Two Sigma's Large Bank Of America Investment: $236.55 Million Stake Analyzed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Sigma's Massive Bank of America Investment: A $236.55 Million Stake Analyzed

Two Sigma Investments, a prominent quantitative investment firm, has made headlines with its significant purchase of a $236.55 million stake in Bank of America (BAC). This strategic move has sparked considerable interest within the financial community, prompting analysis of the investment's implications for both Two Sigma and Bank of America. This article delves into the details, exploring the potential reasons behind this substantial investment and its broader market significance.

Why Two Sigma Invested in Bank of America

Two Sigma's investment strategy is known for its data-driven approach, leveraging advanced analytics and sophisticated algorithms to identify undervalued assets. While the firm doesn't publicly disclose the rationale behind every investment, several factors could explain this significant bet on Bank of America:

-

Undervalued Asset: Many analysts believe Bank of America's stock price may not fully reflect its intrinsic value. The bank has demonstrated resilience in recent economic uncertainty, posting strong earnings despite inflationary pressures and rising interest rates. Two Sigma may see this as an opportunity to capitalize on a temporarily depressed market valuation.

-

Long-Term Growth Potential: Bank of America's vast market share, diversified business model, and ongoing digital transformation initiatives present compelling long-term growth prospects. Two Sigma’s investment could reflect a belief in Bank of America's ability to navigate future challenges and deliver robust returns over the long haul.

-

Dividend Income: Bank of America is a consistent dividend payer, offering a relatively attractive yield. For a firm like Two Sigma, which manages substantial assets, dividend income can represent a significant and reliable stream of revenue.

-

Hedging Strategy: The investment could also be part of a broader hedging strategy, mitigating potential risks within Two Sigma's existing portfolio. Bank of America, as a major financial institution, often demonstrates negative correlation with other asset classes, providing diversification benefits.

Implications for Bank of America

Two Sigma's substantial investment serves as a significant vote of confidence in Bank of America. It reinforces the perception of the bank as a stable and potentially undervalued player in the financial sector. This positive sentiment could influence other investors, potentially leading to increased demand and a rise in Bank of America's stock price.

However, it's crucial to note that Two Sigma's investment doesn't guarantee future performance. Market conditions can change rapidly, and unforeseen economic events could impact Bank of America's profitability.

Analyzing Two Sigma's Investment Strategy

Two Sigma’s approach is often characterized by its focus on quantitative analysis and algorithmic trading. This investment in Bank of America, while substantial, is likely just one piece of a much larger, diversified portfolio. The firm’s success relies heavily on its ability to identify and exploit subtle market inefficiencies using sophisticated models. This makes their investment decisions difficult to fully understand without access to their internal data and models.

Conclusion: A Calculated Risk or a Surefire Win?

Two Sigma's $236.55 million investment in Bank of America represents a significant move in the financial markets. While the exact reasoning remains partially undisclosed, the investment likely reflects a calculated assessment of Bank of America's long-term potential, current market undervaluation, and potential diversification benefits. Whether this proves to be a shrewd investment remains to be seen, but it certainly highlights the ongoing interest in the financial sector and the strategic choices being made by leading quantitative investment firms. Further market analysis will be needed to fully gauge the impact of this substantial investment.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two Sigma's Large Bank Of America Investment: $236.55 Million Stake Analyzed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bank Of America Bac Significant In Financial Avengers Portfolio

May 28, 2025

Bank Of America Bac Significant In Financial Avengers Portfolio

May 28, 2025 -

Internal Police Concerns Surface In Abortion Arrest Case Leaked Recording Details

May 28, 2025

Internal Police Concerns Surface In Abortion Arrest Case Leaked Recording Details

May 28, 2025 -

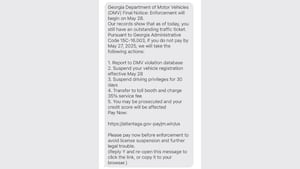

Georgia Drivers Services Scam Alert Watch Out For This Text Message

May 28, 2025

Georgia Drivers Services Scam Alert Watch Out For This Text Message

May 28, 2025 -

Sirius Xm Is This Stock Right For Your Portfolio

May 28, 2025

Sirius Xm Is This Stock Right For Your Portfolio

May 28, 2025 -

Analysis The Liverpool Fc Parade Incident And Its Aftermath

May 28, 2025

Analysis The Liverpool Fc Parade Incident And Its Aftermath

May 28, 2025

Latest Posts

-

Behind The Scenes Of Ellens Show Why The Daytime Dominance Ended

May 29, 2025

Behind The Scenes Of Ellens Show Why The Daytime Dominance Ended

May 29, 2025 -

England V West Indies Mens Cricket Odi Live Score And Highlights

May 29, 2025

England V West Indies Mens Cricket Odi Live Score And Highlights

May 29, 2025 -

Roland Garros Dupla Portuguesa Conquista Feito Historico

May 29, 2025

Roland Garros Dupla Portuguesa Conquista Feito Historico

May 29, 2025 -

Meter Fitting Scandal Payouts Thousands Await Compensation

May 29, 2025

Meter Fitting Scandal Payouts Thousands Await Compensation

May 29, 2025 -

Us Halts Student Visa Appointments Amidst Increased Social Media Scrutiny

May 29, 2025

Us Halts Student Visa Appointments Amidst Increased Social Media Scrutiny

May 29, 2025