Sam Altman's Fears: What Terrifies Him About The Current Financial System?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Sam Altman's Fears: What Terrifies Him About the Current Financial System?

Sam Altman, the CEO of OpenAI and a prominent figure in the tech world, isn't just concerned about the future of artificial intelligence; he's also deeply worried about the fragility of the current financial system. His concerns, expressed in various interviews and public appearances, offer a compelling perspective on potential systemic risks and highlight the need for innovative solutions. But what exactly terrifies him? Let's delve into Altman's anxieties and explore the potential implications.

The Risk of Systemic Collapse: Altman's Central Fear

Altman's primary fear revolves around the possibility of a catastrophic financial collapse. While he doesn't explicitly predict a specific event, his concerns stem from several interconnected factors:

-

Over-reliance on debt: Altman, like many economists, points to the escalating levels of global debt as a major vulnerability. This unsustainable debt burden, he argues, leaves the system susceptible to even minor shocks. A sudden economic downturn or unforeseen geopolitical event could trigger a domino effect, leading to widespread defaults and a systemic crisis.

-

The interconnectedness of global finance: The intricate web of financial institutions and markets creates a ripple effect. A failure in one area, such as a large bank collapse or a sovereign debt crisis, can quickly spread, impacting even seemingly stable economies. This interconnectedness amplifies the risk, making localized problems into global crises.

-

Lack of transparency and regulation: Altman highlights the opaque nature of certain financial instruments and the limitations of existing regulations. The complexity of modern finance makes it difficult to fully understand and manage risk, increasing the potential for unforeseen vulnerabilities to emerge. This lack of transparency hinders effective oversight and increases the likelihood of systemic failure.

Beyond the Macro: Micro-Level Concerns

While systemic collapse is Altman's primary concern, he also expresses anxieties on a micro level:

-

The impact on innovation: A major financial crisis could severely hamper innovation by restricting access to capital for startups and small businesses. This would disproportionately impact the tech sector, potentially slowing down technological advancements.

-

Social instability: Financial instability can lead to widespread social unrest and political upheaval. The economic hardship resulting from a collapse could have profound societal consequences.

-

The need for proactive solutions: Altman stresses the urgency of developing proactive solutions to mitigate these risks. This includes improving regulatory frameworks, promoting financial literacy, and exploring alternative financial models.

What Can Be Done? Altman's Implicit Call to Action

Although Altman doesn't offer concrete policy prescriptions, his concerns implicitly call for several actions:

-

Strengthening financial regulation: Improved oversight and greater transparency are crucial to effectively manage risk. This requires international cooperation to address the interconnectedness of global markets.

-

Promoting financial inclusion: Expanding access to financial services for underserved populations can increase resilience and reduce inequality, making the system more robust.

-

Exploring alternative financial systems: Innovation in finance is crucial. Exploring decentralized technologies and alternative models could offer greater resilience and reduce reliance on traditional, centralized institutions.

Conclusion: A Wake-Up Call

Sam Altman's fears are not mere speculation. They represent a serious warning about the vulnerabilities of the current financial system. His concerns should serve as a wake-up call, prompting policymakers, financial institutions, and individuals to actively address the potential risks before a crisis unfolds. The future of the global economy may well depend on it. What are your thoughts on Altman's concerns? Share your perspective in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Sam Altman's Fears: What Terrifies Him About The Current Financial System?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

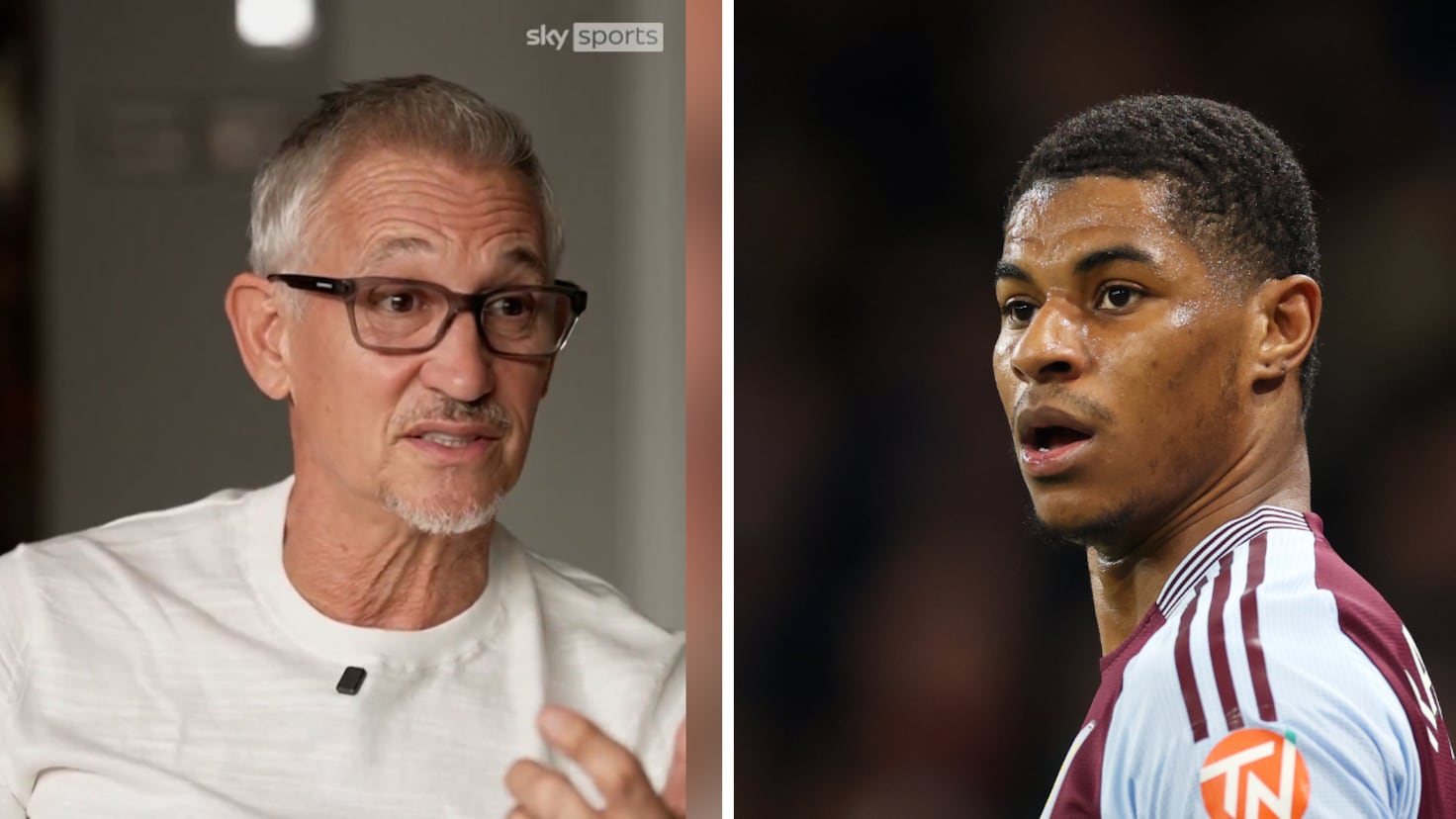

Rashford Lineker Aconseja Cautela A Real Madrid Y Fc Barcelona

Jul 24, 2025

Rashford Lineker Aconseja Cautela A Real Madrid Y Fc Barcelona

Jul 24, 2025 -

The Financial Systems Weaknesses Insights From Open Ai Ceo Sam Altman

Jul 24, 2025

The Financial Systems Weaknesses Insights From Open Ai Ceo Sam Altman

Jul 24, 2025 -

Tulsi Gabbards Allegations Of Russian Interference A Direct Challenge To Trumps Team

Jul 24, 2025

Tulsi Gabbards Allegations Of Russian Interference A Direct Challenge To Trumps Team

Jul 24, 2025 -

Mc Cutchens Latest Achievement A Pirates Legacy Moment

Jul 24, 2025

Mc Cutchens Latest Achievement A Pirates Legacy Moment

Jul 24, 2025 -

Andrew Mc Cutchens Historic Hit Passing Willie Stargells Legacy

Jul 24, 2025

Andrew Mc Cutchens Historic Hit Passing Willie Stargells Legacy

Jul 24, 2025

Washington Open Update Raducanu Advances To Semifinals After Sakkari Win

Washington Open Update Raducanu Advances To Semifinals After Sakkari Win