Tax Troubles: Rob Cross Banned From Acting As Company Director

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tax Troubles: Rob Cross Banned from Acting as Company Director

Former professional darts player Rob Cross has been disqualified from acting as a company director for seven years following a tax investigation. The ban, handed down by the Insolvency Service, highlights the serious consequences of failing to comply with UK tax regulations, even for high-profile individuals. This case serves as a stark warning to business owners and directors nationwide about the importance of meticulous record-keeping and timely tax payments.

The Insolvency Service's investigation revealed significant failings in Cross's management of his company's tax affairs. While the specifics haven't been fully disclosed to protect ongoing investigations, the severity of the breaches led to the disqualification order. This highlights the rigorous scrutiny that companies, regardless of size or the individual's public profile, face from HMRC.

The Impact of Tax Evasion on Business Reputation

The consequences extend beyond the financial penalties. A director's disqualification significantly damages their professional reputation and can severely limit future business opportunities. This case underscores the reputational risk associated with non-compliance. For individuals like Rob Cross, who previously enjoyed significant public recognition, the reputational damage can be particularly profound. The news will undoubtedly impact his brand and future business ventures.

Understanding the Director Disqualification Process

The disqualification process, overseen by the Insolvency Service, is designed to protect creditors and maintain public confidence in the business environment. Investigations often involve scrutiny of company accounts, tax returns, and other financial records. The penalties for non-compliance can be substantial, ranging from financial fines to imprisonment in severe cases. This case reinforces the importance of seeking professional tax advice and maintaining accurate financial records. Ignoring tax obligations can have far-reaching consequences, ultimately impacting personal and professional life.

Key Takeaways for Business Owners and Directors:

- Maintain Accurate Records: Meticulous record-keeping is crucial for demonstrating compliance with tax regulations.

- Seek Professional Advice: Consulting with tax professionals can help prevent costly mistakes and ensure compliance.

- Understand Your Tax Obligations: Staying informed about changes in tax laws and regulations is essential.

- Prompt Tax Payments: Timely payment of taxes is critical in avoiding penalties and potential disqualification.

Looking Ahead:

The seven-year ban represents a significant setback for Rob Cross. It serves as a cautionary tale for other business owners and directors, emphasizing the importance of prioritizing tax compliance. This case highlights that no one is immune to the repercussions of tax evasion, regardless of their past successes or public profile. The Insolvency Service's action underscores its commitment to enforcing tax regulations and protecting the integrity of the UK's business environment. For more information on director disqualifications, visit the . Furthermore, seeking advice from a qualified accountant specializing in tax law is strongly recommended.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tax Troubles: Rob Cross Banned From Acting As Company Director. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Serious Concerns Police Investigate Heart Operation Deaths At Uk Nhs Hospital

Jun 06, 2025

Serious Concerns Police Investigate Heart Operation Deaths At Uk Nhs Hospital

Jun 06, 2025 -

3 000 Car Ship Fire 22 Crew Members Rescued In Dramatic North Pacific Operation

Jun 06, 2025

3 000 Car Ship Fire 22 Crew Members Rescued In Dramatic North Pacific Operation

Jun 06, 2025 -

I Slowly Realized I Was Running Two Households A Financial And Emotional Toll

Jun 06, 2025

I Slowly Realized I Was Running Two Households A Financial And Emotional Toll

Jun 06, 2025 -

Gaza Operation Israeli And American Citizens Bodies Retrieved

Jun 06, 2025

Gaza Operation Israeli And American Citizens Bodies Retrieved

Jun 06, 2025 -

Ketema Casting Fuels Rumors Will Ryan Gosling Play A White Black Panther In The Mcu

Jun 06, 2025

Ketema Casting Fuels Rumors Will Ryan Gosling Play A White Black Panther In The Mcu

Jun 06, 2025

Latest Posts

-

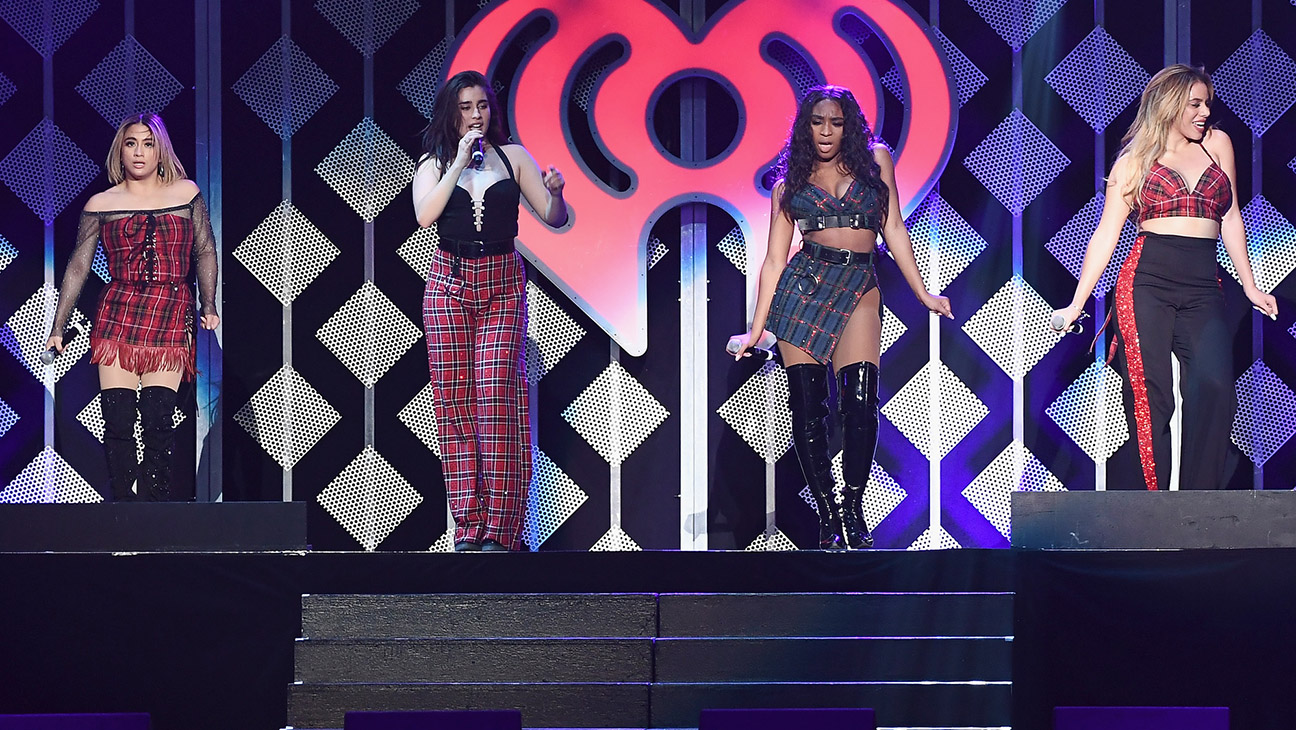

Is A Fifth Harmony Reunion Happening Exclusive Update On Talks

Jun 07, 2025

Is A Fifth Harmony Reunion Happening Exclusive Update On Talks

Jun 07, 2025 -

Disqualification For Rob Cross Ex Darts Champion Banned As Director Following Tax Investigation

Jun 07, 2025

Disqualification For Rob Cross Ex Darts Champion Banned As Director Following Tax Investigation

Jun 07, 2025 -

Under Fire Bbc Journalists Detained By Israeli Forces In Syria

Jun 07, 2025

Under Fire Bbc Journalists Detained By Israeli Forces In Syria

Jun 07, 2025 -

Mps Burka Ban Idea Criticized By Reform Party Chairman

Jun 07, 2025

Mps Burka Ban Idea Criticized By Reform Party Chairman

Jun 07, 2025 -

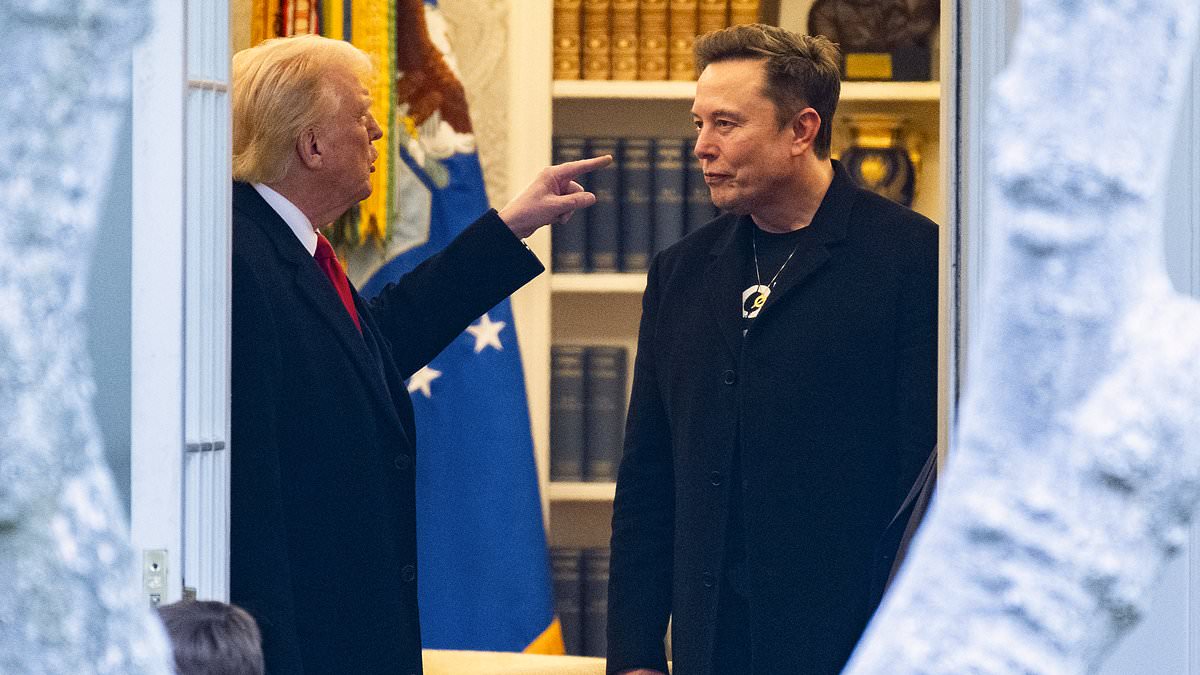

Behind The Trump Musk Rift Influence Of A Powerful Advisor

Jun 07, 2025

Behind The Trump Musk Rift Influence Of A Powerful Advisor

Jun 07, 2025