Two Sigma's $236.55 Million Bank Of America Investment: A Deep Dive

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Sigma's $236.55 Million Bank of America Investment: A Deep Dive into the Hedge Fund's Strategic Move

Two Sigma, the prominent quantitative investment firm known for its data-driven approach, recently made headlines with a significant investment in Bank of America. The $236.55 million stake signals a bold move, sparking curiosity and analysis across the financial world. This deep dive explores the implications of this investment, examining Two Sigma's strategy, Bank of America's current position, and the potential future outcomes.

Two Sigma's Data-Driven Approach: A Key to Understanding the Investment

Two Sigma isn't your typical hedge fund. Their investment decisions are heavily reliant on sophisticated algorithms and quantitative analysis of massive datasets. This data-driven approach allows them to identify subtle market inefficiencies and potentially lucrative opportunities that might be missed by traditional investment firms. This commitment to quantitative analysis likely played a crucial role in their decision to invest in Bank of America. Their success hinges on accurately predicting market trends and identifying undervalued assets – a strategy that requires both technological expertise and deep financial market understanding. Learn more about Two Sigma's unique investment philosophy on their . (Note: This is a placeholder link; replace with a valid link if available).

Bank of America's Current Standing: A Stable Giant in a Shifting Landscape

Bank of America, a financial behemoth, currently occupies a significant position in the global financial market. However, the banking sector is facing ongoing challenges, including increased regulatory scrutiny, evolving technological landscapes, and fluctuating interest rates. Despite these challenges, Bank of America has demonstrated resilience, showcasing strong earnings and a robust balance sheet. This stability may have been a key factor in attracting Two Sigma's substantial investment.

What Motivated Two Sigma's Investment? Possible Scenarios

Several factors could have driven Two Sigma's significant investment in Bank of America.

- Undervaluation: Two Sigma's sophisticated algorithms might have identified Bank of America as undervalued compared to its intrinsic worth. Their quantitative models could have predicted future growth exceeding current market expectations.

- Long-Term Growth Potential: Two Sigma's investment might reflect a belief in Bank of America's long-term growth potential, considering factors like increasing digital adoption and expansion into new financial services.

- Strategic Positioning: The investment could be part of a broader strategic positioning by Two Sigma within the financial sector, diversifying their portfolio and capitalizing on opportunities within the banking industry.

Analyzing the Implications for Both Parties

This investment holds significant implications for both Two Sigma and Bank of America. For Two Sigma, it represents a substantial commitment to a large-cap financial institution, potentially yielding significant returns based on their analysis. For Bank of America, the investment signifies a vote of confidence from a highly respected quantitative investment firm, reinforcing their market standing and potentially attracting further investment.

Future Outlook: Uncertainties and Potential Outcomes

While the investment represents a positive sign for both entities, predicting future outcomes remains challenging. The performance of this investment will heavily depend on numerous factors, including broader economic conditions, regulatory changes, and the overall performance of the banking sector. Continued monitoring of both Two Sigma's portfolio adjustments and Bank of America's financial performance will be crucial in assessing the long-term success of this strategic move.

Conclusion: A Significant Investment with Long-Term Implications

Two Sigma's substantial investment in Bank of America is a noteworthy event with far-reaching implications. This data-driven approach, combined with Bank of America's strong fundamentals, suggests a calculated risk with potentially significant returns. Time will tell whether this investment proves to be a shrewd move or a mere blip on the radar of the financial world. The coming months and years will offer valuable insights into the effectiveness of Two Sigma's quantitative strategies and the resilience of Bank of America in the face of ongoing market uncertainties.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two Sigma's $236.55 Million Bank Of America Investment: A Deep Dive. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Predicting The French Open R1 Zverev Mensik And Their Opponents

May 27, 2025

Predicting The French Open R1 Zverev Mensik And Their Opponents

May 27, 2025 -

Increased Police Presence Needed Seaside Heights Boardwalk Plagued By Violence

May 27, 2025

Increased Police Presence Needed Seaside Heights Boardwalk Plagued By Violence

May 27, 2025 -

Developers On Notice Unfinished Housing Sites Under Scrutiny For Non Compliance

May 27, 2025

Developers On Notice Unfinished Housing Sites Under Scrutiny For Non Compliance

May 27, 2025 -

Two Sigmas Large Bank Of America Investment Analysis And Implications

May 27, 2025

Two Sigmas Large Bank Of America Investment Analysis And Implications

May 27, 2025 -

Memorial Day Shopping T J Maxx Store Hours And Sales Events

May 27, 2025

Memorial Day Shopping T J Maxx Store Hours And Sales Events

May 27, 2025

Latest Posts

-

Analyzing The Aep Rate Hike A Look Back At Past Policies And Practices

May 30, 2025

Analyzing The Aep Rate Hike A Look Back At Past Policies And Practices

May 30, 2025 -

Early Heart Disease Risk Elevated By Cannabis Use Research Shows

May 30, 2025

Early Heart Disease Risk Elevated By Cannabis Use Research Shows

May 30, 2025 -

Record High Home Sellers Outpace Buyers By Largest Margin In 12 Years

May 30, 2025

Record High Home Sellers Outpace Buyers By Largest Margin In 12 Years

May 30, 2025 -

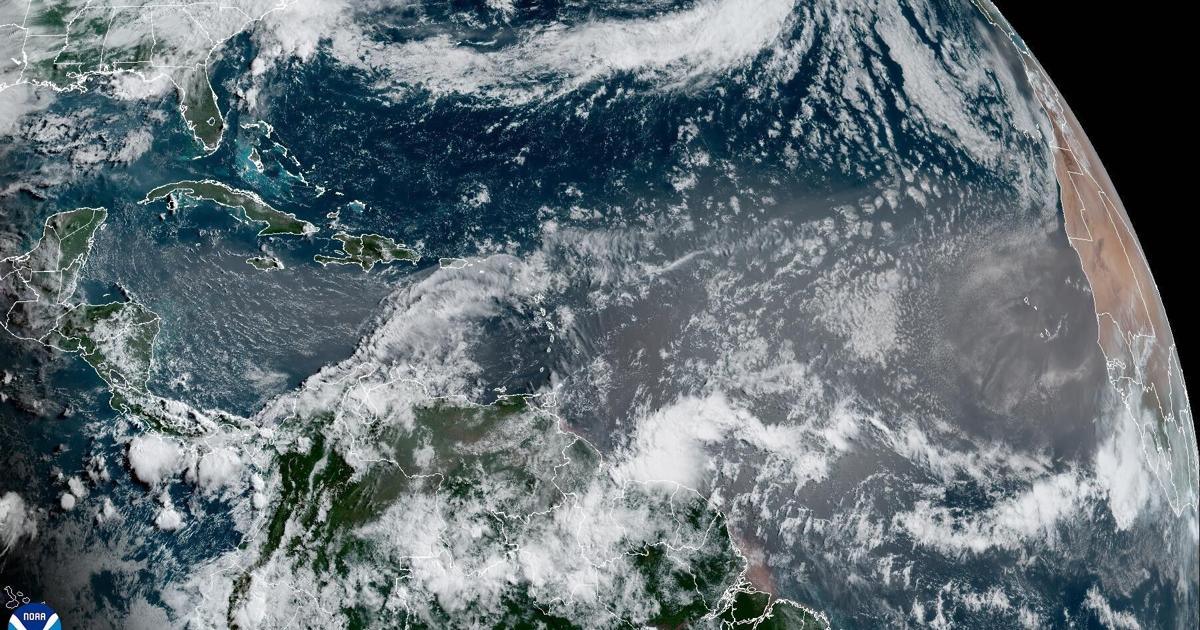

Louisiana Sunsets To Dazzle Saharan Dust Plume Forecast

May 30, 2025

Louisiana Sunsets To Dazzle Saharan Dust Plume Forecast

May 30, 2025 -

Rhode Skin Sold Hailey Biebers Brand Acquired By E L F In Massive 1 Billion Acquisition

May 30, 2025

Rhode Skin Sold Hailey Biebers Brand Acquired By E L F In Massive 1 Billion Acquisition

May 30, 2025