Stock Market Today: Six-Day Winning Streak For S&P 500, Positive Close For Dow And Nasdaq

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Today: S&P 500 Extends Winning Streak to Six Days, Dow and Nasdaq Close Positive

The US stock market continued its impressive rally today, with the S&P 500 extending its winning streak to an impressive six days. This positive momentum propelled the Dow Jones Industrial Average and the Nasdaq Composite to close in the green as well, signaling a potential shift in market sentiment. Investors are cautiously optimistic, but several factors are contributing to this sustained upward trend.

S&P 500's Six-Day Surge: A Closer Look

The S&P 500's six-day winning streak is a significant development, marking its longest such run in several months. This rally is fueled by a combination of factors, including easing inflation concerns, positive corporate earnings reports, and renewed confidence in the Federal Reserve's ability to manage the economy without triggering a severe recession. The index closed at [insert closing value here], representing a [insert percentage change here] increase for the day. This sustained growth suggests a potential turning point for the market after a period of volatility.

Dow and Nasdaq Join the Rally

The Dow Jones Industrial Average also ended the day with a positive close, mirroring the gains seen in the broader market. This suggests that investor optimism is not limited to technology stocks, which often dominate the Nasdaq. The Dow's performance reflects a broader sense of confidence across various sectors. Similarly, the Nasdaq Composite experienced a positive close, boosted by strong performances from key technology companies. This indicates continued investor interest in the growth potential of the tech sector.

What's Driving the Market's Upward Trajectory?

Several factors are contributing to the current market optimism:

- Easing Inflation Concerns: Recent economic data suggests that inflation may be cooling faster than initially anticipated. This reduces pressure on the Federal Reserve to implement further aggressive interest rate hikes, lessening concerns about a potential economic slowdown.

- Strong Corporate Earnings: A number of major corporations have recently reported better-than-expected earnings, boosting investor confidence and fueling further market gains. [Link to relevant earnings reports news].

- Federal Reserve's Measured Approach: The Federal Reserve's recent communication suggests a more measured approach to future interest rate adjustments, offering a degree of reassurance to investors. This less hawkish stance is viewed positively by the market.

- Geopolitical Stability (or lack of major negative events): The absence of significant negative geopolitical developments has also contributed to the improved investor sentiment. While global uncertainties remain, the lack of major crises has provided a degree of stability.

Looking Ahead: Potential Challenges and Opportunities

While the current market trend is positive, it's crucial to acknowledge potential challenges. Interest rates remain elevated, and the threat of a recession, though seemingly lessened, still lingers. Investors should maintain a cautious approach and diversify their portfolios accordingly. However, the current positive momentum provides a degree of optimism, suggesting potential opportunities for growth in the coming weeks and months.

Key Takeaways:

- The S&P 500 has extended its winning streak to six days.

- The Dow and Nasdaq also closed positively.

- Easing inflation, strong earnings, and a more measured approach from the Federal Reserve are contributing factors.

- Investors should remain cautious but recognize potential opportunities.

Disclaimer: This article provides general information and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

This article utilizes relevant keywords like "stock market," "S&P 500," "Dow Jones," "Nasdaq," "winning streak," "market rally," "inflation," "Federal Reserve," and "earnings reports" naturally throughout the text to improve SEO performance. The use of headings, bullet points, and a clear structure enhances readability and user experience. The inclusion of a disclaimer adds a layer of professionalism and protects against legal liability. Finally, the call to action is subtly embedded within the article, encouraging readers to consult a financial advisor before making investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Today: Six-Day Winning Streak For S&P 500, Positive Close For Dow And Nasdaq. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hollywood Friendship Jamie Lee Curtis Speaks Out About Lindsay Lohans Authenticity

May 20, 2025

Hollywood Friendship Jamie Lee Curtis Speaks Out About Lindsay Lohans Authenticity

May 20, 2025 -

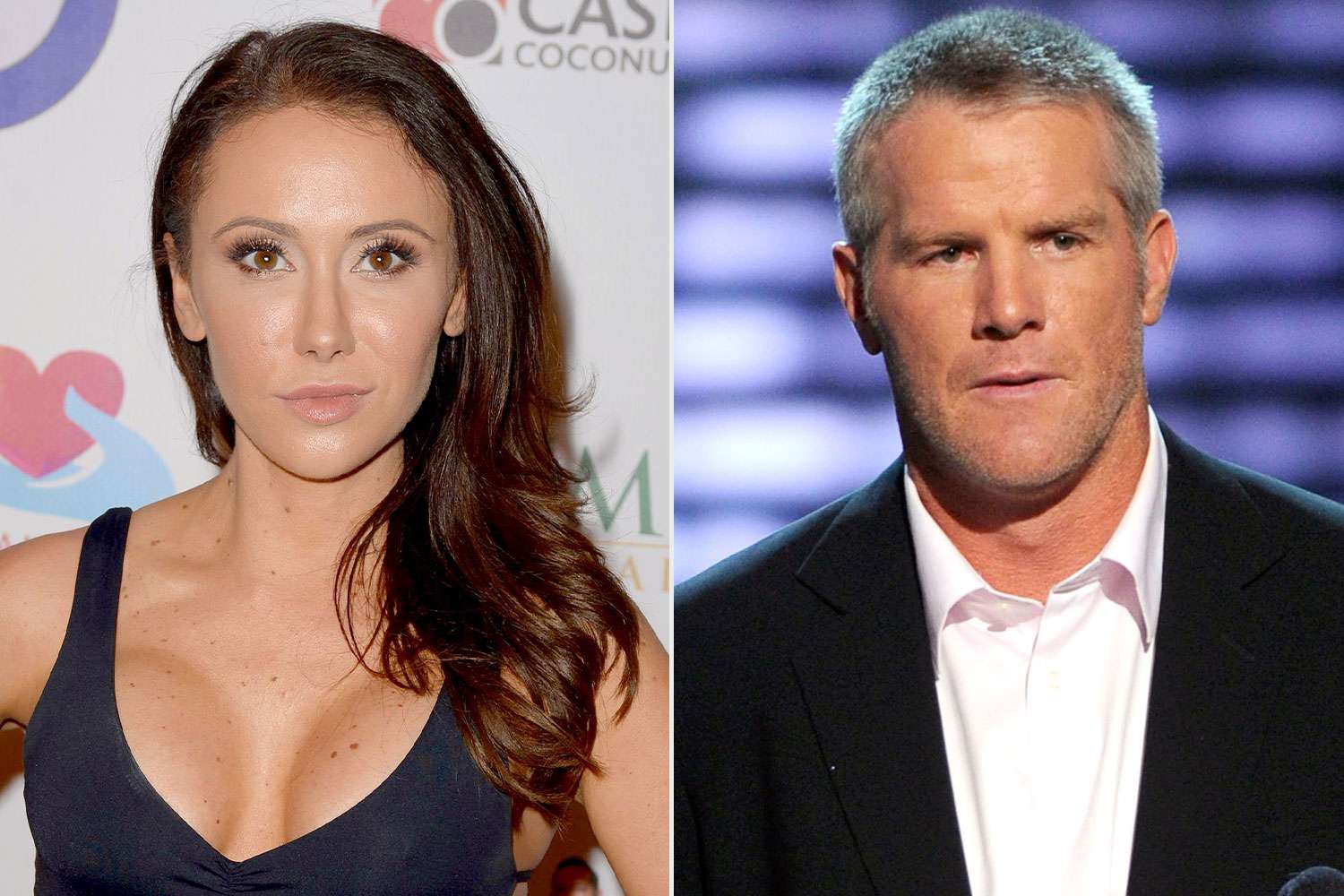

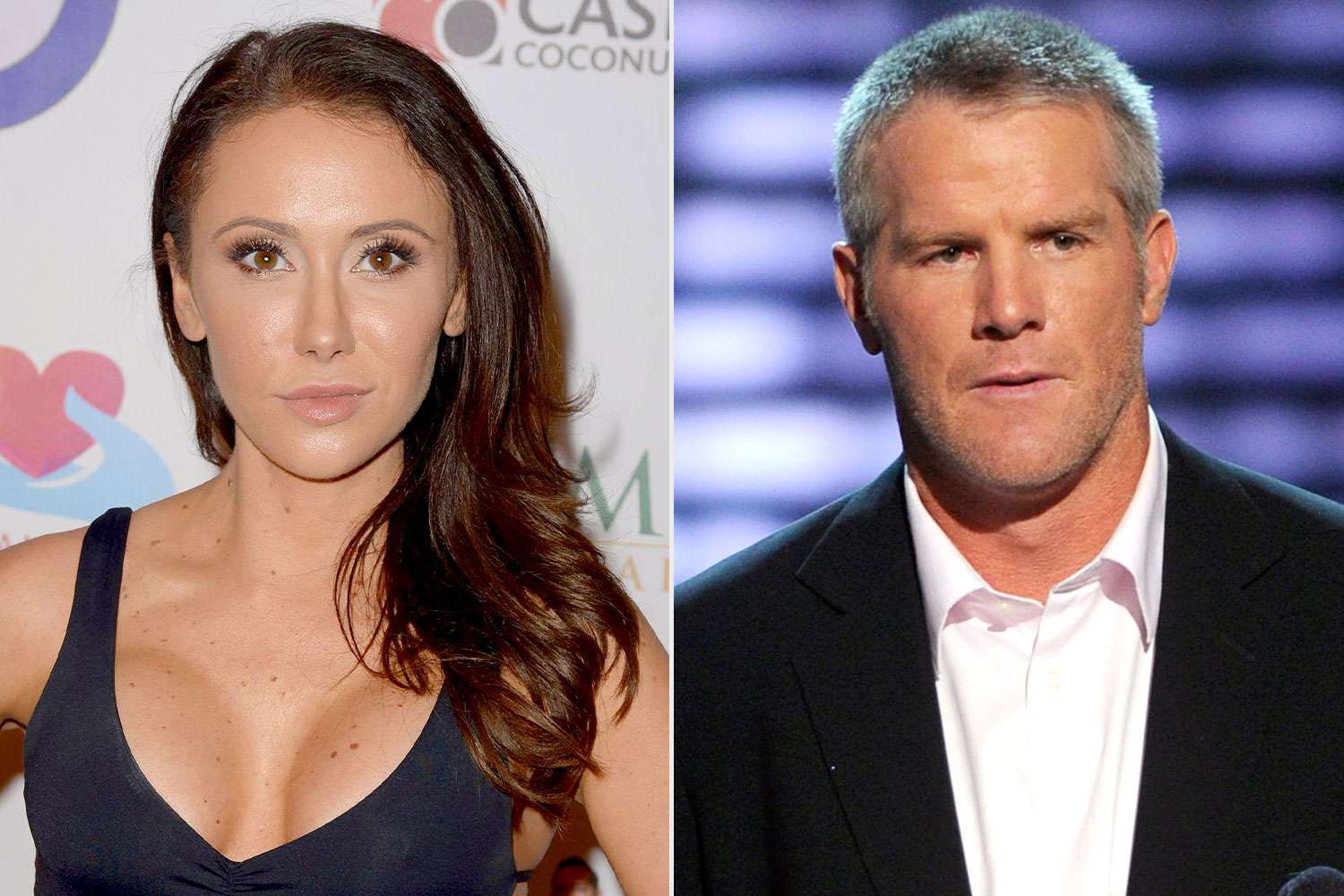

Jenn Sterger On Brett Favre Sext Scandal Fallout I Was Never Treated Like A Person

May 20, 2025

Jenn Sterger On Brett Favre Sext Scandal Fallout I Was Never Treated Like A Person

May 20, 2025 -

New Amazon Series With A24 A Rising Stars Unexpected Breakthrough

May 20, 2025

New Amazon Series With A24 A Rising Stars Unexpected Breakthrough

May 20, 2025 -

Years Later Jenn Sterger Reflects On The Brett Favre Scandal And Its Aftermath

May 20, 2025

Years Later Jenn Sterger Reflects On The Brett Favre Scandal And Its Aftermath

May 20, 2025 -

Violence Against Women Recent Deaths Of A Colombian Model And Mexican Influencer Spark Global Condemnation

May 20, 2025

Violence Against Women Recent Deaths Of A Colombian Model And Mexican Influencer Spark Global Condemnation

May 20, 2025

Latest Posts

-

Lineker Exit Bbc Faces Fallout After Match Of The Day Controversy

May 20, 2025

Lineker Exit Bbc Faces Fallout After Match Of The Day Controversy

May 20, 2025 -

Tense Standoff Eu Brexit Negotiations Enter Final Fraught Stages

May 20, 2025

Tense Standoff Eu Brexit Negotiations Enter Final Fraught Stages

May 20, 2025 -

Cyberattack Exposes Sensitive Data Including Criminal Records From Legal Aid

May 20, 2025

Cyberattack Exposes Sensitive Data Including Criminal Records From Legal Aid

May 20, 2025 -

U S Treasury Yield Slip Federal Reserves 2025 Rate Cut Outlook

May 20, 2025

U S Treasury Yield Slip Federal Reserves 2025 Rate Cut Outlook

May 20, 2025 -

Should Your Child Stop Sucking Their Thumb Or Pacifier Expert Advice

May 20, 2025

Should Your Child Stop Sucking Their Thumb Or Pacifier Expert Advice

May 20, 2025