Triple Lock Pension Scheme: OBR Announces Trebled Cost Projection

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Triple Lock Pension Scheme: OBR Announces Trebled Cost Projection – A Shock to the System?

The Office for Budget Responsibility (OBR) has dropped a bombshell, revealing a staggering threefold increase in projected costs for the UK's Triple Lock pension scheme. This unexpected announcement has sent shockwaves through the political landscape and sparked intense debate about the future of state pensions. The news raises serious questions about the long-term sustainability of this vital social safety net and its impact on public finances.

What is the Triple Lock Pension Scheme?

For those unfamiliar, the Triple Lock guarantees annual state pension increases based on whichever is highest of three measures: inflation as measured by the Consumer Prices Index (CPI), average earnings growth, or 2.5%. Introduced in 2011, it aimed to provide pensioners with a dependable income that keeps pace with rising living costs. This commitment, however, now appears far more expensive than initially anticipated.

The OBR's Revised Projections: A Tripling of Costs

The OBR's latest forecast paints a drastically different picture from previous estimates. Instead of the previously projected cost, the new figures show a dramatic tripling. This significant upward revision is attributed to several factors, including:

- Unexpectedly high inflation: The recent surge in inflation, fueled by global energy prices and supply chain disruptions, has significantly increased the cost of upholding the Triple Lock's promise. The CPI has far exceeded initial predictions, directly impacting the pension uplifts.

- Stronger-than-expected earnings growth: While seemingly positive, robust wage growth also contributes to higher pension costs under the Triple Lock mechanism. This unexpected element adds another layer of complexity to the financial equation.

- Underlying demographic shifts: The aging population and increasing life expectancy continue to exert upward pressure on pension expenditure. This long-term trend necessitates a careful reassessment of the scheme's long-term affordability.

Political Fallout and Potential Solutions

The OBR's announcement has ignited a fierce political debate. The government faces the difficult task of balancing its commitment to pensioners with the need for fiscal responsibility. Potential solutions being discussed include:

- Modifying the Triple Lock: One option is to amend the Triple Lock formula, perhaps by removing or modifying one of the three measures used to calculate annual increases. This could involve replacing average earnings growth with a different metric, or capping the annual increase at a certain percentage.

- Increased National Insurance Contributions: Another possibility is to raise National Insurance Contributions to fund the increased pension costs. However, this could prove unpopular with taxpayers already struggling with the cost of living crisis.

- Investing in Pension Reform: Long-term solutions might involve more fundamental pension reforms, such as increasing the state pension age or encouraging greater private pension saving.

What Does This Mean for Pensioners?

The immediate impact on pensioners is likely to be minimal, as the current increases are already set. However, the long-term implications are uncertain. The government will need to carefully consider its options to ensure the continued viability of the Triple Lock while managing public finances effectively. The debate surrounding the Triple Lock’s future is far from over, and its outcome will significantly impact millions of pensioners across the UK. Further updates and analysis are expected in the coming weeks.

Further Reading:

Keywords: Triple Lock, Pension Scheme, OBR, Cost Projection, State Pension, Inflation, Average Earnings, UK Pensions, Pension Reform, Fiscal Responsibility, Cost of Living Crisis, Government Spending.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Triple Lock Pension Scheme: OBR Announces Trebled Cost Projection. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Red Bull Familys Wealth Propels Thailands Richest List To 170 Billion

Jul 10, 2025

Red Bull Familys Wealth Propels Thailands Richest List To 170 Billion

Jul 10, 2025 -

Gary Shteyngart On Writing From A Childs Point Of View

Jul 10, 2025

Gary Shteyngart On Writing From A Childs Point Of View

Jul 10, 2025 -

Katie Holmes On Tom Cruises New Relationship With Ana De Armas

Jul 10, 2025

Katie Holmes On Tom Cruises New Relationship With Ana De Armas

Jul 10, 2025 -

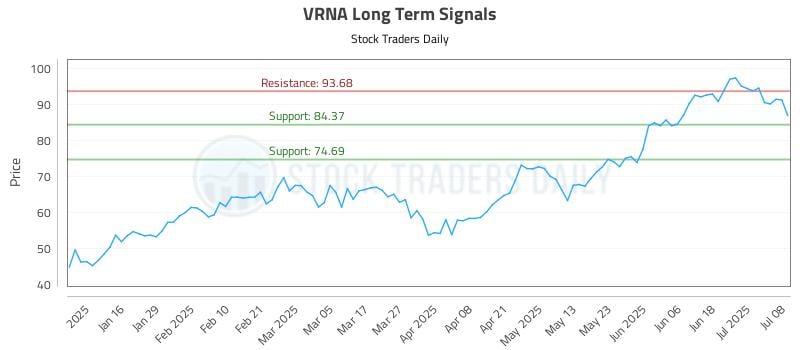

Vrna And Your Investments Deciphering My Stocks Page Data

Jul 10, 2025

Vrna And Your Investments Deciphering My Stocks Page Data

Jul 10, 2025 -

Cruzs Speedy Return From Greece Amid Texas Floods A Timeline

Jul 10, 2025

Cruzs Speedy Return From Greece Amid Texas Floods A Timeline

Jul 10, 2025

Latest Posts

-

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025 -

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025 -

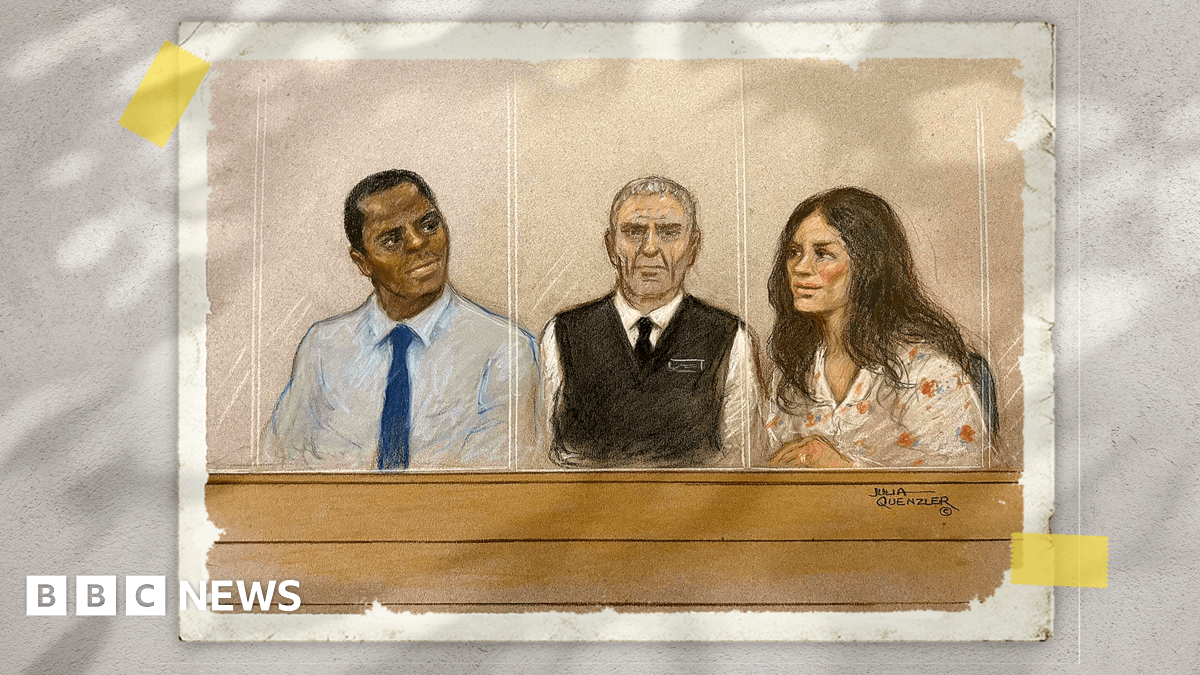

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025 -

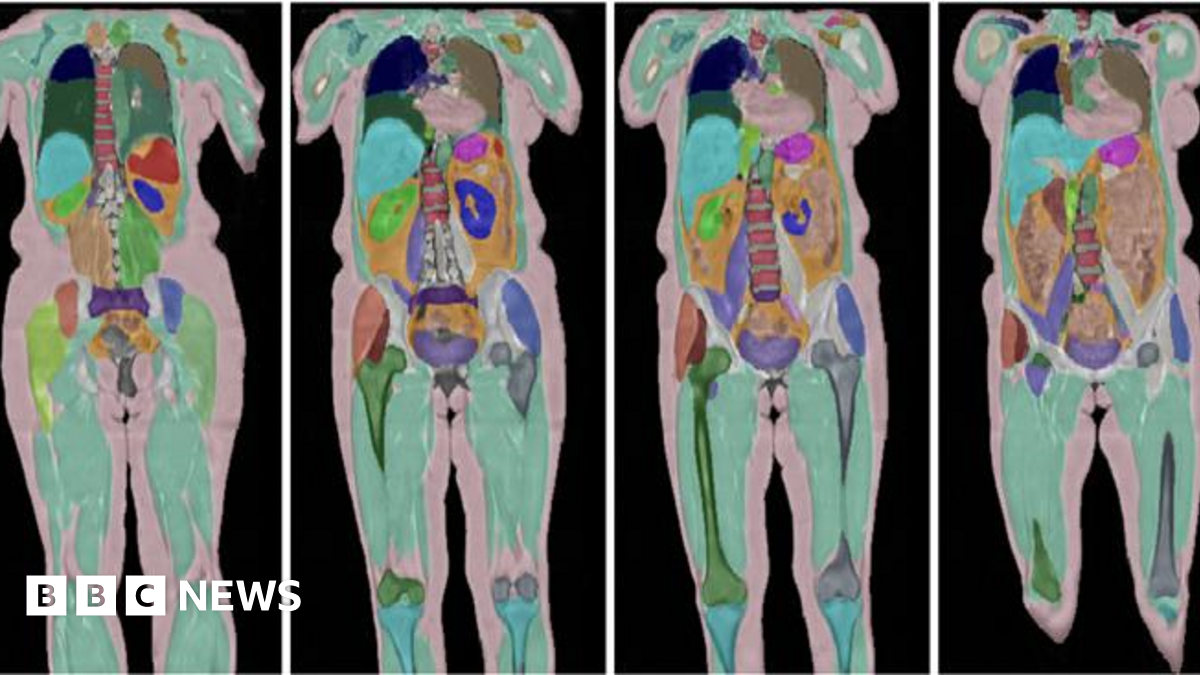

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025 -

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025