State Farm's Insurance Rate Increase Approved In California: What It Means For Consumers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

State Farm's Insurance Rate Increase Approved in California: What it Means for Consumers

California homeowners and auto insurance customers face higher premiums as State Farm's rate hike request is approved. The California Department of Insurance (CDI) recently greenlit a significant increase in insurance rates proposed by State Farm, leaving many Californians wondering what this means for their wallets. This move follows a trend of rising insurance costs across the state, fueled by factors ranging from increased wildfire risk to inflation and rising litigation costs. Understanding the implications of this rate hike is crucial for all California residents.

How Much Will Premiums Increase?

The exact percentage increase varies depending on location, coverage type, and other factors. State Farm's proposal detailed increases averaging around [Insert Percentage Here]%, although some policyholders could see significantly higher or lower adjustments. The CDI approval doesn't automatically mean this exact percentage will apply to every policy; individual rate changes will be communicated directly by State Farm to its policyholders. This lack of transparency initially caused some confusion and concern, prompting the CDI to clarify its approval process and emphasize the individualized nature of rate adjustments.

Reasons Behind the Increase

Several factors contributed to State Farm's request for a rate increase. The CDI's approval cites these key elements:

- Increased claims costs: Rising repair and replacement costs for vehicles and homes, partly driven by inflation, are a major factor. The cost of materials and labor has soared, impacting the financial burden on insurers.

- Higher legal expenses: California's litigation environment plays a significant role. The increasing frequency and cost of lawsuits related to auto accidents and property damage necessitate higher premiums to cover potential payouts.

- Catastrophic events: The increasing frequency and severity of wildfires and other natural disasters in California significantly increase insurance risk. These events lead to massive claims payouts, pushing up premiums for all policyholders, even those in areas not directly affected by the catastrophes.

What Can Consumers Do?

Facing a rate increase can be frustrating, but consumers aren't powerless. Here are some steps to consider:

- Shop around: Don't automatically accept the increase. Compare quotes from other insurers to see if you can find a more competitive rate. Several online comparison tools can streamline this process. [Link to a reputable insurance comparison website].

- Review your coverage: A comprehensive review of your existing coverage might reveal areas where you could reduce costs without compromising essential protection. Consider increasing your deductible to lower your premium, but only if you can comfortably afford a higher out-of-pocket expense in the event of a claim.

- Improve your home's safety: For homeowners, taking steps to mitigate wildfire risk, such as clearing brush and installing fire-resistant roofing materials, could lead to lower premiums in the long run. Consult with your insurer about potential discounts for home safety improvements.

- Contact State Farm directly: If you have questions or concerns about your specific rate increase, reach out to your State Farm agent. Understanding the rationale behind your individual increase is crucial.

Looking Ahead:

The State Farm rate increase highlights the ongoing challenges facing California's insurance market. Rising costs, increased risks, and legal complexities contribute to a complex situation. Consumers need to be proactive and informed to navigate this changing landscape effectively. Staying updated on insurance market trends and actively managing your policy is essential to ensure adequate coverage at a manageable cost. This situation underscores the need for ongoing dialogue between insurers, regulators, and consumers to find sustainable solutions for affordable insurance in California.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on State Farm's Insurance Rate Increase Approved In California: What It Means For Consumers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Independent Film Friendship Soars Detroit Showing And Wider Release

May 17, 2025

Independent Film Friendship Soars Detroit Showing And Wider Release

May 17, 2025 -

Wes Andersons Films A Deeper Look At The Underlying Themes Of Isolation And Loss

May 17, 2025

Wes Andersons Films A Deeper Look At The Underlying Themes Of Isolation And Loss

May 17, 2025 -

Second Quarter Mlb Seven Unexpected Statistics To Watch

May 17, 2025

Second Quarter Mlb Seven Unexpected Statistics To Watch

May 17, 2025 -

Cannes Before Cell Phones A Hilarious Look Back At Iconic Moments

May 17, 2025

Cannes Before Cell Phones A Hilarious Look Back At Iconic Moments

May 17, 2025 -

Cybersecurity Near Miss Bbc Report Exposes Co Ops Vulnerability

May 17, 2025

Cybersecurity Near Miss Bbc Report Exposes Co Ops Vulnerability

May 17, 2025

Latest Posts

-

Relax And Unwind Movie And Tv Recommendations For Graduates

May 18, 2025

Relax And Unwind Movie And Tv Recommendations For Graduates

May 18, 2025 -

Major Security Breach 11 Inmates Escape New Orleans Jail Facility

May 18, 2025

Major Security Breach 11 Inmates Escape New Orleans Jail Facility

May 18, 2025 -

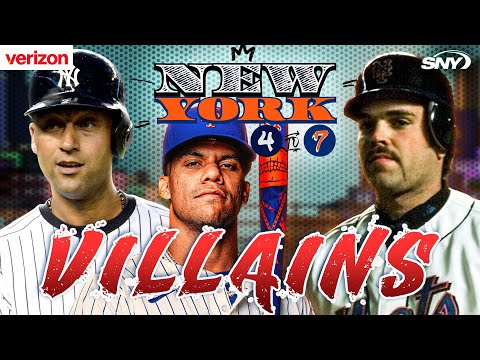

All Time Subway Series Villains Ranking The Most Despised Mets And Yankees

May 18, 2025

All Time Subway Series Villains Ranking The Most Despised Mets And Yankees

May 18, 2025 -

Joe Ryans Stellar Pitching Leads Twins To 12th Consecutive Victory

May 18, 2025

Joe Ryans Stellar Pitching Leads Twins To 12th Consecutive Victory

May 18, 2025 -

Political Firestorm Trump And Springsteen Clash Over Treason Allegation

May 18, 2025

Political Firestorm Trump And Springsteen Clash Over Treason Allegation

May 18, 2025