Should You Invest In SiriusXM Holdings? Weighing The Risks And Rewards.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Invest in SiriusXM Holdings? Weighing the Risks and Rewards

SiriusXM Holdings (SIRI) has captivated investors for years, offering a blend of potential rewards and inherent risks. This in-depth analysis explores the current state of SiriusXM, examining its strengths, weaknesses, and the factors influencing its future performance. Should you add this satellite radio giant to your portfolio? Let's dive in.

SiriusXM's Strengths: A Dominant Player in Satellite Radio

SiriusXM enjoys a near-monopoly in the satellite radio market in North America, boasting a massive subscriber base. This dominant position translates to significant recurring revenue, a key factor contributing to its stability. The company's diverse content offerings, including ad-free music channels, sports programming, and talk radio, cater to a broad audience. This diversification helps to mitigate risks associated with relying on a single revenue stream.

Furthermore, SiriusXM has been successfully expanding its reach beyond traditional satellite radio. Its Pandora subsidiary, a popular music streaming service, adds another layer of diversification and a younger demographic to its subscriber base. This strategic move positions SiriusXM for growth in the evolving digital audio landscape.

Challenges and Risks Facing SiriusXM:

Despite its market dominance, SiriusXM faces several significant challenges. The increasing popularity of streaming services like Spotify and Apple Music poses a formidable competitive threat. These platforms offer a wider variety of content and often at lower prices, potentially attracting subscribers away from SiriusXM.

Another key risk is the dependence on the automotive industry. A decline in car sales or a shift towards electric vehicles with fewer built-in satellite radio receivers could negatively impact SiriusXM's subscriber growth. The company's efforts to diversify beyond automotive integration are crucial to mitigating this risk.

Financial Performance and Future Outlook:

SiriusXM's financial performance has generally been positive, with steady subscriber growth and consistent revenue streams. However, investors should carefully analyze the company's financial reports, paying attention to key metrics such as subscriber churn rate, average revenue per user (ARPU), and debt levels. Understanding these metrics is essential for assessing the long-term financial health of the company.

Is SiriusXM a Good Investment?

The question of whether to invest in SiriusXM is complex and depends on your individual investment goals and risk tolerance. While its market dominance and diversified offerings present significant opportunities, the competitive pressure from streaming services and dependence on the automotive industry introduce considerable risk.

Factors to Consider Before Investing:

- Market Competition: Assess the ongoing competition from streaming services and their impact on SiriusXM's subscriber base.

- Technological Advancements: Consider how advancements in technology and consumer preferences may affect the future demand for satellite radio.

- Economic Conditions: Evaluate the potential impact of economic downturns on consumer spending and subscription rates.

- Debt Levels: Analyze SiriusXM's debt load and its ability to manage its financial obligations.

Conclusion:

Investing in SiriusXM Holdings requires careful consideration of both its strengths and weaknesses. While the company enjoys a dominant market position and generates substantial recurring revenue, the increasing competition from streaming services and its dependence on the automotive industry pose significant risks. Thorough due diligence, including a review of its financial performance and future outlook, is essential before making any investment decisions. Consult with a financial advisor to determine if SiriusXM aligns with your investment strategy and risk tolerance. Remember to always conduct your own research before investing in any stock.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Invest In SiriusXM Holdings? Weighing The Risks And Rewards.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

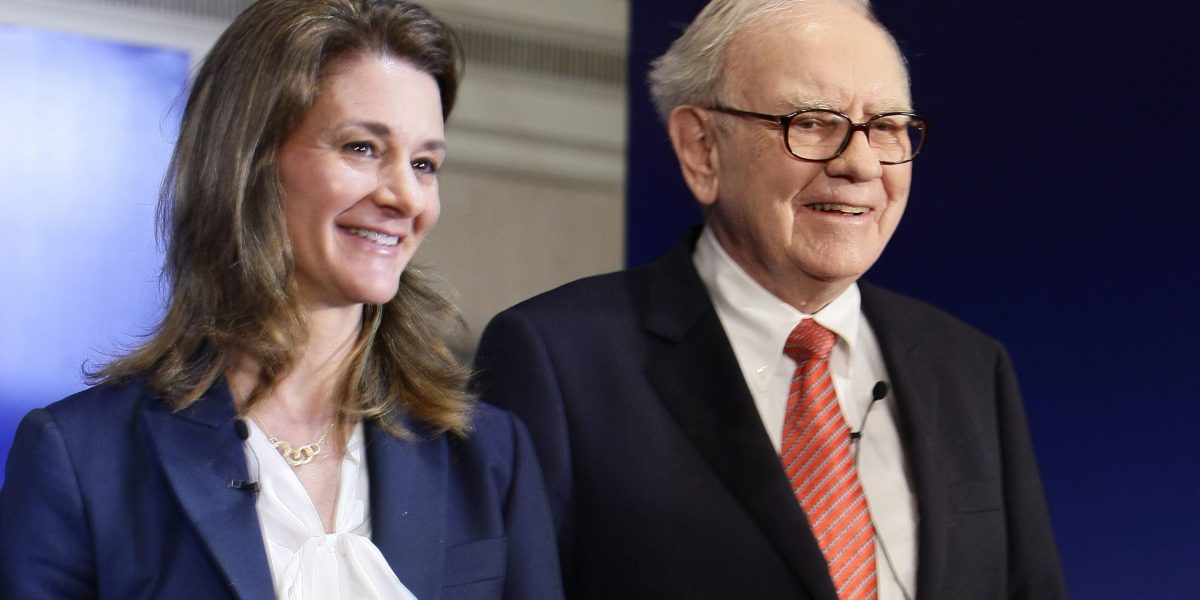

600 Billion Pledge Is The Future Of Billionaire Philanthropy Changing

May 28, 2025

600 Billion Pledge Is The Future Of Billionaire Philanthropy Changing

May 28, 2025 -

Key Facts The Liverpool Fc Parade Disturbance

May 28, 2025

Key Facts The Liverpool Fc Parade Disturbance

May 28, 2025 -

Understanding The Proposed 15 Social Security Cuts For 2025

May 28, 2025

Understanding The Proposed 15 Social Security Cuts For 2025

May 28, 2025 -

Should Investors Reconsider Sirius Xm Holdings

May 28, 2025

Should Investors Reconsider Sirius Xm Holdings

May 28, 2025 -

Ultra Nationalist March In Jerusalem Fuels Tensions Violence Erupts

May 28, 2025

Ultra Nationalist March In Jerusalem Fuels Tensions Violence Erupts

May 28, 2025

Latest Posts

-

Understanding The 1000 Jump In Sbet Stock Price A Comprehensive Analysis

May 30, 2025

Understanding The 1000 Jump In Sbet Stock Price A Comprehensive Analysis

May 30, 2025 -

Detroit Grand Prix 2025 What To Expect Events Roads And Weather

May 30, 2025

Detroit Grand Prix 2025 What To Expect Events Roads And Weather

May 30, 2025 -

Catastrophic Glacier Collapse In Switzerland The Fate Of Blatten

May 30, 2025

Catastrophic Glacier Collapse In Switzerland The Fate Of Blatten

May 30, 2025 -

Rhode Skins Billion Dollar Sale Hailey Biebers Brand Joins E L F Cosmetics

May 30, 2025

Rhode Skins Billion Dollar Sale Hailey Biebers Brand Joins E L F Cosmetics

May 30, 2025 -

Sheinelle Jones And Family Grieve After Husbands Unexpected Death At 45

May 30, 2025

Sheinelle Jones And Family Grieve After Husbands Unexpected Death At 45

May 30, 2025