What's Next For AVGO? Trader Expectations For Broadcom Stock After Earnings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

What's Next for AVGO? Trader Expectations for Broadcom Stock After Earnings

Broadcom (AVGO) delivered a strong Q2 2024 earnings report, exceeding expectations and sending ripples through the tech sector. But with the dust settled, what are traders expecting next from this semiconductor giant? The post-earnings reaction was largely positive, but the future remains a complex landscape of opportunities and challenges. This article delves into the key takeaways from the report and explores the prevailing sentiment among traders regarding AVGO's stock trajectory.

Q2 2024 Earnings: A Recap of Key Highlights

Broadcom's Q2 results showcased impressive growth across various segments. The company significantly beat analyst estimates for both earnings per share (EPS) and revenue, driven by strong demand in its networking and software segments. Key highlights included:

- Exceeding EPS Estimates: AVGO reported EPS significantly higher than projected, demonstrating robust profitability.

- Strong Revenue Growth: Revenue growth exceeded expectations, signaling continued market demand for Broadcom's products.

- Positive Guidance: The company offered positive guidance for the upcoming quarter, fueling optimism among investors.

- Increased Share Repurchases: Broadcom's commitment to share buybacks indicates confidence in its future prospects.

These positive results sparked a surge in AVGO's stock price immediately following the earnings announcement. However, the long-term outlook requires a more nuanced analysis.

Trader Sentiment and Future Expectations

While the immediate reaction to the earnings was bullish, trader sentiment remains somewhat mixed. Several factors are influencing these expectations:

1. The Macroeconomic Landscape: The ongoing global economic uncertainty, including inflation and potential recessionary pressures, casts a shadow over the tech sector's prospects. This macro environment poses a significant risk to Broadcom's growth trajectory.

2. Competition in the Semiconductor Market: Intense competition from other semiconductor companies remains a key challenge. Maintaining market share and technological leadership will be crucial for AVGO's continued success. [Link to article about semiconductor market competition]

3. The Qualcomm Deal: The ongoing integration of VMware following the acquisition continues to be a key factor in AVGO's long-term growth strategy. Success in integrating this acquisition will be paramount for long-term value creation.

4. Supply Chain Dynamics: Navigating potential disruptions to the global supply chain remains a critical factor impacting Broadcom's ability to meet demand and maintain its production schedule.

H2 2024 and Beyond: Potential Catalysts and Risks

Several factors could significantly impact AVGO's stock performance in the coming months:

- Data Center Demand: Continued growth in the data center market will be vital for Broadcom's success. [Link to article about data center market trends]

- 5G Infrastructure Investments: Investments in 5G infrastructure globally will likely boost demand for Broadcom's networking solutions.

- Software Growth: Broadcom's software segment continues to be a major growth driver, with potential for further expansion.

- Geopolitical Risks: Geopolitical instability and trade tensions could impact Broadcom's operations and supply chain.

Conclusion: A Cautiously Optimistic Outlook

Broadcom's Q2 2024 earnings report paints a largely positive picture. The company exceeded expectations and demonstrated robust financial performance. However, traders should remain mindful of the broader macroeconomic environment, competitive pressures, and geopolitical risks. While the short-term outlook appears strong, the long-term trajectory will depend on Broadcom's ability to navigate these challenges and capitalize on emerging opportunities. Investors should carefully consider these factors before making any investment decisions. Further analysis of the company's future strategies and market positioning is recommended.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on What's Next For AVGO? Trader Expectations For Broadcom Stock After Earnings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Expert Forensic Video Analysis Presented In Sean Combs Case

Jun 06, 2025

Expert Forensic Video Analysis Presented In Sean Combs Case

Jun 06, 2025 -

Fact Check White House Vs Bbc On Gaza Coverage

Jun 06, 2025

Fact Check White House Vs Bbc On Gaza Coverage

Jun 06, 2025 -

Revised Winter Fuel Payment Scheme Chancellors Announcement

Jun 06, 2025

Revised Winter Fuel Payment Scheme Chancellors Announcement

Jun 06, 2025 -

Confirmed Remains Found In Portugal Belong To Scot Missing From Stag Weekend

Jun 06, 2025

Confirmed Remains Found In Portugal Belong To Scot Missing From Stag Weekend

Jun 06, 2025 -

Us Supreme Court Sides With Woman In Reverse Discrimination Case Implications For Employment Law

Jun 06, 2025

Us Supreme Court Sides With Woman In Reverse Discrimination Case Implications For Employment Law

Jun 06, 2025

Latest Posts

-

Relationship Update Matthew Hussey To Become A Father

Jun 06, 2025

Relationship Update Matthew Hussey To Become A Father

Jun 06, 2025 -

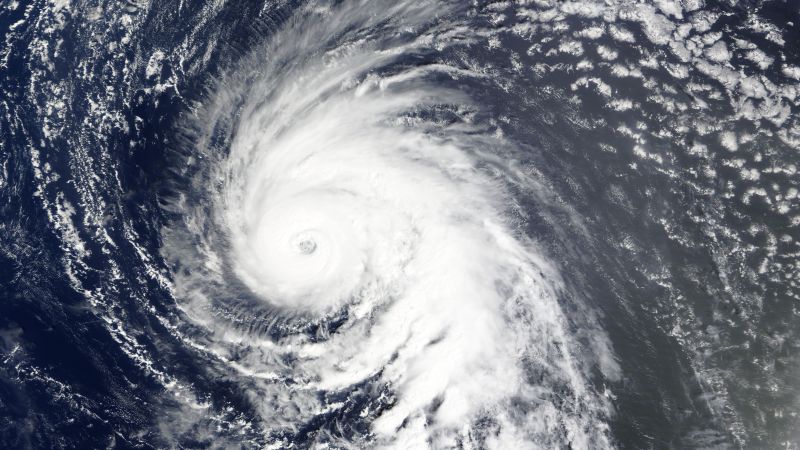

Atmospheric Disturbances How Ghost Hurricanes Aid Hurricane Forecasting

Jun 06, 2025

Atmospheric Disturbances How Ghost Hurricanes Aid Hurricane Forecasting

Jun 06, 2025 -

Microbiomes Role In Preventing Hospitalization A Closer Look

Jun 06, 2025

Microbiomes Role In Preventing Hospitalization A Closer Look

Jun 06, 2025 -

Combs Trial Update Friend Of Cassie Ventura To Testify

Jun 06, 2025

Combs Trial Update Friend Of Cassie Ventura To Testify

Jun 06, 2025 -

Understanding Ibms Recent Stock Market Underperformance

Jun 06, 2025

Understanding Ibms Recent Stock Market Underperformance

Jun 06, 2025