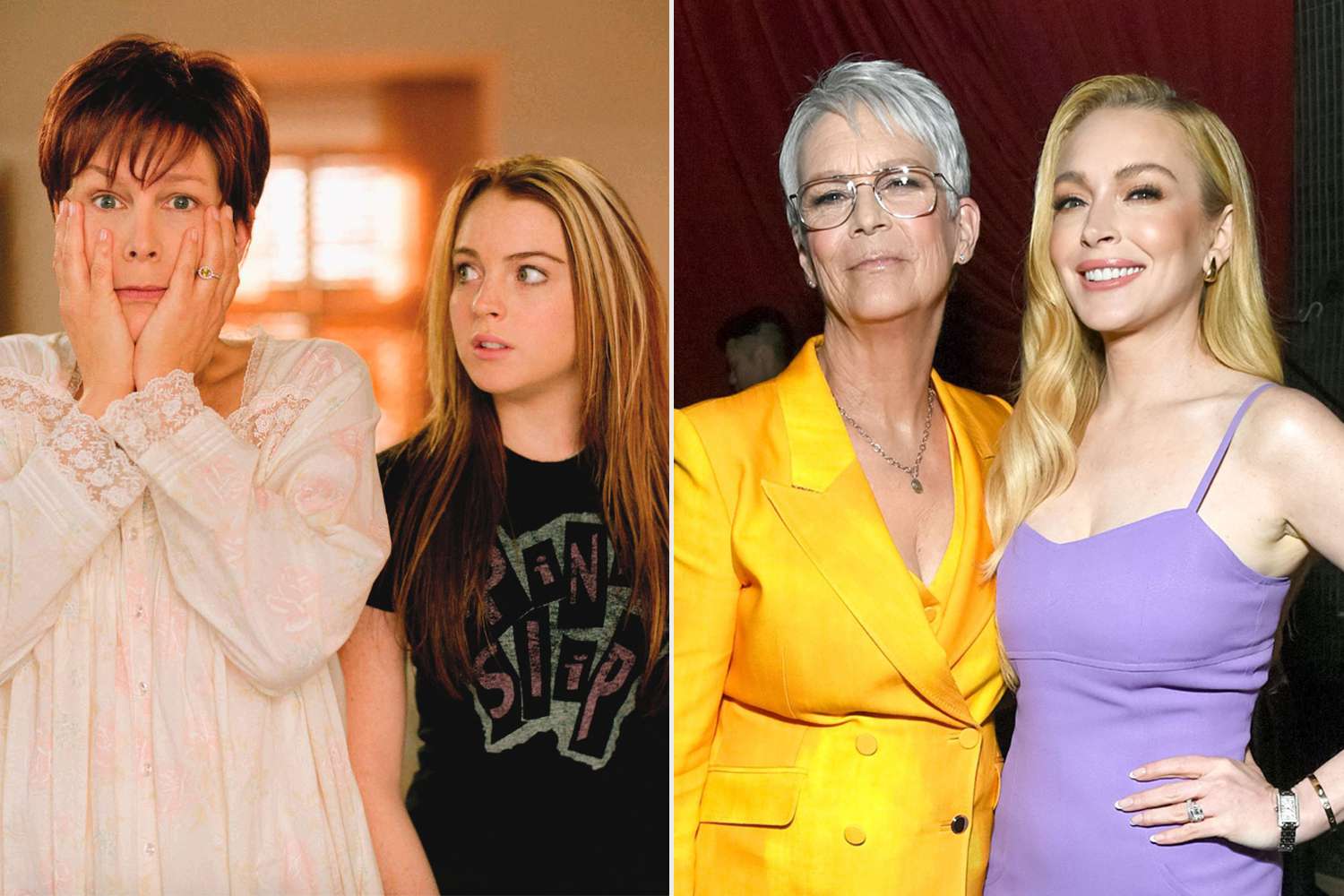

Hollywood Friendship Jamie Lee Curtis Speaks Out About Lindsay Lohans Authenticity

May 20, 2025

Hollywood Friendship Jamie Lee Curtis Speaks Out About Lindsay Lohans Authenticity

May 20, 2025 -

Mass Pachyrhinosaurus Grave Discovered A Glimpse Into Dinosaur Demise

May 20, 2025

Mass Pachyrhinosaurus Grave Discovered A Glimpse Into Dinosaur Demise

May 20, 2025 -

Cathay Pacific Welcomes New Class Of Cadet Pilots

May 20, 2025

Cathay Pacific Welcomes New Class Of Cadet Pilots

May 20, 2025

Latest Posts

-

Slowdown Ahead Feds Rate Cut Projection Impacts U S Treasury Yields

May 20, 2025

Slowdown Ahead Feds Rate Cut Projection Impacts U S Treasury Yields

May 20, 2025 -

Jamie Lee Curtis Lindsay Lohan Always Kept It Real

May 20, 2025

Jamie Lee Curtis Lindsay Lohan Always Kept It Real

May 20, 2025 -

Jamie Lee Curtis Shares Insights Into Her Ongoing Friendship With Lindsay Lohan Post Freaky Friday

May 20, 2025

Jamie Lee Curtis Shares Insights Into Her Ongoing Friendship With Lindsay Lohan Post Freaky Friday

May 20, 2025 -

Stock Market Today Market Rally Persists Despite Moodys Negative Outlook

May 20, 2025

Stock Market Today Market Rally Persists Despite Moodys Negative Outlook

May 20, 2025 -

Breaking Trump Initiates Push For Immediate Russia Ukraine Peace Talks

May 20, 2025

Breaking Trump Initiates Push For Immediate Russia Ukraine Peace Talks

May 20, 2025