Stronger Buy Now, Pay Later Rules: Better Protection For Consumers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stronger Buy Now, Pay Later Rules: Better Protection for Consumers

Buy Now, Pay Later (BNPL) services have exploded in popularity, offering a seemingly effortless way to purchase goods and services. However, the rapid growth of this sector has raised concerns about consumer debt and financial protection. Responding to these concerns, regulators worldwide are implementing stronger rules to safeguard consumers and ensure responsible lending practices within the BNPL industry. This means better protection for you.

The Rise of BNPL and its Associated Risks

BNPL's convenience is undeniable. Its ease of use, particularly for online shopping, has attracted millions of users. However, this ease can mask potential pitfalls. Many consumers underestimate the total cost, including interest and fees, often leading to unexpected debt. The lack of stringent regulation in the early stages of BNPL's growth contributed to this problem, with some providers employing aggressive marketing tactics and insufficient credit checks. This resulted in:

- Increased consumer debt: Overspending fueled by readily available credit became a significant issue.

- Poor credit scores: Missed payments on BNPL loans can negatively impact credit ratings, making it harder to secure loans or credit cards in the future.

- Financial hardship: Unmanageable debt from BNPL services can lead to serious financial difficulties for vulnerable consumers.

New Regulations: A Step Towards Greater Consumer Protection

Recognizing these risks, governments and regulatory bodies are stepping in to strengthen consumer protection around BNPL. These new rules generally focus on several key areas:

- Enhanced Credit Checks: More rigorous credit checks are being mandated to ensure that consumers can afford the repayments before they take out a BNPL loan. This prevents irresponsible lending and helps avoid situations where consumers accumulate unsustainable debt.

- Clearer Disclosure of Costs: Regulations are pushing for greater transparency in outlining all fees and interest charges upfront. This empowers consumers to make informed decisions and compare different BNPL providers.

- Improved Debt Collection Practices: New rules often aim to regulate debt collection methods, preventing aggressive or harassing tactics used by some lenders. Fairer and more humane approaches are being encouraged.

- Affordability Assessments: Many jurisdictions are introducing requirements for lenders to conduct affordability assessments before approving BNPL loans. This ensures that consumers are only offered credit they can realistically repay.

What This Means for Consumers

The strengthened regulations signify a significant shift towards a more responsible and consumer-friendly BNPL landscape. Consumers can expect:

- Greater financial protection: Improved safeguards against irresponsible lending and aggressive debt collection.

- More transparent pricing: A clearer understanding of the total cost of using BNPL services.

- Reduced risk of debt: Stricter credit checks and affordability assessments help prevent overspending and financial hardship.

Looking Ahead: The Future of BNPL Regulation

While the current regulatory changes are a positive step, ongoing monitoring and potential further adjustments are expected. The BNPL industry is constantly evolving, and regulations must adapt to keep pace with technological advancements and evolving consumer behavior. Staying informed about these changes is crucial for responsible BNPL usage. Look for updates from your national consumer protection agency and financial regulators for the latest information in your region.

Call to Action: Before using any BNPL service, carefully review the terms and conditions, including all fees and interest rates. Ensure you understand the repayment schedule and that you can comfortably afford the repayments. If you are struggling with BNPL debt, seek advice from a financial advisor or consumer credit counseling service.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stronger Buy Now, Pay Later Rules: Better Protection For Consumers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Single Rate Cut Projection In 2025 How It Affects U S Treasury Yields

May 20, 2025

Single Rate Cut Projection In 2025 How It Affects U S Treasury Yields

May 20, 2025 -

Cnn Reports Final Northern Gaza Hospital Hit In Israeli Offensive

May 20, 2025

Cnn Reports Final Northern Gaza Hospital Hit In Israeli Offensive

May 20, 2025 -

Shift In Stance Japan Shows Flexibility On Us Tariffs After Elimination Plea

May 20, 2025

Shift In Stance Japan Shows Flexibility On Us Tariffs After Elimination Plea

May 20, 2025 -

New Wwi Drama Featuring Daniel Craig Cillian Murphy And Tom Hardy Where To Watch

May 20, 2025

New Wwi Drama Featuring Daniel Craig Cillian Murphy And Tom Hardy Where To Watch

May 20, 2025 -

The Visionarys Method How One Self Made Billionaire Creates Innovative Concepts

May 20, 2025

The Visionarys Method How One Self Made Billionaire Creates Innovative Concepts

May 20, 2025

Latest Posts

-

Wall Street Defies Moody S S And P 500 Dow And Nasdaq Climb Despite Downgrade

May 20, 2025

Wall Street Defies Moody S S And P 500 Dow And Nasdaq Climb Despite Downgrade

May 20, 2025 -

The Price Of Gold An Olympic Swimmers Story Of Mental And Physical Abuse

May 20, 2025

The Price Of Gold An Olympic Swimmers Story Of Mental And Physical Abuse

May 20, 2025 -

Trumps Waning Power Putin Demonstrates Unilateral Strength

May 20, 2025

Trumps Waning Power Putin Demonstrates Unilateral Strength

May 20, 2025 -

St Louis Tornado Aftermath A Communitys Resilience In The Face Of Disaster

May 20, 2025

St Louis Tornado Aftermath A Communitys Resilience In The Face Of Disaster

May 20, 2025 -

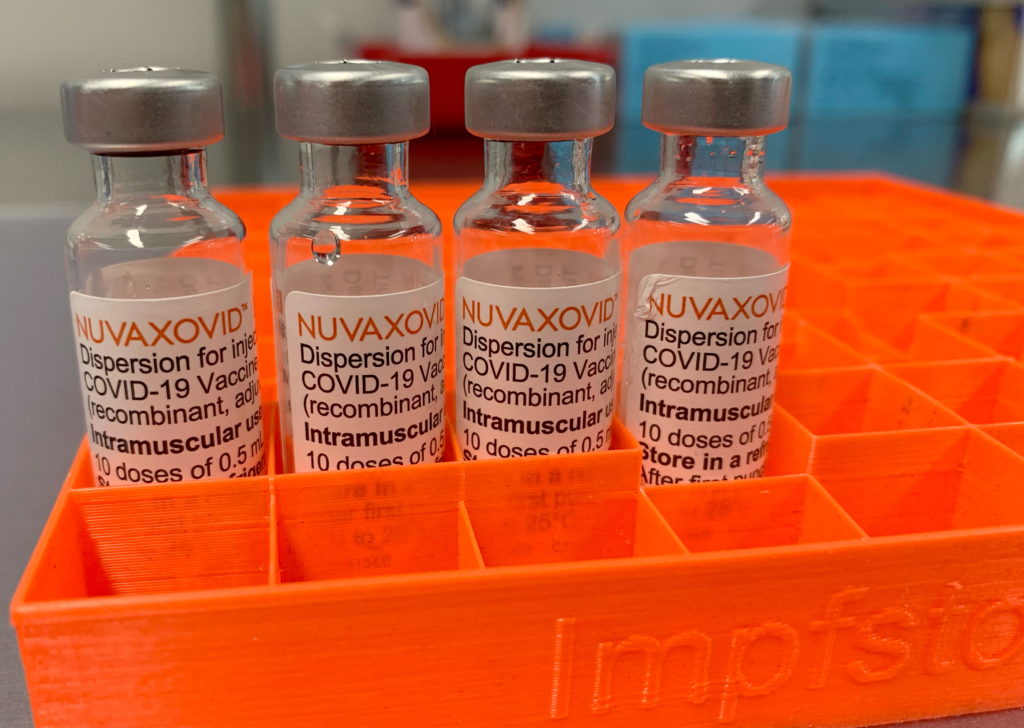

Conditional Fda Approval Novavax Covid 19 Vaccine Faces Usage Restrictions

May 20, 2025

Conditional Fda Approval Novavax Covid 19 Vaccine Faces Usage Restrictions

May 20, 2025