Will State Farm's Emergency Rate Hike Affect Your California Auto Insurance?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will State Farm's Emergency Rate Hike Affect Your California Auto Insurance?

California drivers are facing a potential blow to their wallets as State Farm, one of the state's largest auto insurers, implements an emergency rate hike. The move, announced [insert date of announcement], has left many wondering: how will this impact my premiums? This article breaks down the situation and helps you understand what you need to know.

The State Farm Rate Hike: A Necessary Evil?

State Farm cites increased claims costs and a challenging insurance environment as the primary reasons for the emergency rate increase. These increased costs are reportedly driven by several factors, including:

- Higher repair costs: The cost of auto parts and labor has skyrocketed in recent years, leading to significantly more expensive vehicle repairs.

- Increased severity of accidents: More severe accidents often translate to higher claim payouts for insurers.

- Inflationary pressures: General inflation impacts all aspects of the insurance industry, including administrative costs and overhead.

- Fraudulent claims: Insurance fraud adds to the overall cost burden, impacting premiums for all policyholders.

The company hasn't disclosed the exact percentage increase, stating that it varies depending on individual policy specifics and location. This lack of transparency has understandably fueled anxiety among California drivers. However, State Farm maintains that the increase is a necessary measure to ensure the company's financial stability and its ability to continue providing coverage to its policyholders.

What Does This Mean for You?

The impact of the rate hike will vary from person to person. Factors influencing your premium increase include:

- Your driving record: A clean driving record typically results in lower premiums, even with a rate increase.

- Your vehicle: The make, model, and year of your vehicle all play a role in determining your insurance costs. More expensive vehicles to repair will generally lead to higher premiums.

- Your coverage: Comprehensive and collision coverage typically comes with higher premiums than liability-only coverage.

- Your location: Insurance rates vary by location due to differences in accident rates and other risk factors.

How to Prepare for Potential Increases:

While you can't control the rate hike itself, you can take steps to mitigate its potential impact:

- Shop around: Don't be afraid to compare quotes from other insurers. The competitive insurance market in California offers numerous options. Use online comparison tools to streamline the process.

- Review your coverage: Consider if you need all the coverage you currently have. Dropping unnecessary coverage could potentially lower your premiums.

- Improve your driving record: Safe driving habits are crucial for keeping your insurance costs low.

- Bundle your insurance: Bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, can often result in discounts.

Looking Ahead:

The State Farm rate hike highlights the ongoing challenges facing the California auto insurance market. While the increase is undoubtedly unwelcome news for many, understanding the contributing factors and taking proactive steps can help you navigate this situation. Stay informed about changes in the insurance landscape and regularly review your policy to ensure you have the right coverage at the most competitive price.

Call to Action: Contact your insurance agent or use online comparison tools to compare rates and ensure you're getting the best possible deal on your California auto insurance. Don't wait until your renewal; proactive planning can save you money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will State Farm's Emergency Rate Hike Affect Your California Auto Insurance?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stunning Mlb Numbers 7 Key Stats After The First Half

May 18, 2025

Stunning Mlb Numbers 7 Key Stats After The First Half

May 18, 2025 -

Its A Hell Of A Gift Unraveling The Scheme Designed For Benicio Del Toro

May 18, 2025

Its A Hell Of A Gift Unraveling The Scheme Designed For Benicio Del Toro

May 18, 2025 -

Australian Sentenced To 13 Years In Russian Prison For Fighting In Ukraine

May 18, 2025

Australian Sentenced To 13 Years In Russian Prison For Fighting In Ukraine

May 18, 2025 -

Financial Instability In The Uk The Shocking Savings Gap

May 18, 2025

Financial Instability In The Uk The Shocking Savings Gap

May 18, 2025 -

Inmate Escape Caught On Camera New Orleans Jail Security Breach

May 18, 2025

Inmate Escape Caught On Camera New Orleans Jail Security Breach

May 18, 2025

Latest Posts

-

50 Cent Targets Jay Z Over Diddy Friendship A Heated Hip Hop Rivalry

May 18, 2025

50 Cent Targets Jay Z Over Diddy Friendship A Heated Hip Hop Rivalry

May 18, 2025 -

Unveiling The Cast Your Guide To Netflixs Kakegurui Anime Series

May 18, 2025

Unveiling The Cast Your Guide To Netflixs Kakegurui Anime Series

May 18, 2025 -

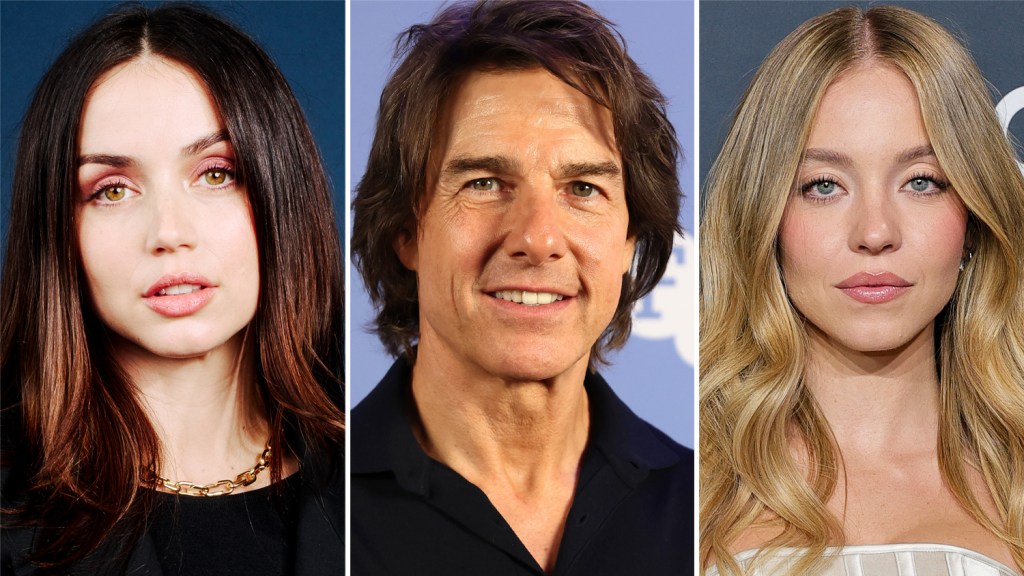

Tom Cruise And Ana De Armas Jon Chus Next Film Sydney Sweeney Also In Talks

May 18, 2025

Tom Cruise And Ana De Armas Jon Chus Next Film Sydney Sweeney Also In Talks

May 18, 2025 -

Minnesota Twins 13 Straight Wins And Counting A Shutout Streak For The Ages

May 18, 2025

Minnesota Twins 13 Straight Wins And Counting A Shutout Streak For The Ages

May 18, 2025 -

Exclusive Interview Jeffrey Dean Morgan Discusses Destination X And His Career

May 18, 2025

Exclusive Interview Jeffrey Dean Morgan Discusses Destination X And His Career

May 18, 2025