Understanding The Trump Tax Plan: A Breakdown By House Republicans

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Trump Tax Plan: A Breakdown by House Republicans

The 2017 Tax Cuts and Jobs Act, often referred to as the "Trump tax plan," significantly reshaped the American tax code. While the legislation itself is complex, understanding its core components, particularly as presented by House Republicans who championed its passage, is crucial for navigating the current tax landscape. This article provides a breakdown of the key features, aiming for clarity and accessibility.

Key Pillars of the Republican Tax Plan:

The House Republicans' approach to tax reform centered on several key pillars, all aimed at stimulating economic growth through lower taxes and reduced regulatory burdens. These included:

-

Significant Corporate Tax Rate Reduction: The most dramatic change was the slashing of the corporate tax rate from 35% to 21%. House Republicans argued this would boost business investment, create jobs, and increase competitiveness globally. This was a major selling point and a central tenet of their economic agenda.

-

Individual Tax Rate Reductions: While not as drastic as the corporate cuts, the plan also lowered individual income tax rates. This involved consolidating tax brackets and reducing the top marginal rate. The aim was to leave more money in the hands of taxpayers, fueling consumer spending and economic growth.

-

Standard Deduction Increase: The standard deduction was significantly increased, benefiting many middle-class families and simplifying tax preparation for a large segment of the population. This change reduced the number of taxpayers itemizing deductions.

-

Child Tax Credit Expansion: The child tax credit was expanded, providing greater tax relief for families with children. This was presented as a measure to support families and reduce the tax burden on working parents.

-

Pass-Through Business Tax Changes: The plan also addressed taxation for pass-through entities like partnerships and S corporations, allowing for a deduction based on qualified business income (QBI). This provision aimed to benefit small business owners and entrepreneurs.

Criticisms and Long-Term Effects:

While the Trump tax plan enjoyed considerable initial popularity among Republicans, it also faced substantial criticism. Opponents argued that:

-

The tax cuts disproportionately benefited corporations and the wealthy: Critics pointed out that the significant corporate tax cuts did not translate into widespread wage increases, and that the benefits were concentrated at the top of the income distribution.

-

The plan added significantly to the national debt: The substantial tax cuts reduced government revenue, contributing to a growing national debt. This fueled concerns about long-term fiscal sustainability.

-

The individual tax cuts were temporary: Some provisions of the individual tax cuts were set to expire, raising concerns about future tax increases.

Understanding the lasting impact: The long-term effects of the 2017 tax cuts are still being debated and analyzed by economists. Studies have yielded mixed results, with some showing a positive impact on economic growth and others highlighting the negative consequences of increased national debt.

Conclusion:

The Trump tax plan, championed by House Republicans, represented a significant overhaul of the US tax code. While intended to stimulate economic growth, its long-term impact remains a subject of ongoing debate. Understanding its key features and the arguments surrounding its effectiveness is crucial for informed discussion about tax policy and its influence on the American economy. Further research into the economic data surrounding the plan is encouraged for a more complete understanding. For more detailed information, you can consult resources from the Congressional Budget Office (CBO) and the Joint Committee on Taxation (JCT).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Trump Tax Plan: A Breakdown By House Republicans. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jets On Brink Of Elimination Road Record The Culprit

May 15, 2025

Jets On Brink Of Elimination Road Record The Culprit

May 15, 2025 -

Meta Stock Post Us China Trade Agreement Investment Analysis

May 15, 2025

Meta Stock Post Us China Trade Agreement Investment Analysis

May 15, 2025 -

Speeding Duck A Swiss Traffic Cameras Unlikely Catch

May 15, 2025

Speeding Duck A Swiss Traffic Cameras Unlikely Catch

May 15, 2025 -

Nba Second Round Playoffs 2025 Schedule Tv Channels And Bracket Breakdown

May 15, 2025

Nba Second Round Playoffs 2025 Schedule Tv Channels And Bracket Breakdown

May 15, 2025 -

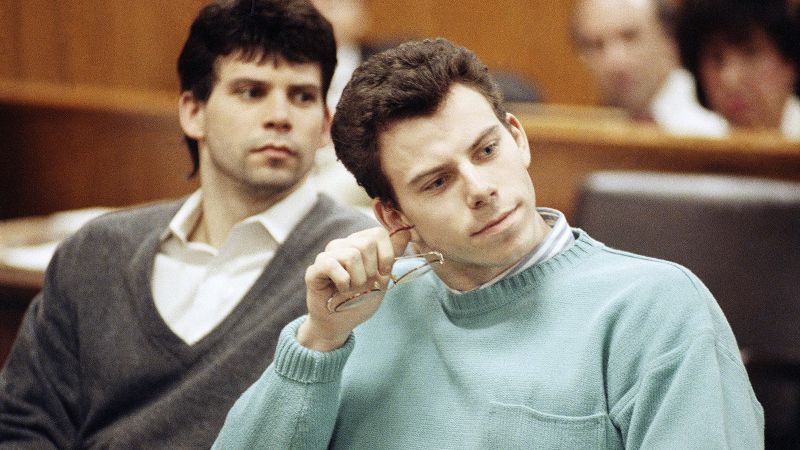

California Judge Opens Door To Resentencing Menendez Brothers

May 15, 2025

California Judge Opens Door To Resentencing Menendez Brothers

May 15, 2025