Upcoming Student Loan Changes: The Case For Federal Loans Persists

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

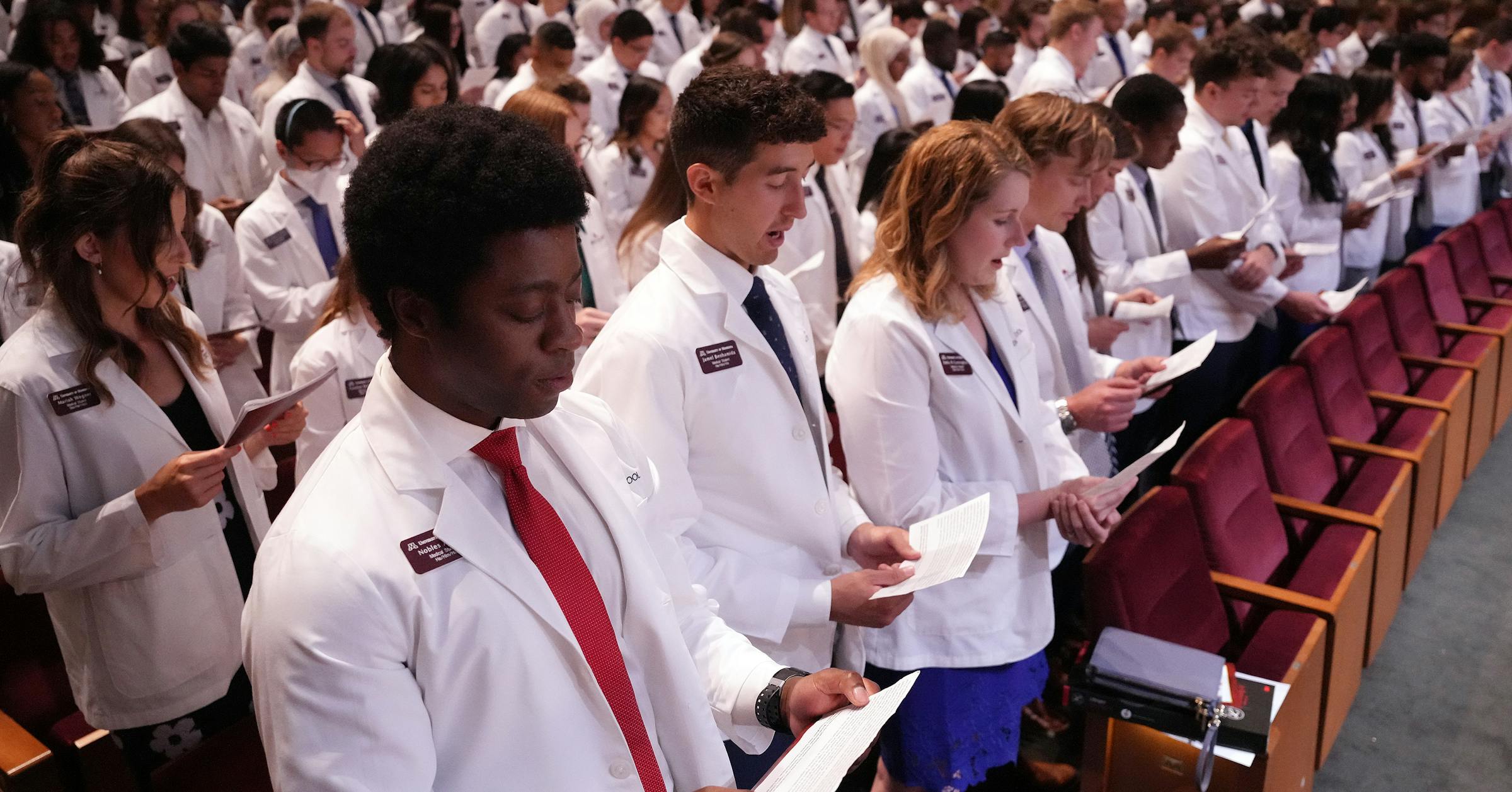

Upcoming Student Loan Changes: The Case for Federal Loans Persists

The landscape of student loan repayment is shifting, leaving many prospective students and current borrowers grappling with uncertainty. With significant changes on the horizon, understanding the advantages of federal student loans remains crucial. While private loan options exist, the enduring benefits of federal loans continue to make them the preferred choice for a vast majority.

The Looming Changes and Their Impact:

The recent extension of the student loan repayment pause, coupled with ongoing discussions surrounding loan forgiveness programs, has created a climate of anticipation and anxiety. While these initiatives offer temporary relief, the long-term implications remain unclear. Understanding your loan options before these changes fully take effect is paramount. This means carefully considering the pros and cons of federal versus private student loans.

Why Federal Loans Still Reign Supreme:

Despite the complexities of the current student loan system, federal loans consistently offer advantages that private loans often lack:

-

Flexible Repayment Plans: Federal loans provide a range of repayment plans tailored to individual circumstances, including income-driven repayment (IDR) plans. These plans adjust your monthly payments based on your income and family size, offering crucial flexibility during challenging financial periods. Private loans rarely offer such flexibility. Learn more about .

-

Forgiveness Programs: While eligibility criteria are stringent, federal loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), offer the possibility of complete loan forgiveness after a period of qualifying employment. This is a significant benefit not typically available with private loans. Find details about PSLF and other forgiveness programs .

-

Lower Interest Rates: Historically, federal student loans have offered lower interest rates compared to private loans. This can translate to significant savings over the life of the loan, especially for borrowers with larger loan balances. Always compare interest rates carefully before committing to a loan.

-

Borrower Protections: Federal loans are subject to robust borrower protections under federal law. These protections safeguard borrowers against unfair lending practices and provide avenues for dispute resolution. Private loans may offer fewer such protections.

-

Deferment and Forbearance Options: Life throws curveballs. Federal loans offer deferment and forbearance options, allowing borrowers to temporarily suspend or reduce their payments during periods of financial hardship. These options provide a safety net that many private loans lack.

Navigating the Changing Landscape:

The upcoming changes to student loan repayment will undoubtedly impact borrowers. Staying informed about these changes and understanding the nuances of federal versus private loans is vital. Consider these steps:

- Consult a Financial Advisor: Seek professional advice to navigate the complexities of student loan repayment and explore the best options for your financial situation.

- Explore Federal Loan Options: Thoroughly research the different types of federal student loans and repayment plans available to determine which best aligns with your needs.

- Compare Interest Rates and Fees: Carefully compare the interest rates and fees associated with federal and private loans before making a decision.

- Understand Your Rights: Familiarize yourself with your rights and protections as a federal student loan borrower.

The Bottom Line:

While the future of student loan repayment remains uncertain, the inherent advantages of federal student loans persist. Their flexibility, borrower protections, and potential for forgiveness programs continue to make them a compelling choice for students navigating the complexities of higher education financing. By understanding these advantages and proactively planning, borrowers can position themselves for success, regardless of upcoming changes.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Upcoming Student Loan Changes: The Case For Federal Loans Persists. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Miami Dade Deputy Involved Shooting West Little River Man Killed

Jul 31, 2025

Miami Dade Deputy Involved Shooting West Little River Man Killed

Jul 31, 2025 -

The Fda And Dr Vinay Prasad A Look At His Contentious Tenure

Jul 31, 2025

The Fda And Dr Vinay Prasad A Look At His Contentious Tenure

Jul 31, 2025 -

War Of The Worlds Remake Ice Cubes Fight For Survival In First Trailer

Jul 31, 2025

War Of The Worlds Remake Ice Cubes Fight For Survival In First Trailer

Jul 31, 2025 -

New Federal Loan Limits Higher Education Costs Price Out Students

Jul 31, 2025

New Federal Loan Limits Higher Education Costs Price Out Students

Jul 31, 2025 -

Real Estate Developers See Profit Potential In Affordable Housing

Jul 31, 2025

Real Estate Developers See Profit Potential In Affordable Housing

Jul 31, 2025

Latest Posts

-

Brazilian Government Actions Potential Threats To Us National Interests

Aug 01, 2025

Brazilian Government Actions Potential Threats To Us National Interests

Aug 01, 2025 -

Oyster Bay Womans 30 Million Fraud Scheme A Guilty Plea And Political Connections

Aug 01, 2025

Oyster Bay Womans 30 Million Fraud Scheme A Guilty Plea And Political Connections

Aug 01, 2025 -

Cnn Politics Examining The Maga Medias Rally Around Trump On Epstein Allegations

Aug 01, 2025

Cnn Politics Examining The Maga Medias Rally Around Trump On Epstein Allegations

Aug 01, 2025 -

Market Movers Apples Earnings Surprise Amazons Stock Slip Reddits Rally

Aug 01, 2025

Market Movers Apples Earnings Surprise Amazons Stock Slip Reddits Rally

Aug 01, 2025 -

Pop Cap Reimagines Plants Vs Zombies Replanted As Franchise Cornerstone

Aug 01, 2025

Pop Cap Reimagines Plants Vs Zombies Replanted As Franchise Cornerstone

Aug 01, 2025