Self-Directed Precious Metal IRAs: The Complete Retirement Planning Report

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Self-Directed Precious Metal IRAs: The Complete Retirement Planning Report

Are you looking for a way to diversify your retirement portfolio and potentially protect your savings from market volatility? Consider the benefits of a Self-Directed Precious Metal IRA (SDPMIRA). This comprehensive report explores the ins and outs of these increasingly popular retirement accounts, offering valuable insights for seasoned investors and newcomers alike.

What is a Self-Directed Precious Metal IRA?

A Self-Directed Precious Metal IRA allows you to invest a portion of your retirement savings in physical precious metals, such as gold, silver, platinum, and palladium. Unlike traditional IRAs that primarily invest in stocks and bonds, a SDPMIRA offers a tangible asset diversification strategy. This means you own the physical metal, held securely in an IRS-approved depository.

Key Advantages of a Self-Directed Precious Metal IRA:

- Diversification: Precious metals often act as a hedge against inflation and market downturns, offering a valuable counterbalance to traditional investments. This diversification can significantly reduce overall portfolio risk.

- Tangible Asset: Unlike stocks or bonds, which represent ownership in a company or debt instrument, precious metals are physical assets you possess. This can provide a sense of security and control over your retirement savings.

- Inflation Hedge: Historically, precious metals have performed well during inflationary periods, preserving purchasing power. This makes them an attractive option for those concerned about rising prices.

- Potential for Growth: The value of precious metals can fluctuate, offering the potential for significant returns, although it's important to remember that past performance is not indicative of future results.

- Control and Flexibility: With a Self-Directed IRA, you have greater control over your investment choices than with a traditional IRA.

Choosing the Right Precious Metals:

The decision of which precious metal to invest in depends on your individual risk tolerance and financial goals.

- Gold: Considered a safe haven asset, gold is often seen as a reliable store of value.

- Silver: Generally more volatile than gold, silver can offer greater potential for growth, but also carries higher risk.

- Platinum and Palladium: These rarer metals are often used in industrial applications and can be influenced by supply and demand factors.

Understanding the IRS Regulations:

It's crucial to understand the IRS rules and regulations governing Self-Directed Precious Metal IRAs. You must work with a custodian approved by the IRS to ensure compliance. Improper handling can lead to significant penalties. .

Finding a Reputable Custodian:

Selecting a reputable custodian is paramount. A good custodian will provide secure storage, transparent fees, and expert guidance on navigating the complexities of a SDPMIRA. Look for custodians with a proven track record and positive reviews. [Link to example of custodian comparison website - avoid direct promotion].

Potential Drawbacks:

While offering significant advantages, SDPMIRAs also have potential downsides:

- Storage Costs: Storing your precious metals incurs fees.

- Liquidity: Converting precious metals back into cash can take time.

- Market Volatility: Precious metal prices can fluctuate significantly, potentially leading to losses.

Conclusion:

A Self-Directed Precious Metal IRA can be a valuable component of a well-diversified retirement plan. However, thorough research and careful consideration of your individual circumstances are essential before investing. Consult with a qualified financial advisor to determine if a SDPMIRA aligns with your retirement goals and risk tolerance. Remember to always prioritize working with reputable custodians and fully understanding the IRS regulations. Proper planning and due diligence will help you navigate the complexities of this investment strategy and potentially achieve your retirement aspirations.

Call to Action: Learn more about self-directed IRAs and explore your retirement options today. [Link to a relevant resource - Avoid direct promotion].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Self-Directed Precious Metal IRAs: The Complete Retirement Planning Report. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Critics And Viewers Agree Netflixs New Series Is Utterly Addictive

Jun 04, 2025

Critics And Viewers Agree Netflixs New Series Is Utterly Addictive

Jun 04, 2025 -

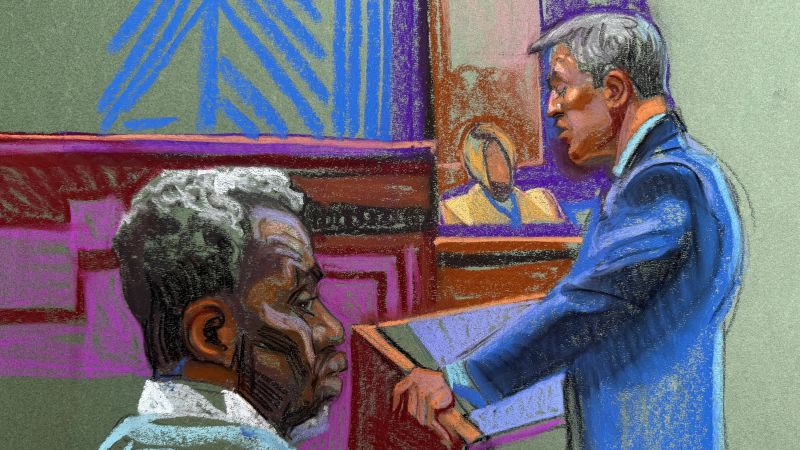

The Sean Diddy Combs Case Recent Proceedings And Potential Outcomes

Jun 04, 2025

The Sean Diddy Combs Case Recent Proceedings And Potential Outcomes

Jun 04, 2025 -

Coalition Collapse Looms Wilders Exit Shakes Dutch Politics

Jun 04, 2025

Coalition Collapse Looms Wilders Exit Shakes Dutch Politics

Jun 04, 2025 -

Sinner Reveals Why He Cant Beat Alcaraz A Roland Garros Showdown Looms

Jun 04, 2025

Sinner Reveals Why He Cant Beat Alcaraz A Roland Garros Showdown Looms

Jun 04, 2025 -

Lengthening Loan Terms How 31 Year Mortgages Affect First Time Homebuyers

Jun 04, 2025

Lengthening Loan Terms How 31 Year Mortgages Affect First Time Homebuyers

Jun 04, 2025

Latest Posts

-

Rangers Mike Sullivan Bolsters Coaching Team With David Quinns Return

Jun 06, 2025

Rangers Mike Sullivan Bolsters Coaching Team With David Quinns Return

Jun 06, 2025 -

Ryan Goslings Mcu Future Exploring The Possibility Of A White Black Panther Role

Jun 06, 2025

Ryan Goslings Mcu Future Exploring The Possibility Of A White Black Panther Role

Jun 06, 2025 -

Analyzing Robinhoods Stock Performance Reasons For Continued Investment

Jun 06, 2025

Analyzing Robinhoods Stock Performance Reasons For Continued Investment

Jun 06, 2025 -

Robinhood Hood Stock Performance 6 46 Increase Detailed June 3rd

Jun 06, 2025

Robinhood Hood Stock Performance 6 46 Increase Detailed June 3rd

Jun 06, 2025 -

Mike Lindells Business Success And Subsequent Challenges A Cnn Report By Harry Enten

Jun 06, 2025

Mike Lindells Business Success And Subsequent Challenges A Cnn Report By Harry Enten

Jun 06, 2025