Stock Market Surge: Six-Day Winning Streak For S&P 500 Despite Moody's Action

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Surge: S&P 500 Extends Winning Streak to Six Days Despite Moody's Downgrade

The S&P 500 has defied expectations, closing higher for a sixth consecutive day, a remarkable feat considering the recent downgrade of the U.S. government's credit rating by Moody's. This unexpected surge showcases the resilience of the market and raises questions about the true impact of the downgrade on investor sentiment. The rally suggests that other economic factors are currently outweighing the concerns raised by Moody's.

Moody's Downgrade: A Damp Squib?

Moody's decision to lower the U.S. government's credit rating from Aaa to Aa1, citing concerns about fiscal strength and rising debt, sent shockwaves through the financial world. Many analysts predicted a significant market correction following the announcement. However, the market's response has been surprisingly muted, with the S&P 500 continuing its upward trajectory.

This counterintuitive reaction highlights the complexity of the market and the multitude of factors influencing investor behavior. While the downgrade is undoubtedly a negative development, other factors, such as strong corporate earnings reports and positive economic indicators, may be overriding its impact.

What's Driving the Market's Resilience?

Several contributing factors may explain the S&P 500's remarkable six-day winning streak despite the Moody's downgrade:

-

Strong Corporate Earnings: A string of better-than-expected earnings reports from major corporations has boosted investor confidence. These positive results suggest that the overall economy remains relatively strong despite inflationary pressures and interest rate hikes. [Link to relevant financial news source about corporate earnings]

-

Resilient Consumer Spending: Consumer spending continues to show remarkable resilience, indicating a robust economy capable of withstanding the current economic headwinds. This suggests that the downgrade's impact on consumer confidence is limited. [Link to relevant economic data source]

-

Market Anticipation: The market may have already priced in much of the negative impact of the Moody's downgrade. Investors might be focusing on the long-term prospects of the economy and individual companies, rather than reacting solely to short-term events.

-

Federal Reserve's Stance: While the Federal Reserve continues to battle inflation, its recent comments suggest a potential pause in interest rate hikes, providing some relief to investors concerned about further tightening monetary policy. [Link to Federal Reserve website]

Looking Ahead: Uncertainty Remains

While the current market surge is encouraging, it's crucial to acknowledge the ongoing uncertainty. The long-term implications of the Moody's downgrade remain unclear, and other economic challenges, such as inflation and geopolitical instability, persist.

Investors should remain cautious and diversify their portfolios to mitigate potential risks. It’s advisable to consult with a qualified financial advisor before making any significant investment decisions. The current rally shouldn't be interpreted as a guarantee of sustained growth.

Keywords: S&P 500, stock market, Moody's, credit rating downgrade, six-day winning streak, market surge, investor sentiment, economic indicators, corporate earnings, Federal Reserve, interest rates, inflation, investment advice, financial news.

Call to Action (subtle): Stay informed about the latest market trends by following our financial news updates. [Link to your website or relevant news source]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Surge: Six-Day Winning Streak For S&P 500 Despite Moody's Action. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bitcoin Etf Investments Exceed 5 Billion Analyzing The Bold Strategy

May 20, 2025

Bitcoin Etf Investments Exceed 5 Billion Analyzing The Bold Strategy

May 20, 2025 -

In The Wake Of The St Louis Tornado Resilience And Community Support

May 20, 2025

In The Wake Of The St Louis Tornado Resilience And Community Support

May 20, 2025 -

Urgent Security Alert Legal Aid System Hacked Sensitive Data Exposed

May 20, 2025

Urgent Security Alert Legal Aid System Hacked Sensitive Data Exposed

May 20, 2025 -

Reserve Bank Of Australia Lowers Rates To Two Year Low Amid Easing Inflation

May 20, 2025

Reserve Bank Of Australia Lowers Rates To Two Year Low Amid Easing Inflation

May 20, 2025 -

Cathay Pacifics In House Pilot Training A New Benchmark For Aviation Excellence

May 20, 2025

Cathay Pacifics In House Pilot Training A New Benchmark For Aviation Excellence

May 20, 2025

Latest Posts

-

Investigation Lufthansa Flight Operated Without Pilot For 10 Minutes

May 20, 2025

Investigation Lufthansa Flight Operated Without Pilot For 10 Minutes

May 20, 2025 -

Israeli Airstrikes Devastate Final Northern Gaza Hospital

May 20, 2025

Israeli Airstrikes Devastate Final Northern Gaza Hospital

May 20, 2025 -

Balis Plea Global Cooperation Needed For Responsible Tourism

May 20, 2025

Balis Plea Global Cooperation Needed For Responsible Tourism

May 20, 2025 -

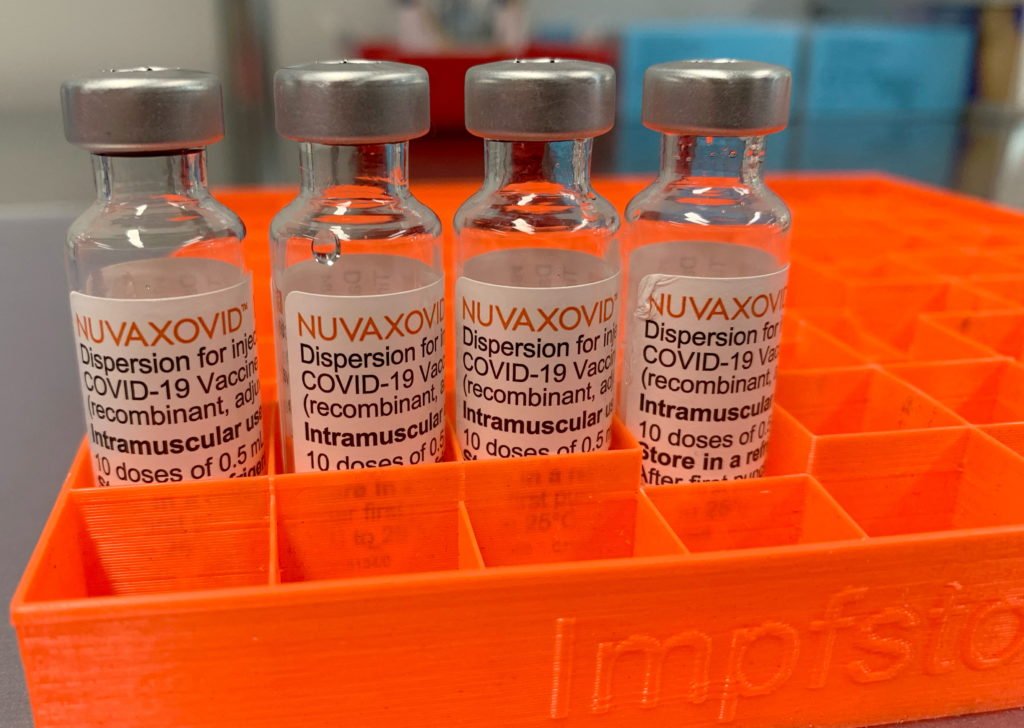

Limited Fda Approval Understanding The Novavax Covid 19 Vaccine Restrictions

May 20, 2025

Limited Fda Approval Understanding The Novavax Covid 19 Vaccine Restrictions

May 20, 2025 -

Stock Market Upbeat Six Day Win Streak For S And P 500 Amidst Moodys Action

May 20, 2025

Stock Market Upbeat Six Day Win Streak For S And P 500 Amidst Moodys Action

May 20, 2025