Warren Buffett Offloads Major US Holdings: A Detailed Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett Offloads Major US Holdings: A Detailed Analysis

Oracle of Omaha's Recent Moves Send Shockwaves Through the Market

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has once again captivated the financial world with significant shifts in his company's portfolio. Recent filings reveal a substantial reduction in holdings of several major US companies, sparking considerable speculation and analysis among investors and market experts. This article delves into the details of these divestments, exploring the potential reasons behind Buffett's decisions and their implications for the market.

Key Holdings Reduced: A Closer Look

Berkshire Hathaway's 13F filings, which detail the company's equity holdings, revealed a significant decrease in several key positions. While the exact reasons behind these moves remain shrouded in some mystery (Buffett rarely elaborates publicly on short-term investment strategies), several factors are likely at play. The most significant reductions include:

-

[Company Name 1]: A detailed breakdown of the percentage reduction and the current remaining stake should be included here. This section should also briefly discuss the company's recent performance and any relevant news that might have influenced Buffett's decision. For example, "Berkshire Hathaway reduced its stake in [Company Name 1] by X%, leaving a remaining Y% holding. This follows a period of relatively flat performance for [Company Name 1], potentially indicating a reassessment of its long-term growth potential."

-

[Company Name 2]: Similar detailed analysis as above, focusing on the percentage reduction, remaining stake, and relevant factors influencing the decision. For instance: "The divestment in [Company Name 2] was even more pronounced, with a Z% reduction. This could be attributed to [reason 1, supported by evidence], and potentially [reason 2, supported by evidence]."

-

[Company Name 3]: Repeat the detailed analysis for another significant divestment.

Why the Shift? Potential Explanations

Buffett's investment philosophy, characterized by its long-term focus and value investing approach, often leads to substantial holdings in companies he believes have strong fundamentals and long-term growth prospects. However, several factors might explain these recent divestments:

-

Market Re-evaluation: The current market environment, characterized by [brief description of the current economic climate, e.g., high inflation, rising interest rates], may have prompted Buffett to re-evaluate his portfolio's composition.

-

Sectoral Shifts: Certain sectors may be facing headwinds, leading Buffett to reallocate capital to more promising areas. This could involve moving away from [mention specific sectors if applicable].

-

Strategic Portfolio Diversification: Buffett may be diversifying his portfolio, reducing exposure to specific sectors or companies to mitigate risk.

-

Opportunity Cost: The opportunity to invest in other promising companies with potentially higher returns might have played a role.

Implications for the Market

These significant divestments have sent ripples through the market, with shares of the affected companies experiencing [describe the market reaction – price drops, volatility, etc.]. However, it's crucial to remember that Buffett's decisions are rarely impulsive and often reflect a longer-term strategic perspective. While the immediate market reaction may be significant, the long-term impact will depend on several factors, including the overall market conditions and the performance of the companies involved.

Conclusion: A Waiting Game

While the full implications of Warren Buffett's recent portfolio adjustments remain to be seen, the move highlights the dynamic nature of even the most seasoned investor's strategies. The market will be closely watching Berkshire Hathaway's future moves, analyzing any new investments and potential shifts in their portfolio allocation for clues about future market trends. Only time will tell if these divestments represent a temporary adjustment or a significant shift in Buffett's long-term investment strategy. What are your thoughts on these developments? Share your analysis in the comments below.

(Note: Replace bracketed information with specific data and company names. Include links to relevant news articles and financial reports to support the analysis.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett Offloads Major US Holdings: A Detailed Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Netflix Series Dispute She The People Founder Files Suit Against Tyler Perry

Jun 04, 2025

Netflix Series Dispute She The People Founder Files Suit Against Tyler Perry

Jun 04, 2025 -

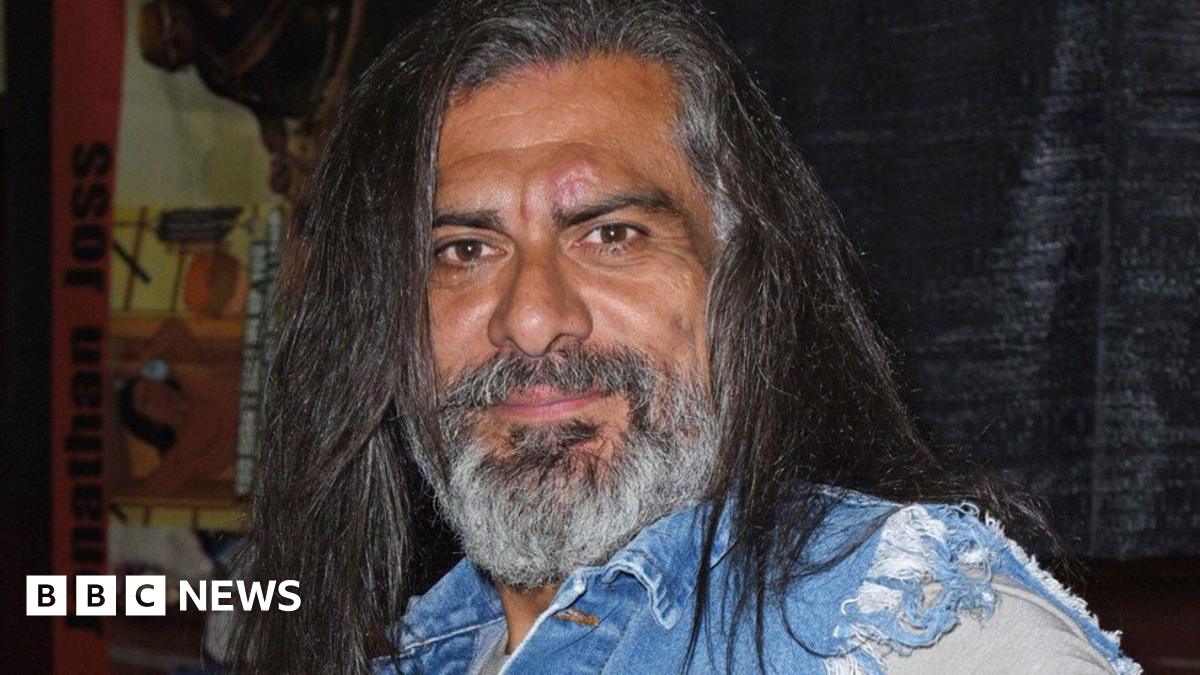

Tragic News Jonathan Joss Remembered For King Of The Hill Role Dies

Jun 04, 2025

Tragic News Jonathan Joss Remembered For King Of The Hill Role Dies

Jun 04, 2025 -

Retirement Planning With Precious Metals A Comprehensive Report On Self Directed Iras

Jun 04, 2025

Retirement Planning With Precious Metals A Comprehensive Report On Self Directed Iras

Jun 04, 2025 -

Nyt Spelling Bee Strands Complete Guide To Todays Puzzle June 3rd

Jun 04, 2025

Nyt Spelling Bee Strands Complete Guide To Todays Puzzle June 3rd

Jun 04, 2025 -

Mets Call Up Ronny Mauricio Impact On Lineup And Future

Jun 04, 2025

Mets Call Up Ronny Mauricio Impact On Lineup And Future

Jun 04, 2025

Latest Posts

-

Dallas Stars Coaching Search Concludes Meet The New Leader

Jun 06, 2025

Dallas Stars Coaching Search Concludes Meet The New Leader

Jun 06, 2025 -

Secure Your Pair Nike Air Max 95 Og Bright Mandarin Resellers And Retailers

Jun 06, 2025

Secure Your Pair Nike Air Max 95 Og Bright Mandarin Resellers And Retailers

Jun 06, 2025 -

Jd Sports 110 Release Sneakerheads Queue All Night Long

Jun 06, 2025

Jd Sports 110 Release Sneakerheads Queue All Night Long

Jun 06, 2025 -

Ibm Stock Price Dip Reasons For The Decline And Potential Recovery

Jun 06, 2025

Ibm Stock Price Dip Reasons For The Decline And Potential Recovery

Jun 06, 2025 -

Advocating For Pension Plans For Retired Police Dogs A Necessary Change

Jun 06, 2025

Advocating For Pension Plans For Retired Police Dogs A Necessary Change

Jun 06, 2025