Understanding The Social Security Payment Reductions In June 2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Social Security Payment Reductions in June 2025: What You Need to Know

The looming threat of Social Security payment reductions in June 2025 has many retirees and beneficiaries worried. The possibility of a significant cut isn't just a distant concern; it's a real possibility stemming from the Social Security trust fund's projected depletion. Understanding these potential reductions and their implications is crucial for planning your financial future. This article will break down the key factors contributing to this situation and explain what you can expect.

The Looming Crisis: Why are Social Security Payments at Risk?

The Social Security Administration (SSA) faces a significant challenge: the trust funds that support retirement, disability, and survivor benefits are projected to be depleted by 2034. This doesn't mean Social Security will disappear entirely, but it does mean significant benefit cuts are likely if Congress doesn't act. The looming deadline of June 2025 highlights the urgency of the situation. The SSA's annual report consistently underscores this impending crisis, emphasizing the need for legislative action to prevent benefit reductions.

Key factors contributing to the problem include:

- Aging population: The baby boomer generation is retiring, leading to a larger number of beneficiaries drawing benefits.

- Increased life expectancy: People are living longer, receiving benefits for a greater number of years.

- Declining birth rate: Fewer workers are contributing to the system to support a growing number of retirees.

What Kind of Reductions are We Talking About?

While the exact percentage of the reduction remains uncertain, estimates suggest a potential cut of around 20% to Social Security benefits. This substantial decrease would significantly impact the financial security of millions of Americans who rely on these payments. This isn't just a hypothetical scenario; the SSA's projections paint a clear picture of the potential consequences of inaction.

What Can Be Done to Avoid or Mitigate These Cuts?

The solution requires Congressional action. Several proposals are under discussion, including:

- Raising the full retirement age: Gradually increasing the age at which individuals can receive full retirement benefits.

- Increasing the Social Security tax rate: Slightly increasing the percentage of income subject to Social Security taxes.

- Raising the earnings base: Increasing the maximum amount of earnings subject to Social Security taxes.

- Adjusting the formula used to calculate benefits: This could involve changes to the Consumer Price Index (CPI) used for cost-of-living adjustments (COLAs).

These are just some of the possible solutions, and the debate surrounding them is complex and politically charged. Understanding these options and their potential impacts is vital for informed civic engagement.

What Should You Do Now?

While the future remains uncertain, proactive planning is essential. Consider these steps:

- Review your retirement plan: Assess your savings and determine how a potential benefit reduction might affect your financial security.

- Explore other income sources: Investigate additional income streams to supplement your Social Security benefits, such as part-time work or investment income.

- Stay informed: Keep up-to-date on the latest developments regarding Social Security reform through reputable sources like the Social Security Administration website ().

- Contact your elected officials: Let your voice be heard by contacting your representatives in Congress and urging them to address the Social Security funding crisis.

The potential Social Security payment reductions in June 2025 represent a serious challenge. By understanding the factors involved, staying informed, and engaging in responsible financial planning, you can better prepare for the future and advocate for solutions that protect the vital safety net provided by Social Security. This is not just about numbers; it's about the financial well-being of millions of Americans.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Social Security Payment Reductions In June 2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Financial Avengers Inc Portfolio Analysis Bank Of Americas Role

May 28, 2025

Financial Avengers Inc Portfolio Analysis Bank Of Americas Role

May 28, 2025 -

Match Of The Day Gary Linekers Departure After A 26 Year Bbc Career

May 28, 2025

Match Of The Day Gary Linekers Departure After A 26 Year Bbc Career

May 28, 2025 -

A Mothers Legacy Tennis Players Unique Name Fuels Rise To Challenge Top 3

May 28, 2025

A Mothers Legacy Tennis Players Unique Name Fuels Rise To Challenge Top 3

May 28, 2025 -

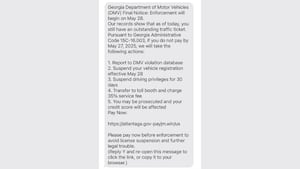

Is That Text From The Ga Department Of Driver Services Real Identify And Avoid The Scam

May 28, 2025

Is That Text From The Ga Department Of Driver Services Real Identify And Avoid The Scam

May 28, 2025 -

Propane Leak Causes Truck Explosion Damaging Nearby Residences

May 28, 2025

Propane Leak Causes Truck Explosion Damaging Nearby Residences

May 28, 2025

Latest Posts

-

Smart Planning Key To Smooth Heat Pump Installations In Homes

May 31, 2025

Smart Planning Key To Smooth Heat Pump Installations In Homes

May 31, 2025 -

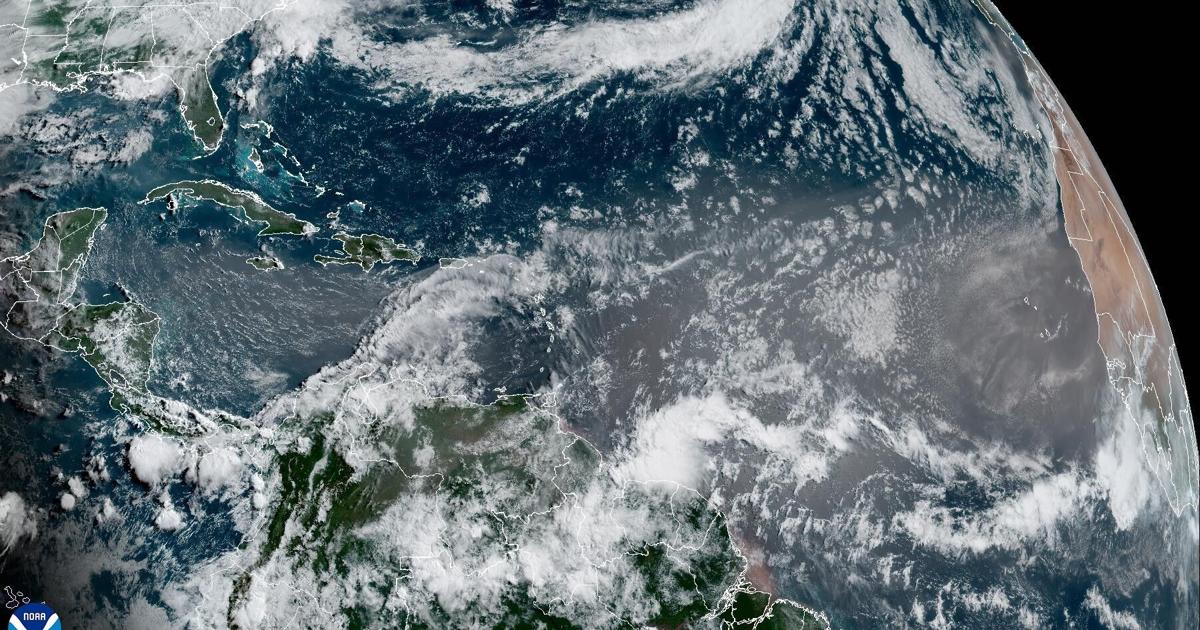

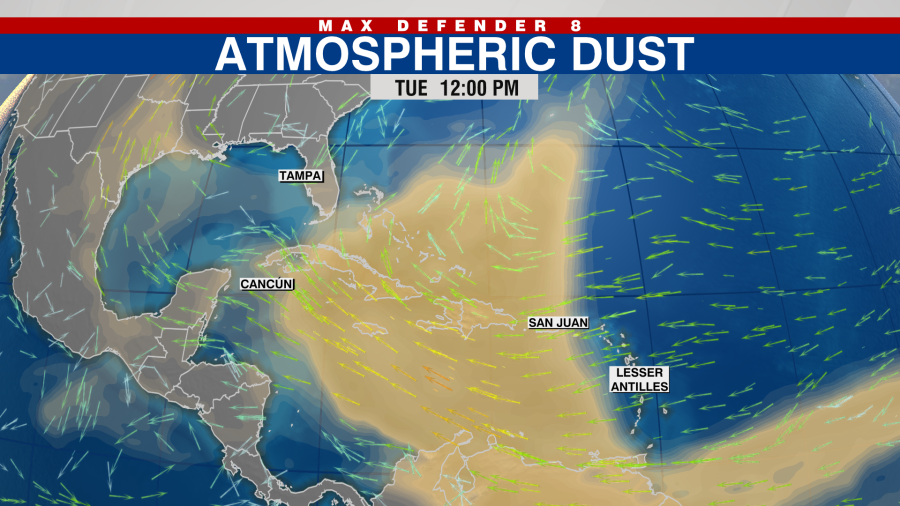

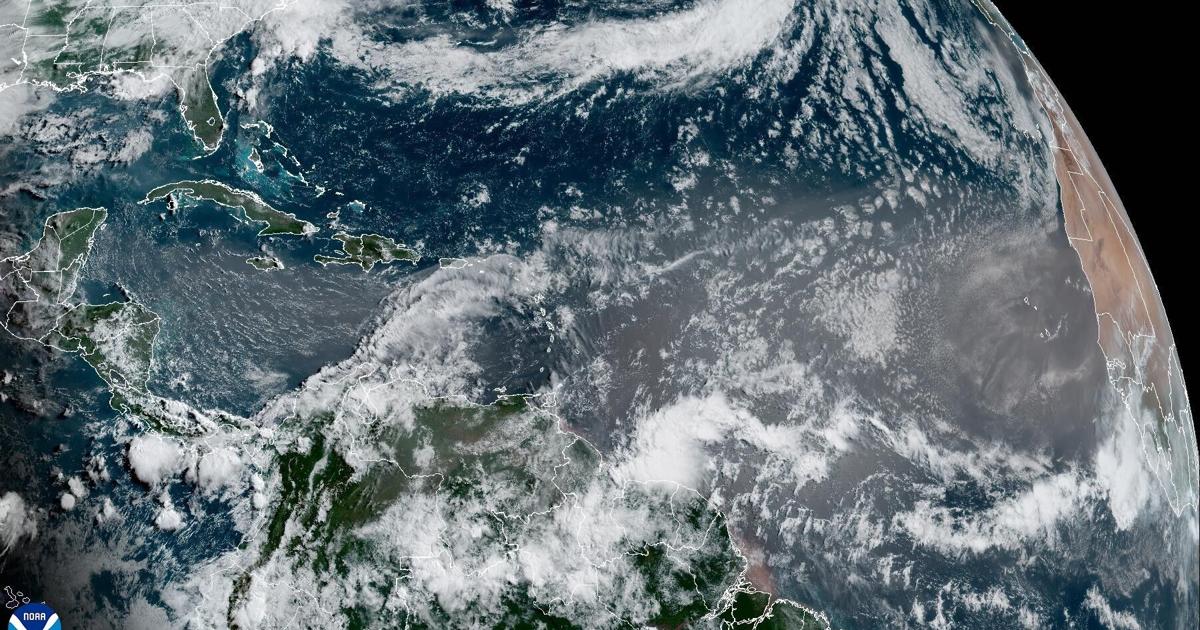

Intense Louisiana Sunsets Expected Due To Saharan Dust

May 31, 2025

Intense Louisiana Sunsets Expected Due To Saharan Dust

May 31, 2025 -

Ohio Electricity Rates Soaring Duke Energys June 1 Increase

May 31, 2025

Ohio Electricity Rates Soaring Duke Energys June 1 Increase

May 31, 2025 -

Understanding The Saharan Dust Plume Approaching Florida

May 31, 2025

Understanding The Saharan Dust Plume Approaching Florida

May 31, 2025 -

Louisiana Sunsets Dazzled By Saharan Dust Plume See The Forecast

May 31, 2025

Louisiana Sunsets Dazzled By Saharan Dust Plume See The Forecast

May 31, 2025