Two Sigma Invests $236.55 Million In Bank Of America: A Strategic Move?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Sigma Invests $236.55 Million in Bank of America: A Strategic Gambit or Just Smart Investing?

Headline: Two Sigma's Massive Bank of America Investment: What Does It Mean?

Introduction: The financial world is buzzing after quantitative investment firm Two Sigma revealed a significant investment of $236.55 million in Bank of America (BAC). This substantial stake raises eyebrows and prompts questions about the underlying strategy. Is this a purely financial play, capitalizing on perceived undervaluation, or does it hint at a deeper, more strategic partnership between the two financial giants? Let's delve into the details and explore the potential implications.

Two Sigma's Investment Strategy: Two Sigma, renowned for its data-driven approach and sophisticated algorithms, isn't known for impulsive decisions. Their investment in Bank of America, representing a considerable portion of their portfolio, suggests a strong belief in the bank's future prospects. While the exact details of their investment strategy remain undisclosed, several factors likely contributed to their decision.

Potential Factors Driving Two Sigma's Investment:

-

Undervaluation: Many analysts believe Bank of America's stock price may not fully reflect its intrinsic value. Two Sigma, with its advanced analytical capabilities, might have identified opportunities overlooked by traditional market analysis. This suggests a shrewd investment based on a thorough assessment of BAC's financials and market position.

-

Long-Term Growth Potential: Bank of America's diversified business model, spanning retail banking, wealth management, and investment banking, offers exposure to various economic sectors. This diversification minimizes risk and presents attractive long-term growth prospects, particularly in a recovering economy. Two Sigma may be betting on this sustained growth trajectory.

-

Technological Synergies: Two Sigma's expertise in data analytics and artificial intelligence could potentially synergize with Bank of America's vast data resources. This collaboration could lead to innovative financial products and services, further enhancing both companies' competitive advantages. While this remains speculative, it's a compelling possibility.

-

Strategic Partnership Potential: Although not explicitly stated, a strategic partnership between these two industry leaders could be a longer-term goal. This investment could serve as a stepping stone towards collaborative ventures in areas like financial technology (FinTech) or risk management.

Market Reaction and Analyst Opinions:

The market's reaction to Two Sigma's investment has been generally positive, with Bank of America's stock price experiencing a modest increase following the announcement. Analysts are divided on the long-term implications, with some emphasizing the potential for increased value and others expressing caution about the inherent risks involved in banking investments. Further research is necessary for a complete understanding.

Conclusion: A Calculated Risk or a Masterstroke?

Two Sigma's $236.55 million investment in Bank of America is a significant event with potentially far-reaching consequences. While the precise motivations remain somewhat opaque, the investment likely reflects a combination of factors: a belief in BAC's undervalued potential, the promise of long-term growth, and possibly the potential for future strategic collaborations. Only time will tell whether this bold move proves to be a calculated risk or a masterstroke of financial strategy. We will continue to monitor the situation and provide updates as they emerge.

Keywords: Two Sigma, Bank of America, investment, BAC, stock, financial markets, quantitative investing, data-driven investing, strategic partnership, Fintech, financial technology, market analysis, stock market, investment strategy

Call to Action (subtle): Stay tuned for further analysis and updates on this developing story by subscribing to our newsletter! (link to newsletter signup).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two Sigma Invests $236.55 Million In Bank Of America: A Strategic Move?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Deadly Fungus Global Warming Expands Its Reach

May 27, 2025

Deadly Fungus Global Warming Expands Its Reach

May 27, 2025 -

Pdd Holdings Q1 2025 Financial Report Analyzing Revenue Profitability And Growth

May 27, 2025

Pdd Holdings Q1 2025 Financial Report Analyzing Revenue Profitability And Growth

May 27, 2025 -

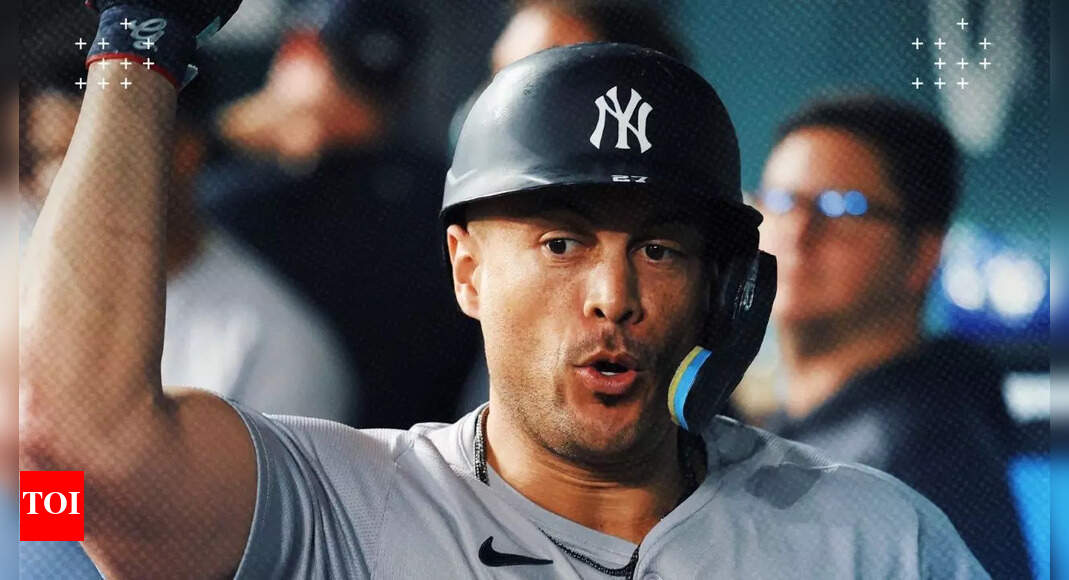

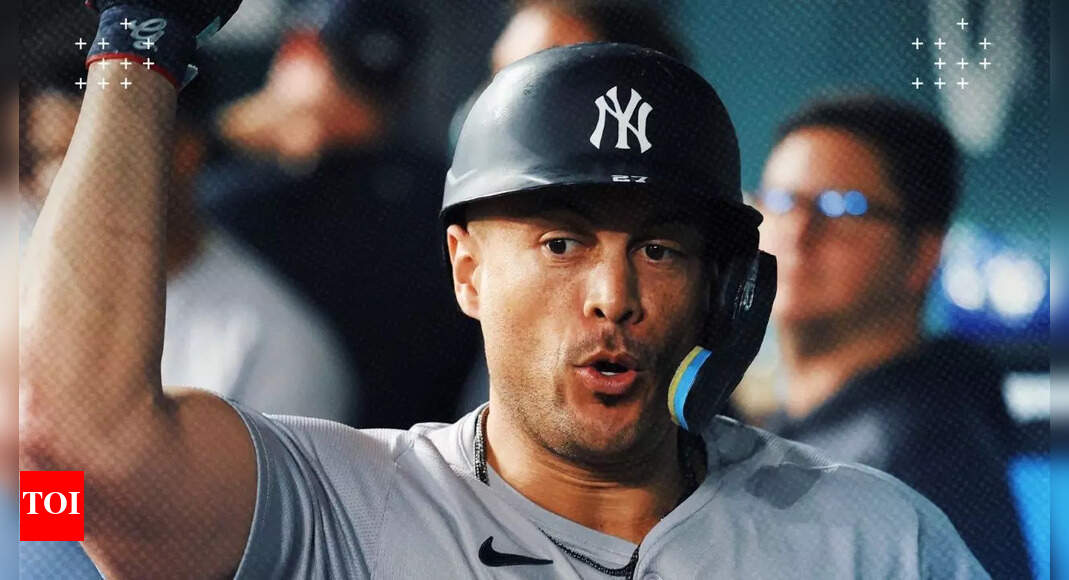

Giancarlo Stanton To Seattle Mariners Pursuit Reported

May 27, 2025

Giancarlo Stanton To Seattle Mariners Pursuit Reported

May 27, 2025 -

Financial Avengers Inc Significant Investment In Bank Of America Revealed

May 27, 2025

Financial Avengers Inc Significant Investment In Bank Of America Revealed

May 27, 2025 -

Giancarlo Stanton New Beginning With Seattle Mariners After Yankees Departure

May 27, 2025

Giancarlo Stanton New Beginning With Seattle Mariners After Yankees Departure

May 27, 2025

Latest Posts

-

Leaked Audio Police Doubts Emerge In High Profile Abortion Case Arrest

May 28, 2025

Leaked Audio Police Doubts Emerge In High Profile Abortion Case Arrest

May 28, 2025 -

See Alexandra Daddarios Show Stopping Sheer Gown At Dior Cruise

May 28, 2025

See Alexandra Daddarios Show Stopping Sheer Gown At Dior Cruise

May 28, 2025 -

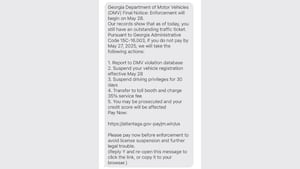

Received A Suspicious Text From The Ga Department Of Driver Services

May 28, 2025

Received A Suspicious Text From The Ga Department Of Driver Services

May 28, 2025 -

Preventing Premature Heart Attacks Lessons From Lost Loved Ones

May 28, 2025

Preventing Premature Heart Attacks Lessons From Lost Loved Ones

May 28, 2025 -

Could Reversed Climate Policies Under Trump Result In A Livestock Pest Epidemic

May 28, 2025

Could Reversed Climate Policies Under Trump Result In A Livestock Pest Epidemic

May 28, 2025