Wall Street Rebounds: S&P 500's 6-Day Rally Defies Moody's Downgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Rebounds: S&P 500's 6-Day Rally Defies Moody's Downgrade

Wall Street experienced a surprising surge this week, with the S&P 500 enjoying a remarkable six-day rally that defied expectations following Moody's downgrade of several US banking giants. This unexpected rebound has left investors and analysts scrambling to understand the market's resilience in the face of seemingly negative economic news. The rally, which saw significant gains across major indices, raises questions about the future trajectory of the market and the effectiveness of Moody's credit rating actions.

Moody's Downgrade and Market Reaction:

Moody's recent decision to downgrade the credit ratings of several regional banks sent shockwaves through the financial sector. The agency cited concerns about the deteriorating credit quality of banks' commercial real estate portfolios and the potential for further losses. Many predicted a significant market downturn following this announcement. However, the market's response has been far from the anticipated negative reaction.

The Six-Day Rally: A Deeper Dive:

The S&P 500's impressive six-day rally saw the index climb significantly, defying the negative sentiment fueled by Moody's downgrade. This unexpected positive trend suggests that investors may be focusing on other factors, potentially including:

- Stronger-than-expected corporate earnings: Recent positive earnings reports from several major corporations may have boosted investor confidence, offsetting the negative impact of the downgrade.

- Resilience of the US economy: Despite concerns about inflation and potential recession, certain economic indicators continue to show strength, offering a counterpoint to the negative narrative.

- Federal Reserve's policy stance: The Federal Reserve's approach to interest rate hikes, while still impacting the market, may be perceived as less hawkish than initially feared, thus influencing investor sentiment positively.

- Bargain hunting: The initial market dip following the downgrade might have created attractive buying opportunities for investors seeking undervalued assets.

Analyzing the Disconnect:

The disconnect between Moody's assessment and the market's reaction is a key point of discussion among financial experts. Some argue that Moody's downgrade was already largely priced into the market, meaning the impact was less severe than anticipated. Others suggest that investors are looking beyond the immediate concerns and focusing on the long-term potential of the US economy. The debate continues, highlighting the complexity and volatility of the financial markets.

Looking Ahead: Uncertainty Remains:

While the recent rally is encouraging, it's crucial to remember that market fluctuations are common. The long-term impact of Moody's downgrade and other economic factors remains uncertain. Investors should remain vigilant and continue monitoring key economic indicators and market trends.

Further Reading:

For more in-depth analysis of the current market conditions, we recommend exploring resources such as the and the .

Conclusion:

The S&P 500's six-day rally following Moody's downgrade presents a fascinating case study in market dynamics. While the reasons behind this unexpected rebound are multifaceted and subject to ongoing debate, it underscores the unpredictable nature of the financial markets and the importance of staying informed about economic trends and investor sentiment. The future trajectory of the market remains uncertain, highlighting the need for careful analysis and a long-term perspective.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Rebounds: S&P 500's 6-Day Rally Defies Moody's Downgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jon Jones Strip The Duck Remark Aspinall Fight Fallout And Fan Reactions

May 20, 2025

Jon Jones Strip The Duck Remark Aspinall Fight Fallout And Fan Reactions

May 20, 2025 -

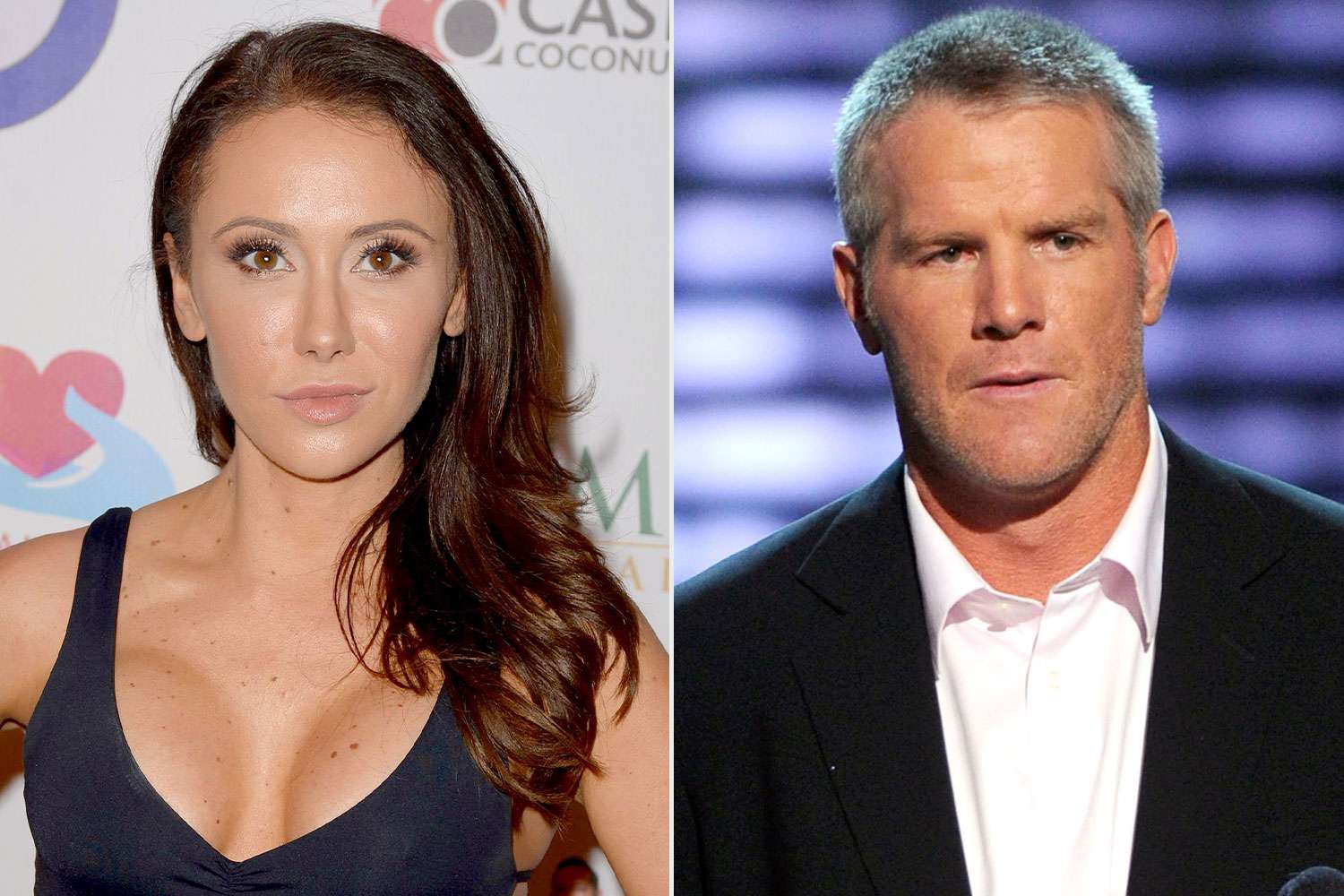

Jenn Sterger On Brett Favre Sext Scandal Fallout I Was Never Treated Like A Person

May 20, 2025

Jenn Sterger On Brett Favre Sext Scandal Fallout I Was Never Treated Like A Person

May 20, 2025 -

Arthur Triumphs Coaching Battle Won In Super League

May 20, 2025

Arthur Triumphs Coaching Battle Won In Super League

May 20, 2025 -

Improving Tourist Conduct In Bali A Call For Global Collaboration

May 20, 2025

Improving Tourist Conduct In Bali A Call For Global Collaboration

May 20, 2025 -

Moodys Downgrade Fails To Dampen Market S And P 500 Leads Six Day Rally

May 20, 2025

Moodys Downgrade Fails To Dampen Market S And P 500 Leads Six Day Rally

May 20, 2025

Latest Posts

-

Breaking Point Olympic Champions Harrowing Account Of Abusive Coaching Practices

May 21, 2025

Breaking Point Olympic Champions Harrowing Account Of Abusive Coaching Practices

May 21, 2025 -

Femicide Statistics Examining The Global Increase In Violence Against Women

May 21, 2025

Femicide Statistics Examining The Global Increase In Violence Against Women

May 21, 2025 -

Ubers Driverless Car Ambitions A 2027 Uk Deployment Hurdle

May 21, 2025

Ubers Driverless Car Ambitions A 2027 Uk Deployment Hurdle

May 21, 2025 -

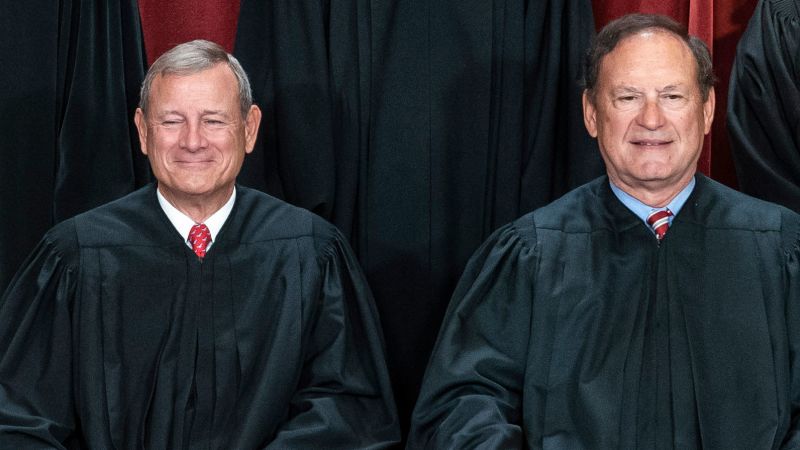

Alito And Roberts Supreme Court Service A Look Back At Two Decades

May 21, 2025

Alito And Roberts Supreme Court Service A Look Back At Two Decades

May 21, 2025 -

Record Bitcoin Etf Investments 5 Billion And Growing

May 21, 2025

Record Bitcoin Etf Investments 5 Billion And Growing

May 21, 2025