U.S. Treasury Yield Slip: Federal Reserve's 2025 Rate Cut Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Yield Slip Hints at Earlier-Than-Expected Fed Rate Cut in 2025

The U.S. Treasury market is sending a clear signal: investors are increasingly betting on the Federal Reserve cutting interest rates sooner than previously anticipated, potentially as early as 2025. This shift is reflected in a noticeable slip in Treasury yields, a key indicator of investor sentiment and expectations for future monetary policy. What's driving this change, and what does it mean for the economy?

Declining Yields: A Sign of Easing Monetary Policy Expectations

The recent decline in Treasury yields, particularly in longer-term bonds, suggests a growing belief among investors that the Fed's aggressive interest rate hikes might be nearing their end. Higher yields typically reflect expectations of future rate increases and robust economic growth. The current dip, however, points towards a more cautious outlook, with investors anticipating a potential pivot towards easing monetary policy. This is significant because it impacts borrowing costs for businesses and consumers, influencing investment decisions and overall economic activity.

Factors Contributing to the Yield Slip

Several factors are contributing to this shift in market sentiment:

- Inflation Slowdown: While inflation remains above the Fed's target, recent data shows a clear deceleration. This easing of inflationary pressures reduces the urgency for further aggressive rate hikes. The latest Consumer Price Index (CPI) and Producer Price Index (PPI) reports are key data points investors are scrutinizing.

- Economic Growth Concerns: Concerns about a potential economic slowdown, or even a recession, are also playing a role. Recent economic indicators, including weaker-than-expected retail sales and manufacturing data, have fueled these anxieties. A slowing economy could prompt the Fed to ease its monetary policy stance to stimulate growth.

- Geopolitical Uncertainty: Global geopolitical events, including the ongoing war in Ukraine and escalating trade tensions, contribute to overall market uncertainty. This uncertainty can lead investors to seek safer havens, pushing down yields on U.S. Treasuries.

The Fed's Stance: A Balancing Act

The Federal Reserve continues to maintain a hawkish stance, emphasizing its commitment to bringing inflation down to its 2% target. However, the recent yield slip indicates a divergence between market expectations and the Fed's communicated policy. The central bank faces a delicate balancing act: controlling inflation without triggering a significant economic downturn. Future Federal Open Market Committee (FOMC) meetings will be crucial in providing clarity on the Fed's future course of action.

Looking Ahead: Implications for Investors and the Economy

The implications of this yield slip are far-reaching. Lower yields can boost borrowing and investment, potentially stimulating economic growth. However, they also signal a potential shift in the economic landscape, indicating a less certain future. Investors need to carefully analyze the situation and adjust their portfolios accordingly. This includes diversifying investments and considering the potential impact on various asset classes, from stocks to real estate.

Further Research and Resources:

For more in-depth analysis on Treasury yields and Federal Reserve policy, we recommend exploring resources from the Federal Reserve itself ([link to Federal Reserve website]), the U.S. Treasury Department ([link to U.S. Treasury website]), and reputable financial news outlets. Staying informed about economic indicators and market trends is crucial for navigating the current environment.

Call to Action: Stay tuned for further updates as the situation unfolds. Understanding the interplay between Treasury yields, inflation, and the Fed's policy decisions is crucial for making informed financial decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Yield Slip: Federal Reserve's 2025 Rate Cut Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Exploring Griffith Park Why Its A Top Contender For Best City Park In America

May 20, 2025

Exploring Griffith Park Why Its A Top Contender For Best City Park In America

May 20, 2025 -

Get Ready Helldivers 2 Masters Of Ceremony Warbond Drop Launches May 15th

May 20, 2025

Get Ready Helldivers 2 Masters Of Ceremony Warbond Drop Launches May 15th

May 20, 2025 -

Balis Tourism Strategy Prioritizing Safety And Responsible Tourist Behavior Through International Partnerships

May 20, 2025

Balis Tourism Strategy Prioritizing Safety And Responsible Tourist Behavior Through International Partnerships

May 20, 2025 -

Dealing With Pacifier And Thumb Sucking A Parents Guide

May 20, 2025

Dealing With Pacifier And Thumb Sucking A Parents Guide

May 20, 2025 -

Prostate Cancer Diagnosis For President Joe Biden Implications And Next Steps

May 20, 2025

Prostate Cancer Diagnosis For President Joe Biden Implications And Next Steps

May 20, 2025

Latest Posts

-

Slowdown Ahead Feds Rate Cut Projection Impacts U S Treasury Yields

May 20, 2025

Slowdown Ahead Feds Rate Cut Projection Impacts U S Treasury Yields

May 20, 2025 -

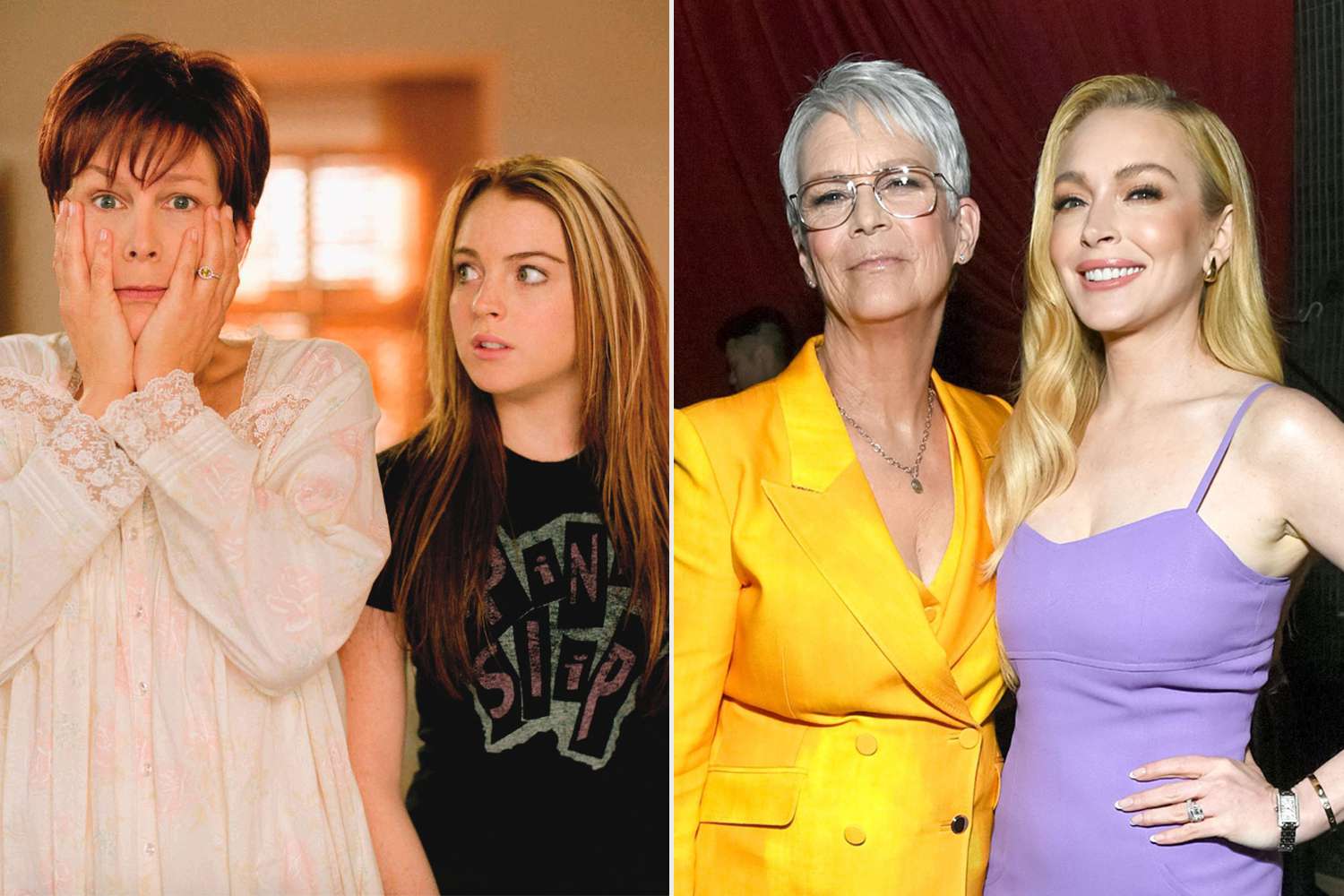

Jamie Lee Curtis Lindsay Lohan Always Kept It Real

May 20, 2025

Jamie Lee Curtis Lindsay Lohan Always Kept It Real

May 20, 2025 -

Jamie Lee Curtis Shares Insights Into Her Ongoing Friendship With Lindsay Lohan Post Freaky Friday

May 20, 2025

Jamie Lee Curtis Shares Insights Into Her Ongoing Friendship With Lindsay Lohan Post Freaky Friday

May 20, 2025 -

Stock Market Today Market Rally Persists Despite Moodys Negative Outlook

May 20, 2025

Stock Market Today Market Rally Persists Despite Moodys Negative Outlook

May 20, 2025 -

Breaking Trump Initiates Push For Immediate Russia Ukraine Peace Talks

May 20, 2025

Breaking Trump Initiates Push For Immediate Russia Ukraine Peace Talks

May 20, 2025