Two Sigma's Large Bank Of America Investment: Analysis And Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Sigma's Massive Bank of America Investment: A Deep Dive into Implications and Analysis

Two Sigma Investments, a prominent quantitative investment firm, recently made headlines with a significant increase in its Bank of America (BAC) holdings. This strategic move has sparked considerable interest and speculation within the financial world, prompting analysts to dissect the implications of this large investment. This article delves into the details, examining the potential reasons behind Two Sigma's decision and exploring the broader ramifications for both Bank of America and the wider financial market.

Two Sigma's Investment Strategy: A Data-Driven Approach

Two Sigma is renowned for its data-driven, quantitative investment strategies. Unlike traditional investment firms that rely heavily on fundamental analysis, Two Sigma leverages advanced algorithms and massive datasets to identify undervalued assets and predict market trends. This makes understanding their investment choices particularly challenging, as their reasoning often involves complex mathematical models and proprietary data analysis. Their investment in Bank of America, therefore, warrants closer scrutiny.

Why Bank of America? Potential Factors Behind Two Sigma's Decision

Several factors could explain Two Sigma's increased stake in Bank of America. These include:

-

Undervalued Asset: Two Sigma's algorithms may have identified Bank of America as an undervalued asset, presenting a compelling risk-reward profile. This could be based on projections of future earnings growth, discounted cash flow analysis, or other quantitative metrics.

-

Macroeconomic Factors: The current macroeconomic environment, characterized by [mention current economic trends, e.g., rising interest rates, inflation concerns], might have influenced Two Sigma's decision. Bank of America's position as a major player in the financial sector could offer resilience during periods of economic uncertainty.

-

Long-Term Growth Potential: Two Sigma might be betting on Bank of America's long-term growth potential, driven by factors such as expansion into new markets, technological advancements in financial services, or strategic acquisitions.

-

Dividend Yield: Bank of America offers a relatively attractive dividend yield, which could be a significant factor for a long-term investor like Two Sigma. This passive income stream contributes to overall return.

Implications for Bank of America and the Market

Two Sigma's substantial investment lends a degree of confidence to Bank of America's future prospects. It signals that at least one sophisticated quantitative investment firm sees significant value in the bank. However, it's crucial to remember that this is just one perspective, and other investors may hold differing views.

The implications for the broader market are less direct but still notable. Large institutional investments often influence market sentiment, and Two Sigma's move could potentially attract other investors to Bank of America, driving up its share price. Conversely, a significant shift in Two Sigma’s holdings could trigger market volatility.

Conclusion: Further Analysis Needed

While we can speculate on the reasons behind Two Sigma's large Bank of America investment, a complete understanding requires access to their proprietary data and analytical models. This article aims to provide a preliminary analysis, highlighting the key factors potentially influencing their decision and exploring the broader implications. Further research and analysis are necessary to draw definitive conclusions. Staying informed on macroeconomic trends and following the activities of key institutional investors will be crucial for understanding future market movements. What are your thoughts on this significant investment? Share your opinions in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two Sigma's Large Bank Of America Investment: Analysis And Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Znamy Juz Date I Godzine Pierwszego Meczu Igi Swiatek W Paryzu

May 27, 2025

Znamy Juz Date I Godzine Pierwszego Meczu Igi Swiatek W Paryzu

May 27, 2025 -

Analyzing Sirius Xm Holdings A Stock For Long Term Growth

May 27, 2025

Analyzing Sirius Xm Holdings A Stock For Long Term Growth

May 27, 2025 -

American Dream Or German Comfort A Personal Account Of Relocation

May 27, 2025

American Dream Or German Comfort A Personal Account Of Relocation

May 27, 2025 -

Investment Update Birmingham Capital Managements Recent Bank Of America Sale

May 27, 2025

Investment Update Birmingham Capital Managements Recent Bank Of America Sale

May 27, 2025 -

Bates Disputes Post Office Compensation Claim Awarded Only Half The Amount Sought

May 27, 2025

Bates Disputes Post Office Compensation Claim Awarded Only Half The Amount Sought

May 27, 2025

Latest Posts

-

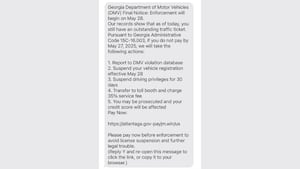

Beware Georgia Dmv Text Scam Targeting Drivers

May 28, 2025

Beware Georgia Dmv Text Scam Targeting Drivers

May 28, 2025 -

Major Blast Rocks Chinese Chemical Plant Authorities Battle To Contain Aftermath

May 28, 2025

Major Blast Rocks Chinese Chemical Plant Authorities Battle To Contain Aftermath

May 28, 2025 -

Chinese Chemical Plant Explosion Rescue Operation Underway After Major Blast

May 28, 2025

Chinese Chemical Plant Explosion Rescue Operation Underway After Major Blast

May 28, 2025 -

Protect Yourself How To Spot And Avoid The Georgia Dmv Imposter Scam

May 28, 2025

Protect Yourself How To Spot And Avoid The Georgia Dmv Imposter Scam

May 28, 2025 -

Us Backed Gaza Aid Group Begins Distribution A New Chapter In Relief Efforts

May 28, 2025

Us Backed Gaza Aid Group Begins Distribution A New Chapter In Relief Efforts

May 28, 2025