Stronger Buy Now, Pay Later Rules: Enhanced Consumer Protections

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stronger Buy Now, Pay Later Rules: Enhanced Consumer Protections Usher in a New Era of Responsible Lending

Buy Now, Pay Later (BNPL) services have exploded in popularity, offering consumers a seemingly effortless way to finance purchases. But this rapid growth has also raised concerns about consumer debt and financial vulnerability. Responding to these concerns, regulators worldwide are implementing stronger BNPL rules, prioritizing enhanced consumer protections. This shift marks a crucial turning point, aiming to balance the convenience of BNPL with responsible lending practices.

The Rise of BNPL and the Need for Regulation

The ease and accessibility of BNPL services have made them incredibly attractive to consumers, particularly younger generations. However, the lack of stringent regulations in the early stages led to worries about:

- Overspending and Debt Accumulation: The "easy credit" nature of BNPL can tempt consumers to overspend, leading to accumulating debt that can be difficult to manage.

- Lack of Transparency: Fees and interest charges aren't always clearly communicated, leaving consumers unaware of the true cost of their purchases.

- Impact on Credit Scores: While some BNPL providers report payment history to credit bureaus, others don't, creating inconsistencies and potentially harming consumer credit scores.

- Aggressive Marketing Practices: Concerns have been raised about the targeted marketing of BNPL services to vulnerable populations.

New Rules: A Focus on Consumer Safeguards

Recognizing these risks, regulators are introducing a wave of stricter rules designed to safeguard consumers:

1. Increased Transparency: New regulations mandate clearer disclosure of fees, interest rates, and repayment terms. Consumers will have a much better understanding of the total cost before committing to a BNPL agreement.

2. Affordability Assessments: Many jurisdictions are introducing requirements for BNPL providers to conduct affordability assessments before approving applications. This helps ensure consumers can realistically manage repayments without facing financial hardship.

3. Stronger Debt Collection Practices: Rules are being implemented to prevent aggressive debt collection tactics and ensure fair treatment of consumers who fall behind on payments. This includes limitations on late fees and restrictions on contacting consumers at inconvenient times.

4. Enhanced Data Security: Regulations are also addressing data security concerns, requiring BNPL providers to implement robust security measures to protect consumer information.

5. Credit Reporting Consistency: Efforts are underway to standardize the reporting of BNPL payment history to credit bureaus, providing a more accurate reflection of a consumer's creditworthiness.

The Impact on the BNPL Industry and Consumers

These stricter rules are likely to reshape the BNPL landscape. While some providers may face increased compliance costs, the overall goal is to foster a more sustainable and responsible industry. For consumers, the benefits are clear: greater transparency, improved affordability checks, and fairer treatment in case of payment difficulties.

Looking Ahead: A More Sustainable Future for BNPL

The introduction of stronger Buy Now, Pay Later rules signals a crucial shift towards responsible lending. By prioritizing consumer protection and transparency, regulators aim to mitigate the risks associated with BNPL while preserving its benefits. This balanced approach is essential for ensuring the long-term sustainability and responsible growth of the BNPL industry, protecting consumers and promoting financial well-being. This evolution highlights a growing commitment to responsible financial practices and a more secure lending environment for all.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stronger Buy Now, Pay Later Rules: Enhanced Consumer Protections. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fdas Conditional Approval Of Novavax Covid 19 Vaccine What You Need To Know

May 20, 2025

Fdas Conditional Approval Of Novavax Covid 19 Vaccine What You Need To Know

May 20, 2025 -

Tom Aspinall Negotiations Halt Jon Jones Hints At Retirement With I M Done Statement

May 20, 2025

Tom Aspinall Negotiations Halt Jon Jones Hints At Retirement With I M Done Statement

May 20, 2025 -

Hacker Attack On Legal Aid Sensitive Client Information Criminal Records Exposed

May 20, 2025

Hacker Attack On Legal Aid Sensitive Client Information Criminal Records Exposed

May 20, 2025 -

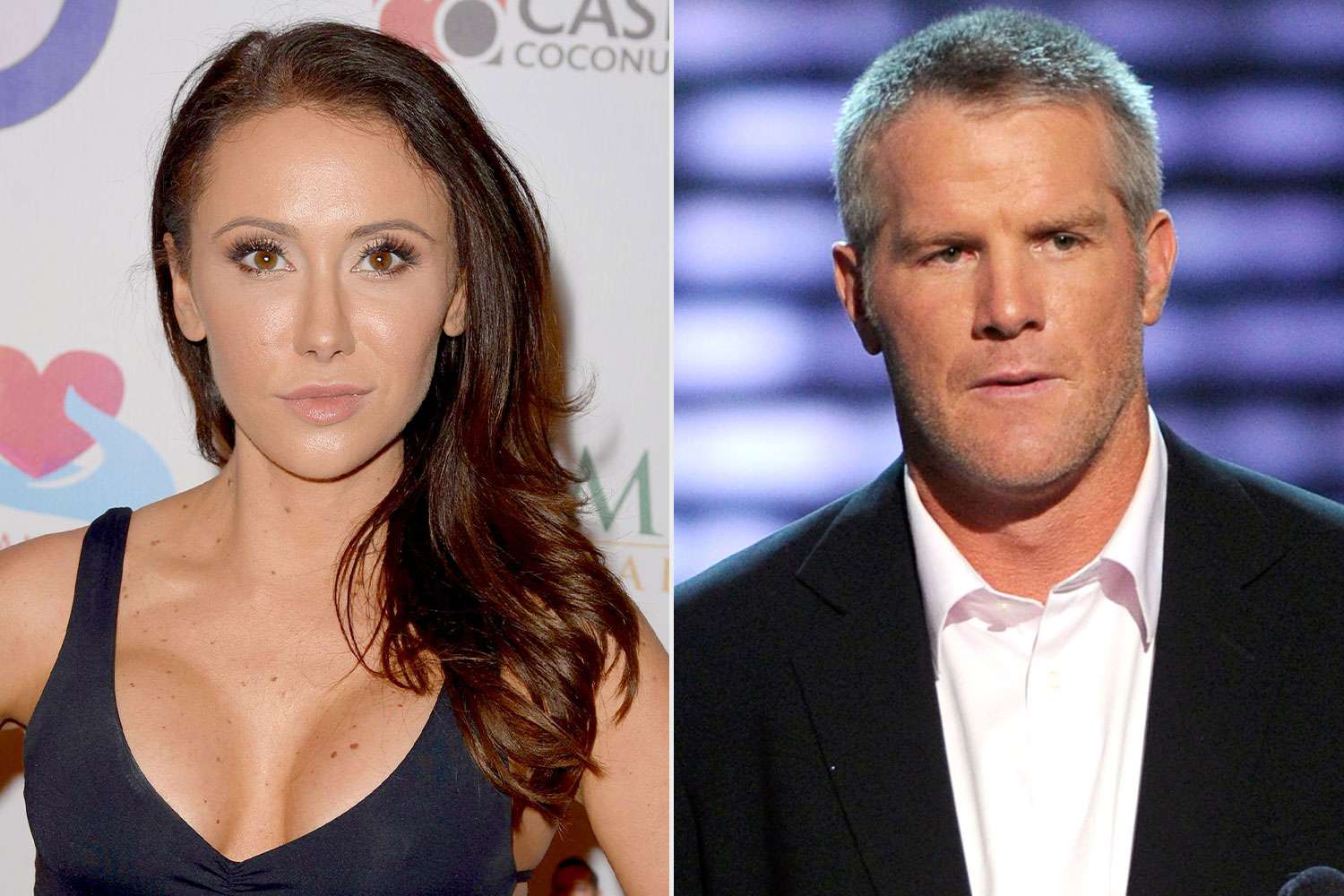

Jenn Sterger Revisits The Brett Favre Scandal A Story Of Exploitation And Disregard

May 20, 2025

Jenn Sterger Revisits The Brett Favre Scandal A Story Of Exploitation And Disregard

May 20, 2025 -

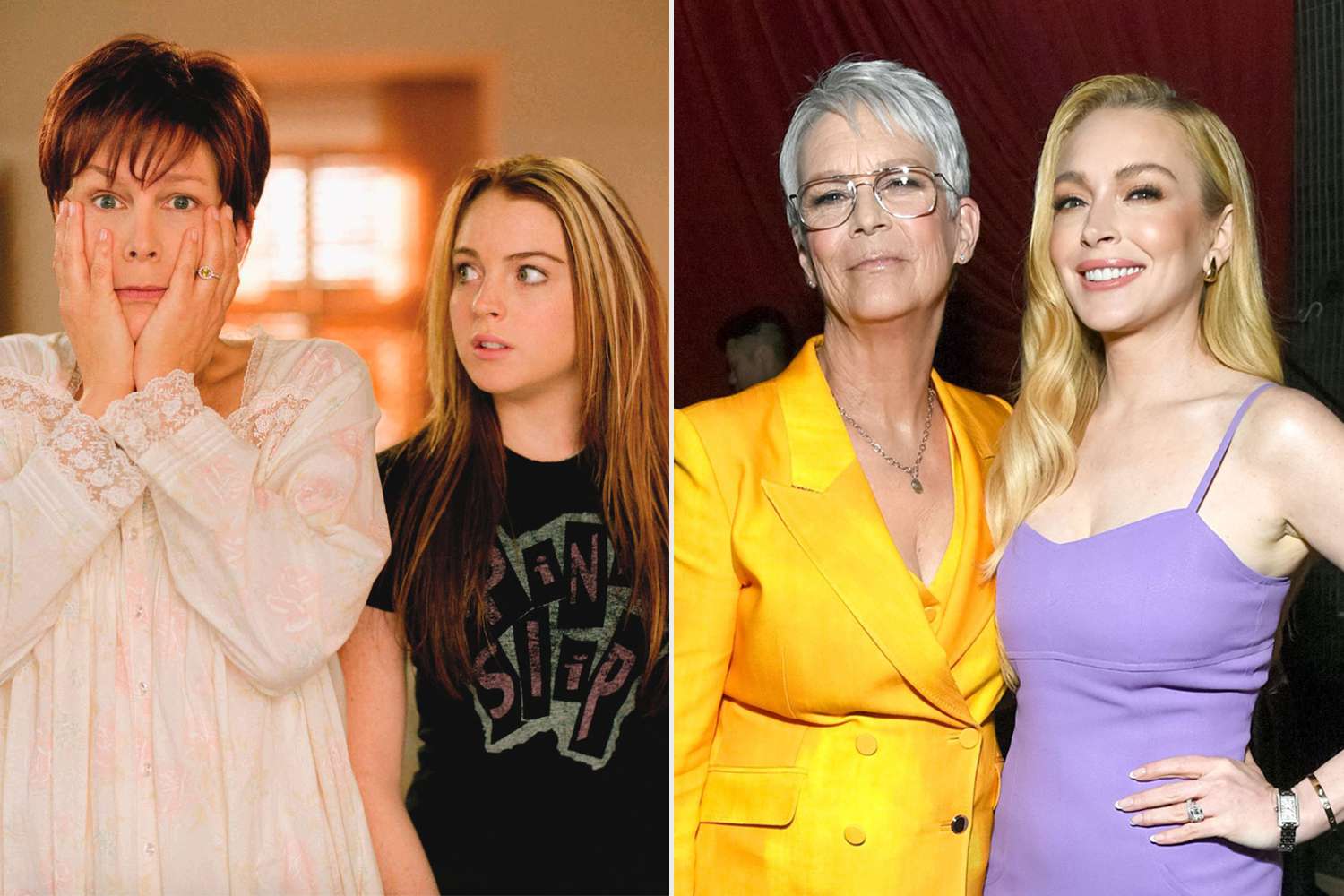

Jamie Lee Curtis Reveals Staying Connected With Lindsay Lohan Post Freaky Friday

May 20, 2025

Jamie Lee Curtis Reveals Staying Connected With Lindsay Lohan Post Freaky Friday

May 20, 2025

Latest Posts

-

Putin Signals Independence From Trump Shifting Global Power Dynamics

May 20, 2025

Putin Signals Independence From Trump Shifting Global Power Dynamics

May 20, 2025 -

Railroad Bridge Accident Leaves Two Adults Dead Children Injured

May 20, 2025

Railroad Bridge Accident Leaves Two Adults Dead Children Injured

May 20, 2025 -

Weaning Your Child Off Pacifiers And Thumbs Age Methods And Challenges

May 20, 2025

Weaning Your Child Off Pacifiers And Thumbs Age Methods And Challenges

May 20, 2025 -

Horrific Train Accident Family Of Four Involved Two Fatalities

May 20, 2025

Horrific Train Accident Family Of Four Involved Two Fatalities

May 20, 2025 -

Lufthansa Pilot Fainting Flight Continues Autopilot For 10 Minutes

May 20, 2025

Lufthansa Pilot Fainting Flight Continues Autopilot For 10 Minutes

May 20, 2025