Warren Buffett Dumps Long-Held US Stocks: A Detailed Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett Dumps Long-Held US Stocks: A Detailed Analysis

The Oracle of Omaha's recent moves send shockwaves through the market. Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has made headlines with significant divestments from long-held US stocks. This unexpected shift in strategy has sparked intense speculation and analysis among market experts and individual investors alike. This article delves into the details of Buffett's recent portfolio adjustments, exploring the potential reasons behind these decisions and their broader implications for the market.

Buffett's Recent Stock Sales: Key Highlights

Berkshire Hathaway's recent 13F filings revealed significant reductions in stakes in several prominent US companies. These weren't minor adjustments; we're talking about substantial decreases in holdings that had been part of Buffett's portfolio for years, even decades. While the exact reasons remain somewhat opaque (Buffett is famously tight-lipped about his investment decisions), several factors are being considered:

-

Shifting Market Dynamics: The current economic climate is characterized by high inflation, rising interest rates, and geopolitical uncertainty. These factors can significantly impact the valuation and performance of even the most robust companies. Buffett's moves could reflect a cautious approach to navigating these turbulent waters.

-

Sectoral Rotation: Some analysts suggest that Buffett may be rotating out of certain sectors deemed less attractive in the current environment and into others perceived as having greater growth potential. This could involve shifting from mature, established companies to those poised for expansion in emerging markets or innovative technologies.

-

Strategic Portfolio Rebalancing: A simple explanation could be a strategic rebalancing of Berkshire Hathaway's vast portfolio. This is a common practice among large investors to mitigate risk and optimize returns. By selling some holdings, Buffett might be freeing up capital to invest in more promising opportunities elsewhere.

Companies Affected by Buffett's Divestments

The specific companies affected by Buffett's recent selling spree vary, but some prominent examples include: (Specific company names and percentage reductions should be inserted here, referencing reliable financial news sources like the Wall Street Journal or Bloomberg. Avoid naming specific companies without reliable source verification).

What Does This Mean for Investors?

Buffett's actions are always closely scrutinized by the market. While his decisions don't necessarily dictate market trends, they often serve as a powerful indicator of his assessment of the economic landscape. This recent divestment should prompt investors to:

-

Review their own portfolios: Buffett's moves highlight the importance of regular portfolio review and diversification. Investors should assess their own risk tolerance and ensure their holdings align with their long-term financial goals.

-

Consider long-term investment strategies: Buffett's long-term investment philosophy emphasizes patience and a focus on value. While short-term market fluctuations can be unsettling, investors should maintain a long-term perspective and avoid impulsive decisions based on short-term market movements.

-

Seek professional advice: For those who lack the expertise to analyze market trends and make informed investment decisions, consulting a qualified financial advisor is crucial.

Conclusion:

Warren Buffett's recent decision to divest from long-held US stocks is a significant development with potential implications for the market. While the exact reasoning behind his actions remains subject to interpretation, the event underscores the importance of adaptability and strategic decision-making in navigating a complex and evolving economic environment. Investors should carefully consider their own portfolios and investment strategies in light of this news. Stay tuned for further developments and analysis as the situation unfolds.

Keywords: Warren Buffett, Berkshire Hathaway, stock market, investment strategy, portfolio adjustment, US stocks, 13F filings, economic outlook, market analysis, investment advice, long-term investment, stock sales, sectoral rotation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett Dumps Long-Held US Stocks: A Detailed Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

John Brenkus Of Sports Science Dies Aged 54

Jun 04, 2025

John Brenkus Of Sports Science Dies Aged 54

Jun 04, 2025 -

Mortgage Trends First Timers Opting For Longer Loan Terms

Jun 04, 2025

Mortgage Trends First Timers Opting For Longer Loan Terms

Jun 04, 2025 -

Third England West Indies Odi Traffic Delays Cause Match Postponement

Jun 04, 2025

Third England West Indies Odi Traffic Delays Cause Match Postponement

Jun 04, 2025 -

9 Proven Ways To Fund Your Childs College Education

Jun 04, 2025

9 Proven Ways To Fund Your Childs College Education

Jun 04, 2025 -

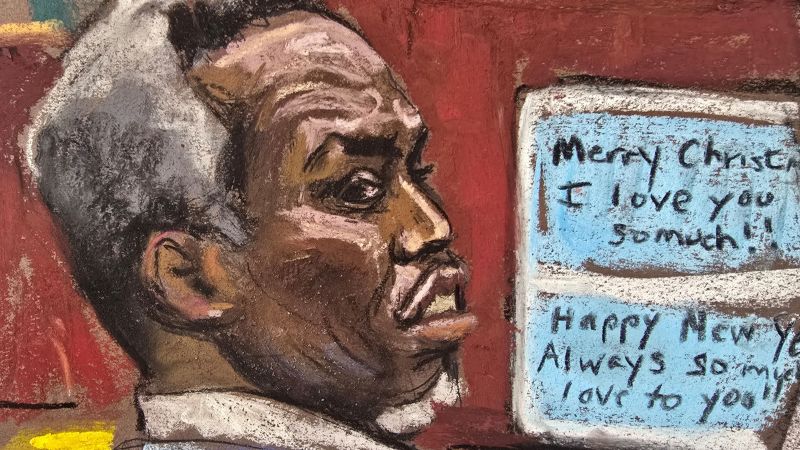

The Sean Diddy Combs Trial Key Moments And Potential Outcomes

Jun 04, 2025

The Sean Diddy Combs Trial Key Moments And Potential Outcomes

Jun 04, 2025

Latest Posts

-

University Of Michigan Two Chinese Researchers Face Charges For Smuggling Biological Material

Jun 06, 2025

University Of Michigan Two Chinese Researchers Face Charges For Smuggling Biological Material

Jun 06, 2025 -

No More Cuts Chancellor Guarantees Winter Fuel Payment

Jun 06, 2025

No More Cuts Chancellor Guarantees Winter Fuel Payment

Jun 06, 2025 -

Ryan Gosling In The Mcu Exploring The White Black Panther Possibility Post Ketema

Jun 06, 2025

Ryan Gosling In The Mcu Exploring The White Black Panther Possibility Post Ketema

Jun 06, 2025 -

Navy Ship Renamed Hegseths Action Sparks Debate Over Harvey Milk Legacy

Jun 06, 2025

Navy Ship Renamed Hegseths Action Sparks Debate Over Harvey Milk Legacy

Jun 06, 2025 -

Villanovas Football Future Secured Patriot League Associate Membership Confirmed

Jun 06, 2025

Villanovas Football Future Secured Patriot League Associate Membership Confirmed

Jun 06, 2025