State Farm's Rate Hike Approved: What It Means For California Drivers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

State Farm's Rate Hike Approved: What it Means for California Drivers

California drivers are bracing for higher insurance premiums after State Farm, the nation's largest auto insurer, received approval for a significant rate increase. This decision, impacting millions of California policyholders, has sparked debate and raised concerns about the affordability of car insurance in the Golden State. What does this mean for you? Let's break it down.

The Details of the Increase:

State Farm's proposed rate hike, varying by region and policy specifics, has been approved by the California Department of Insurance (CDI). While the exact percentage increase isn't uniformly applied across the board, reports suggest significant jumps for many drivers. This follows a trend of rising insurance costs nationwide, attributed to several factors.

Why the Increase? Understanding the Factors:

Several contributing factors pushed State Farm to request this substantial rate adjustment:

- Increased Claims Costs: The cost of repairing vehicles, particularly those with advanced safety features and sophisticated technology, has risen dramatically. This includes the escalating price of parts and labor.

- Inflationary Pressures: General inflation impacts everything, including the cost of materials, medical care associated with accidents, and the overall operating expenses of insurance companies.

- Higher Legal Costs: The increasing cost of legal fees associated with accident claims contributes significantly to the overall expense of providing insurance coverage.

- Catastrophic Events: California's susceptibility to wildfires, earthquakes, and other natural disasters increases the risk profile for insurers, necessitating higher premiums to offset potential payouts.

- Increased Vehicle Theft: A recent uptick in vehicle theft across California adds another layer of risk impacting premiums.

What Can California Drivers Do?

Facing higher insurance premiums can be stressful, but there are steps you can take:

- Shop Around: Don't settle for your current rate. Compare quotes from multiple insurers to find the best deal. Use online comparison tools to streamline the process. [Link to reputable insurance comparison website]

- Improve Your Driving Record: Maintaining a clean driving record is one of the best ways to keep your premiums low. Avoid accidents and traffic violations.

- Consider Bundling: Bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, can often result in discounts.

- Increase Your Deductible: A higher deductible will typically lower your monthly premium, but remember you'll pay more out-of-pocket in the event of a claim. Weigh the risks and rewards carefully.

- Review Your Coverage: Ensure you have the appropriate level of coverage without overpaying for unnecessary extras. Consult with an insurance agent to review your policy and identify potential savings.

Looking Ahead: The Future of California Car Insurance

The State Farm rate hike is likely a sign of things to come. As claims costs and inflation continue to rise, it's expected that other insurance companies will also seek rate increases. Staying informed about market trends and actively managing your insurance policy is crucial for California drivers. Consider consulting a financial advisor for personalized guidance on managing your insurance costs effectively.

Call to Action: Don't wait until your renewal date to compare rates. Start shopping around today to ensure you're getting the best possible coverage at the most competitive price. Protect your financial future by proactively managing your car insurance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on State Farm's Rate Hike Approved: What It Means For California Drivers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Russia And Ukraine Engage In First Direct Talks In Three Years What Happened

May 17, 2025

Russia And Ukraine Engage In First Direct Talks In Three Years What Happened

May 17, 2025 -

Pete Roses Hall Of Fame Chances Opinions From 12 Current Members

May 17, 2025

Pete Roses Hall Of Fame Chances Opinions From 12 Current Members

May 17, 2025 -

State Farms Rate Increase Approved What California Drivers Need To Know

May 17, 2025

State Farms Rate Increase Approved What California Drivers Need To Know

May 17, 2025 -

Box Office Success For Friendship Detroit Showing And Specialty Film Previews Announced

May 17, 2025

Box Office Success For Friendship Detroit Showing And Specialty Film Previews Announced

May 17, 2025 -

Uk Economy Shows Fastest Growth As Labour Leader Navigates Albania Controversy

May 17, 2025

Uk Economy Shows Fastest Growth As Labour Leader Navigates Albania Controversy

May 17, 2025

Latest Posts

-

Japan Seeks Extradition Of British Citizens For Major Jewellery Theft

May 18, 2025

Japan Seeks Extradition Of British Citizens For Major Jewellery Theft

May 18, 2025 -

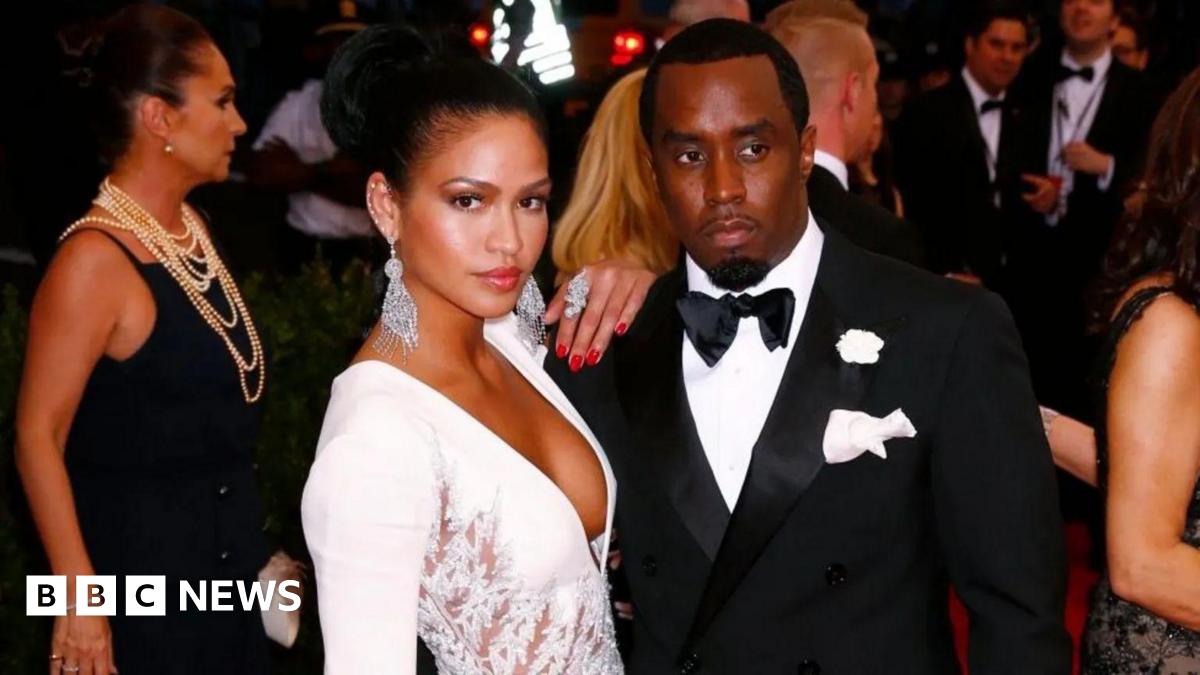

Sean Diddy Combs Trial The Importance Of Cassies Testimony

May 18, 2025

Sean Diddy Combs Trial The Importance Of Cassies Testimony

May 18, 2025 -

I Was On The Plane But British Airways Says I Wasn T Passengers Ordeal

May 18, 2025

I Was On The Plane But British Airways Says I Wasn T Passengers Ordeal

May 18, 2025 -

Ibb Den Kritik Uyari Istanbul Un Stres Seviyesi Tehlikeli Boyutta

May 18, 2025

Ibb Den Kritik Uyari Istanbul Un Stres Seviyesi Tehlikeli Boyutta

May 18, 2025 -

Eurovision 2025 Meet The Top 5 Frontrunners

May 18, 2025

Eurovision 2025 Meet The Top 5 Frontrunners

May 18, 2025