Wall Street Resilient: S&P 500 Extends Winning Streak Despite Moody's Credit Rating Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Resilient: S&P 500 Extends Winning Streak Despite Moody's Credit Rating Cut

Wall Street shrugged off Moody's downgrade of the U.S. government's credit rating, with the S&P 500 extending its winning streak. The unexpected move by Moody's, citing concerns about fiscal strength and the increasing national debt, sent ripples through global markets. Yet, the resilience of the U.S. stock market surprised many analysts, highlighting the complex interplay between economic indicators and investor sentiment.

The S&P 500 closed higher for a [Number] consecutive day on [Date], defying predictions of a significant market correction following the Moody's announcement. This continued upward trajectory underscores a remarkable level of confidence among investors, despite the looming economic uncertainties. This resilience could be attributed to several factors, including strong corporate earnings, ongoing Federal Reserve rate hikes (which some believe are nearing their end), and continued investor appetite for risk.

Moody's Downgrade: A Deeper Dive

Moody's decision to lower the U.S. government's credit rating from Aaa to Aa1 marked the first downgrade since 2011. The agency cited the country's "fiscal deterioration over the past decade," including rising debt levels and the ongoing political gridlock surrounding the budget. This downgrade raises concerns about the increasing cost of borrowing for the U.S. government and potential spillover effects on the broader economy.

However, the impact of this downgrade on the stock market appears to be less severe than initially anticipated. This suggests that investors may be factoring in the long-term implications of the downgrade, rather than reacting solely to the immediate news.

Why Did the Market Remain Resilient?

Several factors contributed to Wall Street's surprising resilience:

- Strong Corporate Earnings: Many major companies have reported strong second-quarter earnings, exceeding analysts' expectations. This positive performance has bolstered investor confidence and fueled further market gains.

- Anticipation of Fed Rate Pause: While the Federal Reserve continues to fight inflation with interest rate hikes, many believe the end of this cycle is near. This expectation has helped to alleviate some of the concerns surrounding higher borrowing costs.

- Resilient Consumer Spending: Despite inflation, consumer spending remains relatively robust, suggesting continued economic strength. This positive indicator reinforces the belief that the U.S. economy can withstand the current economic headwinds.

- Global Market Dynamics: It's important to note the global context. While the U.S. faced a credit downgrade, other major economies are also grappling with challenges. The relative strength of the U.S. economy compared to others might be playing a role in investor sentiment.

What Does the Future Hold?

While the S&P 500's current performance is encouraging, the long-term impact of Moody's downgrade remains uncertain. The increased borrowing costs for the government could eventually translate into higher interest rates for consumers and businesses. Furthermore, political gridlock could continue to hamper efforts to address the nation's fiscal challenges.

Investors should remain vigilant and carefully monitor economic indicators and geopolitical events. Diversification of investment portfolios remains crucial in navigating the complexities of the current market environment.

Disclaimer: This article provides general information and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Keywords: S&P 500, Moody's, Credit Rating Downgrade, Wall Street, Stock Market, US Economy, Fiscal Strength, Interest Rates, Inflation, Investment, Investor Sentiment, Economic Indicators, Market Resilience.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Resilient: S&P 500 Extends Winning Streak Despite Moody's Credit Rating Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Family Struck By Train On Railroad Bridge Two Dead One Child Missing Another Injured

May 21, 2025

Family Struck By Train On Railroad Bridge Two Dead One Child Missing Another Injured

May 21, 2025 -

Record Bitcoin Etf Investments 5 Billion And Growing

May 21, 2025

Record Bitcoin Etf Investments 5 Billion And Growing

May 21, 2025 -

The Last Of Us Slow Burn Thrills And Emotional Depth

May 21, 2025

The Last Of Us Slow Burn Thrills And Emotional Depth

May 21, 2025 -

Railroad Bridge Accident Leaves Two Dead Children Injured One Missing

May 21, 2025

Railroad Bridge Accident Leaves Two Dead Children Injured One Missing

May 21, 2025 -

Investigation Reveals Cat Involved In Costa Rica Prison Drug Trafficking

May 21, 2025

Investigation Reveals Cat Involved In Costa Rica Prison Drug Trafficking

May 21, 2025

Latest Posts

-

Solo Levelings Award Winning Success A Look At Future Prospects

May 21, 2025

Solo Levelings Award Winning Success A Look At Future Prospects

May 21, 2025 -

Jeremy Bowen On Israels Gaza Operation Diplomatic Efforts Face Setback

May 21, 2025

Jeremy Bowen On Israels Gaza Operation Diplomatic Efforts Face Setback

May 21, 2025 -

2025 League Of Legends Hall Of Fame Member Revealed By Riot

May 21, 2025

2025 League Of Legends Hall Of Fame Member Revealed By Riot

May 21, 2025 -

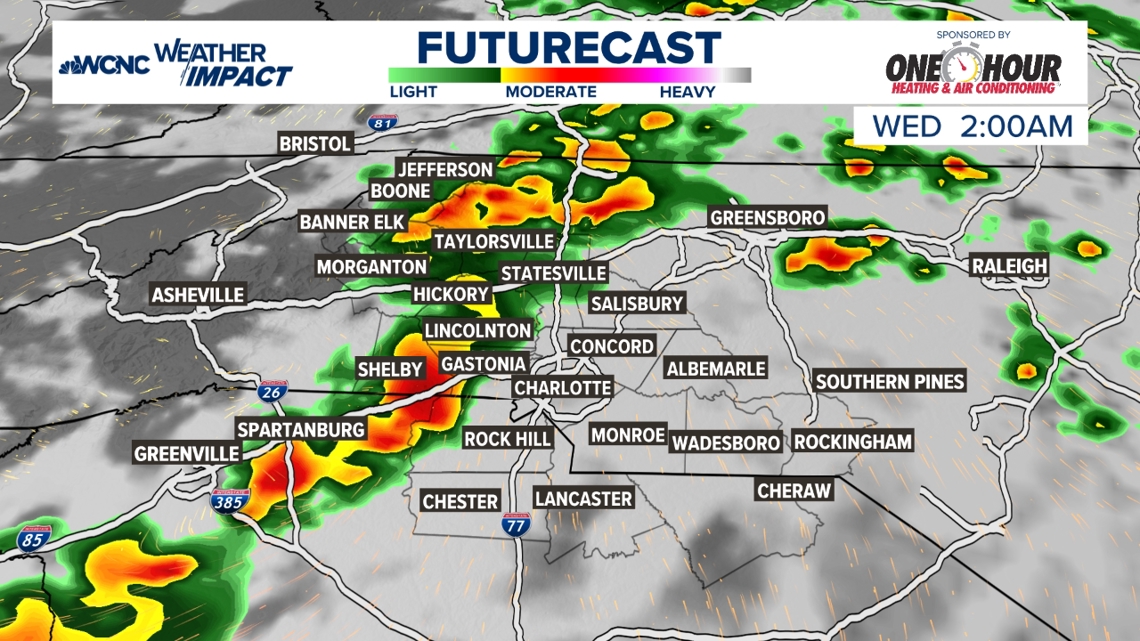

Severe Weather Alert Heavy Rain And Storms To Hit North Carolina Tonight

May 21, 2025

Severe Weather Alert Heavy Rain And Storms To Hit North Carolina Tonight

May 21, 2025 -

Limited Risk Of Severe Weather Tuesday Night Stay Informed

May 21, 2025

Limited Risk Of Severe Weather Tuesday Night Stay Informed

May 21, 2025