Slowdown Ahead? U.S. Treasury Yields Fall On Fed's Rate Cut Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Slowdown Ahead? U.S. Treasury Yields Fall on Fed's Rate Cut Outlook

U.S. Treasury yields tumbled on Wednesday, signaling growing investor expectations that the Federal Reserve will cut interest rates later this year. This dramatic shift reflects mounting concerns about a potential economic slowdown, fueled by recent banking sector turmoil and persistent inflation. The decline in yields indicates a flight to safety, as investors seek the relative security of government bonds amidst economic uncertainty.

The benchmark 10-year Treasury yield dipped below 3.4%, its lowest level in several months, while the 2-year yield also experienced a significant drop. This inverse relationship between yields and bond prices signifies increased demand for these safe-haven assets. The market is clearly pricing in a less aggressive stance from the Federal Reserve, anticipating a pivot towards rate cuts to stimulate economic growth and prevent a deeper recession.

Why the Shift in Sentiment?

Several factors are contributing to this sudden change in market sentiment:

-

Banking Sector Instability: The recent collapses of Silicon Valley Bank (SVB) and Signature Bank have shaken confidence in the financial system. These events highlighted vulnerabilities within the banking sector and raised concerns about potential contagion effects. [Link to relevant news article about banking sector instability]

-

Inflationary Pressures: While inflation has shown signs of cooling, it remains stubbornly high. The Fed's battle to tame inflation without triggering a recession is proving to be a delicate balancing act. Continued high inflation could force the Fed’s hand towards further rate hikes, contradicting current market expectations. [Link to relevant article about inflation data]

-

Economic Growth Concerns: Recent economic data has painted a mixed picture, with some indicators suggesting slowing growth. This has fueled fears that the U.S. economy may be heading towards a recession, further bolstering the case for rate cuts. [Link to relevant economic data source]

What Does This Mean for Investors?

The fall in Treasury yields presents both opportunities and challenges for investors. Lower yields mean lower returns on new investments in government bonds. However, it also suggests a potential shift towards a more accommodative monetary policy, which could benefit other asset classes such as stocks.

Investors should carefully consider their risk tolerance and investment strategy in light of these developments. Diversification remains crucial in navigating this period of economic uncertainty. Consulting with a financial advisor can provide personalized guidance based on individual circumstances.

The Fed's Next Move: A Crucial Crossroads

The Federal Reserve's upcoming policy meetings will be closely scrutinized by markets worldwide. The central bank faces a difficult decision: continue its fight against inflation or prioritize preventing a significant economic downturn. The market's current pricing of rate cuts suggests investors believe a pivot towards supporting growth is imminent. However, any unexpected shift in the Fed’s stance could trigger significant market volatility.

Conclusion: Navigating Uncertainty

The decline in U.S. Treasury yields reflects a significant shift in market expectations regarding the Federal Reserve's future monetary policy. While lower yields offer some level of security, investors must carefully navigate the uncertainties surrounding economic growth and inflation. Staying informed about economic indicators and the Fed's pronouncements is crucial for making informed investment decisions in this dynamic environment. The coming months will be critical in determining the true trajectory of the U.S. economy and the effectiveness of the Fed's response. This situation demands vigilance and a proactive approach to investment planning.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Slowdown Ahead? U.S. Treasury Yields Fall On Fed's Rate Cut Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

President Biden Receives Prostate Cancer Diagnosis Impact On Health And Policy

May 20, 2025

President Biden Receives Prostate Cancer Diagnosis Impact On Health And Policy

May 20, 2025 -

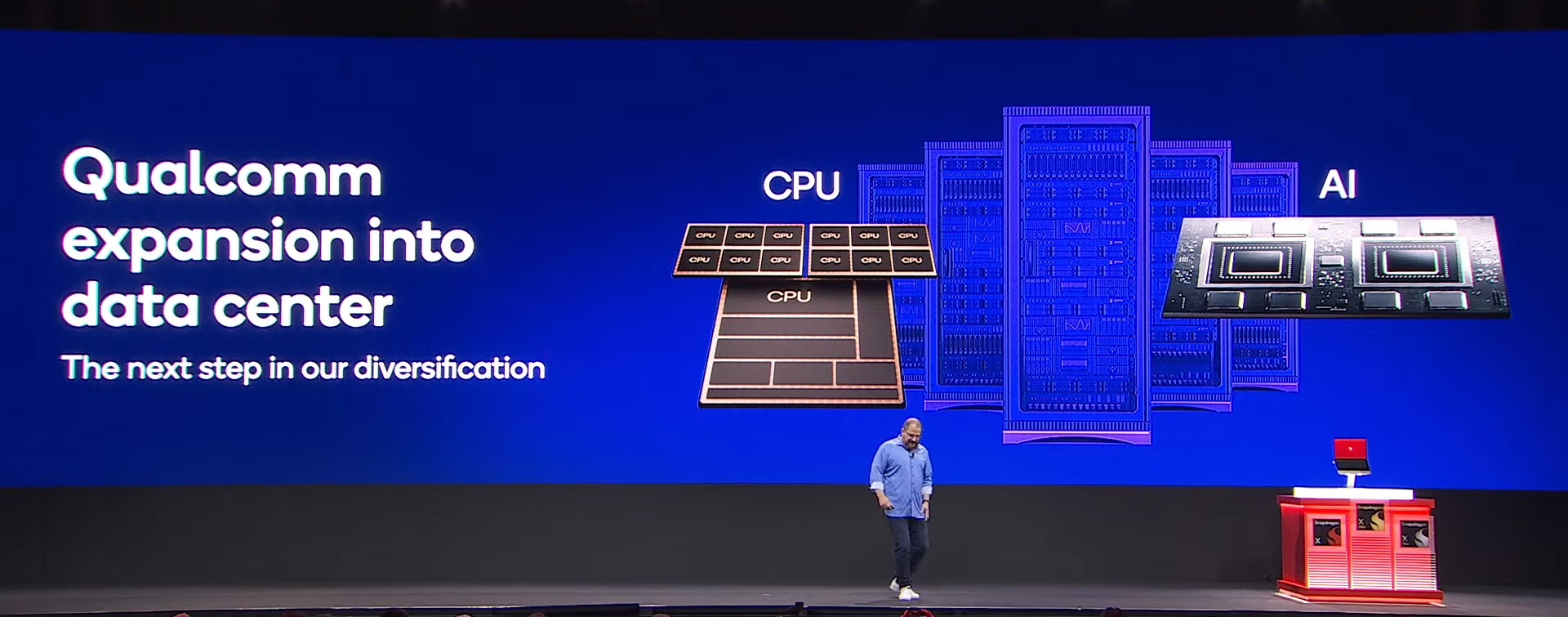

Qualcomms Next Gen Data Center Cpus And Ai Accelerators What To Expect

May 20, 2025

Qualcomms Next Gen Data Center Cpus And Ai Accelerators What To Expect

May 20, 2025 -

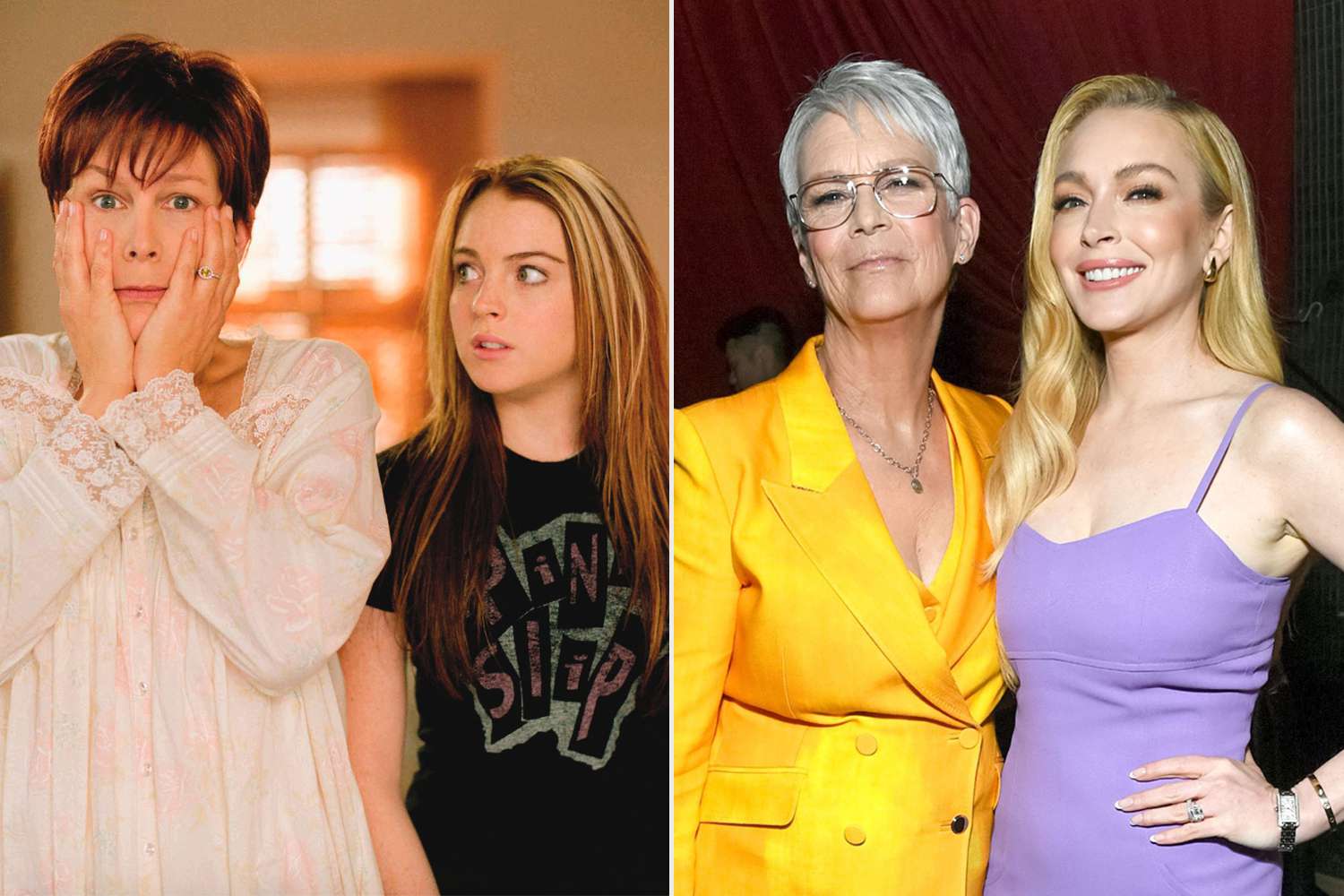

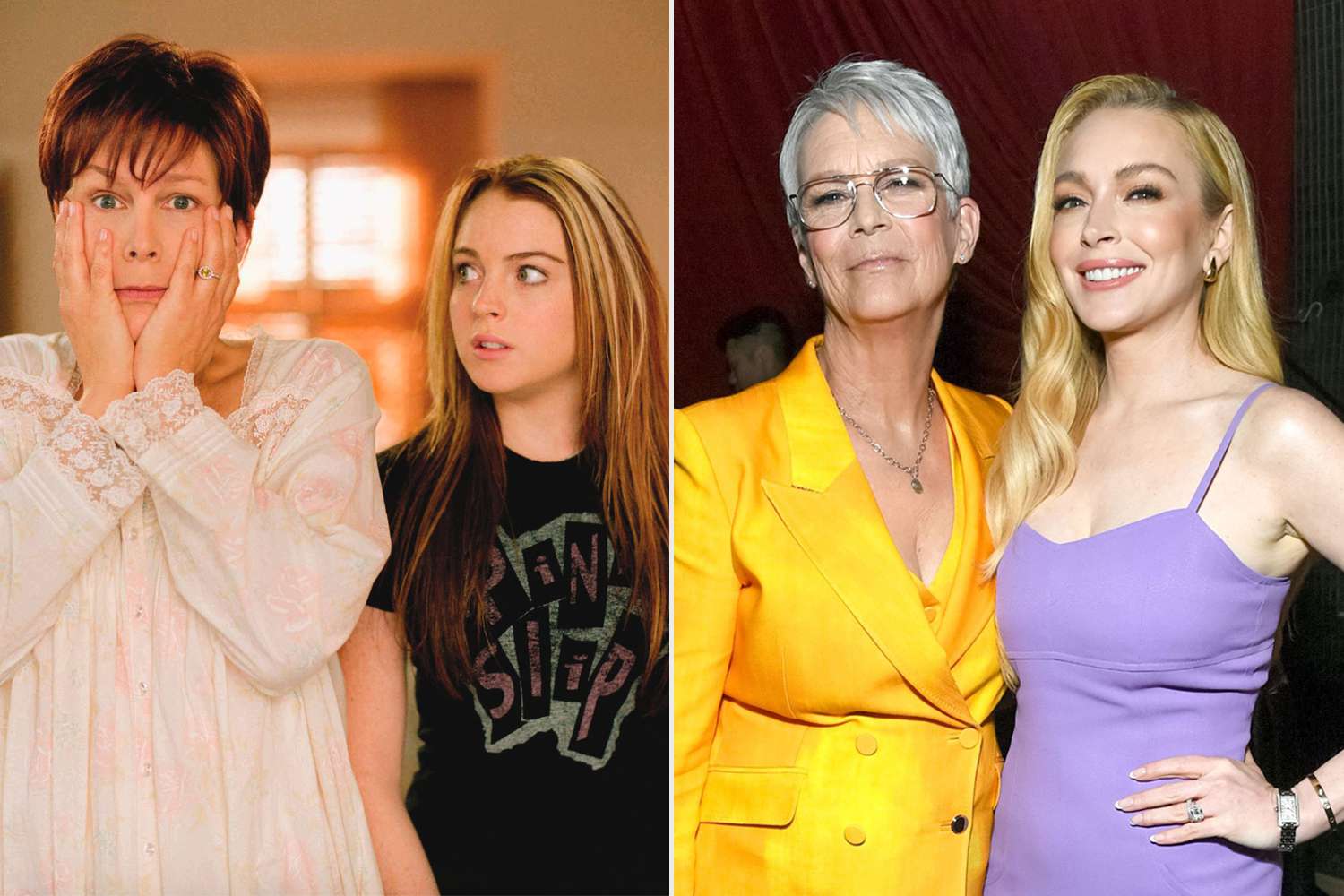

Jamie Lee Curtis Discusses Lasting Friendship With Lindsay Lohan Following Freaky Friday

May 20, 2025

Jamie Lee Curtis Discusses Lasting Friendship With Lindsay Lohan Following Freaky Friday

May 20, 2025 -

A Us Factory Reveals The Unintended Consequences Of Trumps Economic Policies

May 20, 2025

A Us Factory Reveals The Unintended Consequences Of Trumps Economic Policies

May 20, 2025 -

Yankees Prospects Struggles Continue 20 Run Loss In Scranton Highlights Weaknesses

May 20, 2025

Yankees Prospects Struggles Continue 20 Run Loss In Scranton Highlights Weaknesses

May 20, 2025

Latest Posts

-

Trumps Intervention Russia And Ukraine To Begin Truce Talks

May 21, 2025

Trumps Intervention Russia And Ukraine To Begin Truce Talks

May 21, 2025 -

Urgent Action Needed Colombian Model And Mexican Influencer Murders Highlight Rising Femicide Crisis

May 21, 2025

Urgent Action Needed Colombian Model And Mexican Influencer Murders Highlight Rising Femicide Crisis

May 21, 2025 -

Jamie Lee Curtis Discusses Her Lasting Connection With Lindsay Lohan Following Their Iconic Film

May 21, 2025

Jamie Lee Curtis Discusses Her Lasting Connection With Lindsay Lohan Following Their Iconic Film

May 21, 2025 -

Market Update Six Day Win Streak For S And P 500 As Investors Ignore Moodys

May 21, 2025

Market Update Six Day Win Streak For S And P 500 As Investors Ignore Moodys

May 21, 2025 -

Client Data Breach Legal Aid Confirms Theft Of Sensitive Information Including Criminal Records

May 21, 2025

Client Data Breach Legal Aid Confirms Theft Of Sensitive Information Including Criminal Records

May 21, 2025