U.S. Treasury Yields Dip As Federal Reserve Hints At Single 2025 Rate Decrease

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Yields Dip as Fed Hints at Single 2025 Rate Decrease

U.S. Treasury yields experienced a noticeable dip following recent statements from the Federal Reserve, signaling a potential shift in monetary policy. The central bank hinted at a single interest rate decrease in 2025, a more cautious approach than some market analysts had predicted. This news has sent ripples through the financial markets, impacting everything from bond prices to investor sentiment.

The Federal Open Market Committee (FOMC) minutes, released [Insert Date], revealed a nuanced perspective on the future direction of interest rates. While acknowledging the ongoing fight against inflation, the committee members indicated a growing belief that a single rate cut in 2025 would be sufficient to manage the economic landscape. This cautious optimism contrasts with earlier predictions of multiple rate reductions throughout the year.

<h3>Why the Dip in Treasury Yields?</h3>

The shift in Fed rhetoric has directly impacted Treasury yields. Treasury yields move inversely to bond prices. When investors anticipate lower interest rates in the future, the demand for existing bonds increases, driving up their prices and consequently lowering their yields. The expectation of a single, rather than multiple, rate cuts suggests a more stable economic outlook, reducing the perceived need for aggressive action from the Fed. This calmer outlook has emboldened investors to purchase longer-term Treasuries, further contributing to the yield dip.

<h3>What Does This Mean for Investors?</h3>

The implications of this development are multifaceted. For investors, the decreased yields might mean:

- Lower returns on new bond investments: Lower yields translate to lower returns on newly purchased Treasury bonds.

- Potential for capital appreciation on existing bonds: If interest rates remain stable or decline as predicted, the value of existing bonds held by investors could appreciate.

- Increased opportunities in other asset classes: Some investors may shift their focus to other asset classes, such as stocks or real estate, seeking higher potential returns.

<h3>Uncertainty Remains: Inflation and Economic Growth</h3>

Despite the seemingly positive news, significant uncertainties remain. The ongoing battle against inflation is far from over, and the Fed's projections are highly dependent on several economic factors, including:

- Inflation data: Future inflation reports will play a crucial role in shaping the Fed's future decisions. A resurgence of inflation could easily alter their current trajectory.

- Economic growth: Sustained economic growth is vital for a successful rate reduction strategy. A slowing economy might necessitate a different approach.

- Geopolitical events: Unforeseen global events can significantly impact economic conditions and, in turn, influence the Fed's decisions.

<h3>Looking Ahead: Navigating Market Volatility</h3>

The current situation highlights the inherent volatility of the financial markets. While the single rate cut projection offers a degree of stability, investors should remain vigilant and diversify their portfolios to mitigate risk. Staying informed about economic indicators and Fed announcements is crucial for making sound investment decisions.

This analysis provides a general overview and should not be considered financial advice. Consulting with a qualified financial advisor is recommended before making any significant investment decisions. For further updates on economic developments, you might want to check reputable sources like the [link to Federal Reserve website] and [link to reputable financial news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Yields Dip As Federal Reserve Hints At Single 2025 Rate Decrease. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

America Vs Mohamed La Final Perdida Que Marco Una Epoca

May 20, 2025

America Vs Mohamed La Final Perdida Que Marco Una Epoca

May 20, 2025 -

Walk Off Wagers Your Guide To Mlb Best Bets Today White Sox Cubs Red Sox Braves

May 20, 2025

Walk Off Wagers Your Guide To Mlb Best Bets Today White Sox Cubs Red Sox Braves

May 20, 2025 -

Juego De Voces 2025 Mira La Presentacion En Vivo De Yahir Y Victor Garcia

May 20, 2025

Juego De Voces 2025 Mira La Presentacion En Vivo De Yahir Y Victor Garcia

May 20, 2025 -

New Comedy Overcompensating Explores Identity And Humor

May 20, 2025

New Comedy Overcompensating Explores Identity And Humor

May 20, 2025 -

Investor Confidence In Ethereum Soars 200 M Investment Post Pectra

May 20, 2025

Investor Confidence In Ethereum Soars 200 M Investment Post Pectra

May 20, 2025

Latest Posts

-

Jamie Lee Curtis Reveals The Truth About Her Connection To Lindsay Lohan

May 20, 2025

Jamie Lee Curtis Reveals The Truth About Her Connection To Lindsay Lohan

May 20, 2025 -

International Support Urged For Balis Tourist Safety And Behavior Initiatives

May 20, 2025

International Support Urged For Balis Tourist Safety And Behavior Initiatives

May 20, 2025 -

Institutional Investors Fuel Bitcoin Etf Boom 5 Billion And Counting

May 20, 2025

Institutional Investors Fuel Bitcoin Etf Boom 5 Billion And Counting

May 20, 2025 -

Slowdown Ahead U S Treasury Yields Fall On Feds Rate Cut Outlook

May 20, 2025

Slowdown Ahead U S Treasury Yields Fall On Feds Rate Cut Outlook

May 20, 2025 -

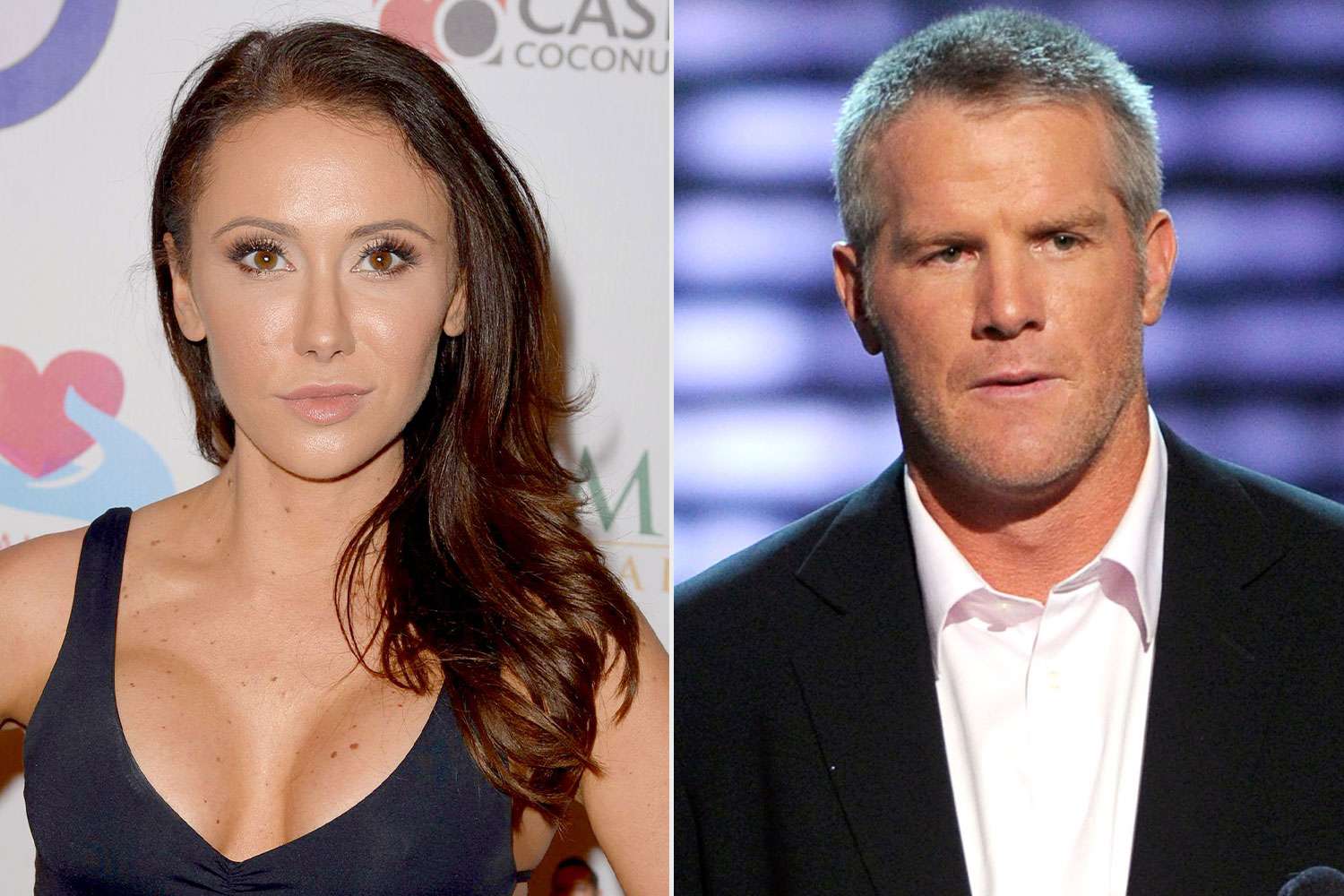

Jenn Sterger Speaks Out Fallout From Brett Favre Sexting Scandal

May 20, 2025

Jenn Sterger Speaks Out Fallout From Brett Favre Sexting Scandal

May 20, 2025