US Treasury Market Reacts: Fed's 2025 Rate Cut Projection

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Market Reacts: Fed's 2025 Rate Cut Projection Sends Shockwaves

The US Treasury market experienced significant volatility following the Federal Reserve's unexpected projection of potential interest rate cuts as early as 2025. This announcement, delivered during the latest Federal Open Market Committee (FOMC) meeting, directly contradicts previous assurances of sustained high rates to combat inflation. The market's reaction highlights the ongoing uncertainty surrounding the future trajectory of US monetary policy and its impact on long-term investment strategies.

The Fed's Surprise Announcement: A Shift in Strategy?

The Fed's "dot plot," a chart showing individual policymakers' interest rate projections, revealed a notable shift. Several members now foresee rate cuts beginning in 2025, a stark contrast to earlier predictions of rates remaining elevated throughout the year and potentially into 2026. This suggests a growing belief within the Fed that inflation is finally cooling and that the current aggressive monetary tightening measures are nearing their endpoint. This pivot, however unexpected, could signal a change in the Fed's overall strategy.

Immediate Market Impact: Treasury Yields Tumble

The immediate reaction in the Treasury market was dramatic. Yields on US Treasury bonds, which move inversely to prices, fell sharply following the announcement. This indicates increased investor demand for these perceived safe-haven assets, driven by the expectation of lower future interest rates. The 10-year Treasury yield, a key benchmark, experienced its largest single-day decline in several months. This significant drop reflects investors' reassessment of the risk-reward profile of various investments, leading to a flight to safety.

Analyzing the Implications: What's Next for Investors?

The Fed's projection has several key implications for investors:

- Bond Market Rally: The lower yields are a boon for bondholders, but also signal a potential end to the current bond bear market. Investors who have been hesitant to invest in bonds due to rising rates may now find them more attractive.

- Equity Market Uncertainty: While initially positive, the uncertainty surrounding the Fed's future actions could create volatility in the stock market. Rate cuts, while potentially beneficial for economic growth, could also spur inflation if implemented too early.

- Dollar Depreciation: A potential easing of monetary policy could weaken the US dollar, impacting international trade and investment flows.

Long-Term Outlook: Navigating the Uncertainty

The long-term outlook remains uncertain. The Fed's projections are not guarantees, and the actual timing and magnitude of future rate cuts will depend heavily on evolving economic data, including inflation figures and employment reports. Investors need to carefully consider these uncertainties when making investment decisions.

Experts Weigh In: Divergent Opinions and Future Predictions

Financial analysts are offering mixed assessments of the Fed's move. Some praise the flexibility shown in adapting to changing economic conditions, while others express concerns about the potential for premature easing. Many emphasize the importance of monitoring upcoming economic indicators to gain a clearer picture of the future path of interest rates. This situation underscores the need for diligent market monitoring and well-diversified investment portfolios.

Call to Action: Stay informed about upcoming economic releases and Fed statements to make informed investment decisions. Consider consulting with a financial advisor to develop a personalized strategy that aligns with your risk tolerance and financial goals.

Keywords: US Treasury market, Federal Reserve, interest rate cuts, FOMC, bond yields, inflation, monetary policy, investment strategy, economic outlook, 10-year Treasury yield, dot plot, risk-reward, bond market rally, equity market, US dollar.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Market Reacts: Fed's 2025 Rate Cut Projection. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

5 Must See Tv Shows For Fans Of The Studio

May 20, 2025

5 Must See Tv Shows For Fans Of The Studio

May 20, 2025 -

Trump Immediate Start To Russia Ukraine Peace Negotiations

May 20, 2025

Trump Immediate Start To Russia Ukraine Peace Negotiations

May 20, 2025 -

Pet Cremation Bipartisan Bill Aims To Prevent Future Scandals

May 20, 2025

Pet Cremation Bipartisan Bill Aims To Prevent Future Scandals

May 20, 2025 -

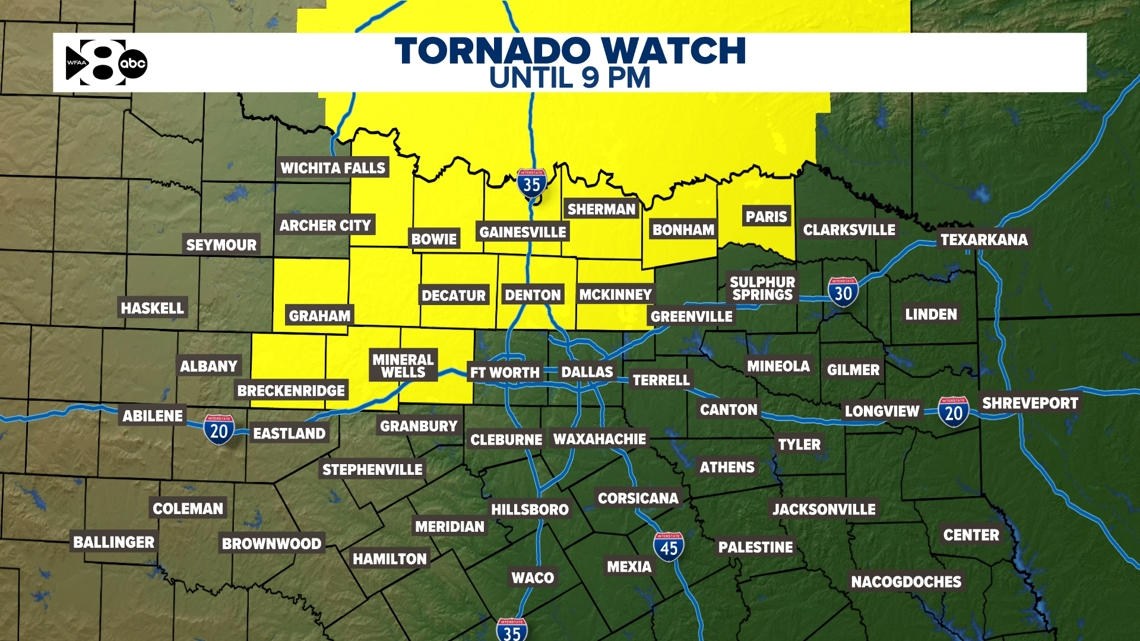

Dfw Area Severe Weather Passes Cold Front Incoming

May 20, 2025

Dfw Area Severe Weather Passes Cold Front Incoming

May 20, 2025 -

Report Reveals Lufthansa Flight Flew Unaided After Co Pilot Collapsed

May 20, 2025

Report Reveals Lufthansa Flight Flew Unaided After Co Pilot Collapsed

May 20, 2025

Latest Posts

-

Lineker Exit Bbc Faces Fallout After Match Of The Day Controversy

May 20, 2025

Lineker Exit Bbc Faces Fallout After Match Of The Day Controversy

May 20, 2025 -

Tense Standoff Eu Brexit Negotiations Enter Final Fraught Stages

May 20, 2025

Tense Standoff Eu Brexit Negotiations Enter Final Fraught Stages

May 20, 2025 -

Cyberattack Exposes Sensitive Data Including Criminal Records From Legal Aid

May 20, 2025

Cyberattack Exposes Sensitive Data Including Criminal Records From Legal Aid

May 20, 2025 -

U S Treasury Yield Slip Federal Reserves 2025 Rate Cut Outlook

May 20, 2025

U S Treasury Yield Slip Federal Reserves 2025 Rate Cut Outlook

May 20, 2025 -

Should Your Child Stop Sucking Their Thumb Or Pacifier Expert Advice

May 20, 2025

Should Your Child Stop Sucking Their Thumb Or Pacifier Expert Advice

May 20, 2025