Will You Qualify? A Guide To The New Car Loan Interest Deduction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Will You Qualify? A Guide to the New Car Loan Interest Deduction

Are you dreaming of a new car but worried about the cost? The prospect of financing a vehicle can be daunting, but what if we told you there might be a way to lessen the financial burden? Recent changes to tax laws may introduce a new car loan interest deduction, potentially saving you thousands. But will you qualify? This guide breaks down everything you need to know.

The possibility of a car loan interest deduction is exciting, but it's crucial to understand the complexities and eligibility requirements. Unlike mortgage interest, which typically enjoys broader deductibility, car loan interest deductions are often more limited. Let's delve into the specifics.

Understanding the Potential Deduction:

The current tax code doesn't explicitly offer a blanket deduction for car loan interest. However, certain scenarios might allow for deductions. This usually involves situations where the car loan is used for business purposes. For example:

-

Business Use: If you use your vehicle predominantly for business, a portion of the interest paid on your car loan might be deductible as a business expense. This requires meticulous record-keeping to track business mileage versus personal use. The IRS scrutinizes these claims closely, so accurate documentation is paramount. Consult a tax professional for guidance on proper record-keeping methods.

-

Self-Employed Individuals: Self-employed individuals often have more flexibility in claiming business-related expenses. A car used extensively for business purposes – deliveries, client visits, etc. – may allow for a larger deduction than for someone using the vehicle solely for commuting.

-

Limited Deductibility: Even if you qualify for a deduction, it's important to remember that it's likely to be limited. This means you won't be able to deduct the entire interest amount. The deductibility is usually tied to the percentage of business use.

What Documents Do You Need?

To successfully claim a deduction, you'll need impeccable documentation. This typically includes:

- Loan Agreement: This document clearly outlines the interest paid throughout the year.

- Mileage Log: A detailed record of business miles versus personal miles driven. This is critical for determining the percentage of business use. Consider using mileage tracking apps for accuracy and ease of record-keeping.

- Tax Forms: Ensure you have all the necessary tax forms to report the deduction accurately.

Seeking Professional Advice:

Navigating tax laws can be complicated. The information provided here is for general guidance only and doesn't constitute financial or tax advice. It's highly recommended to consult with a qualified tax advisor or accountant. They can assess your specific financial situation and advise you on the best course of action. They can also help you understand any potential changes in tax laws that may impact your eligibility.

Key Considerations:

- Always keep accurate records: Thorough documentation is your best defense if the IRS audits your return.

- Consult a professional: Don't hesitate to seek professional help; it's worth the investment for peace of mind.

- Stay updated on tax laws: Tax laws can change, so stay informed about any updates that might affect your eligibility.

Conclusion:

While a comprehensive car loan interest deduction might not be readily available, specific circumstances, particularly business use, may allow for deductions. Careful planning, meticulous record-keeping, and professional guidance are essential for maximizing potential tax savings. Don't rely solely on this article; consult a tax professional to determine your eligibility and optimize your tax strategy. Remember to explore other potential tax benefits to reduce your overall tax burden. Learn more about [link to relevant IRS website or reputable financial resource].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Will You Qualify? A Guide To The New Car Loan Interest Deduction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Millions Of Homeowners To Experience Increased Mortgage Payments

Jul 11, 2025

Millions Of Homeowners To Experience Increased Mortgage Payments

Jul 11, 2025 -

Whos Eligible For The Updated Car Loan Interest Deduction A Comprehensive Guide

Jul 11, 2025

Whos Eligible For The Updated Car Loan Interest Deduction A Comprehensive Guide

Jul 11, 2025 -

Bidens Doctor Rejects Gop Inquiry Into Trumps Mental Health

Jul 11, 2025

Bidens Doctor Rejects Gop Inquiry Into Trumps Mental Health

Jul 11, 2025 -

Rising Interest Rates Impact On Millions Of Mortgage Holders

Jul 11, 2025

Rising Interest Rates Impact On Millions Of Mortgage Holders

Jul 11, 2025 -

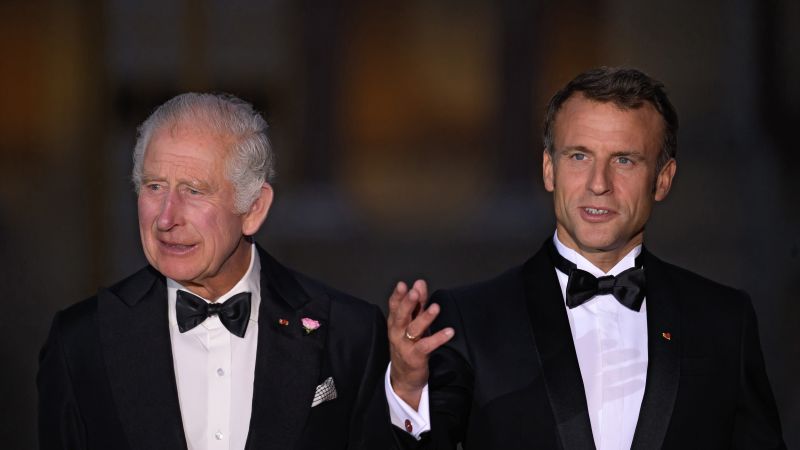

Royal Diplomacy King Charles And Macrons Bid To Strengthen Uk France Bonds

Jul 11, 2025

Royal Diplomacy King Charles And Macrons Bid To Strengthen Uk France Bonds

Jul 11, 2025

Latest Posts

-

Financial Inclusion Debate Rachel Reeves And The Saver Investor Divide

Jul 17, 2025

Financial Inclusion Debate Rachel Reeves And The Saver Investor Divide

Jul 17, 2025 -

House Of The Dragons Emmy Snub Did The Prequel Fail To Impress

Jul 17, 2025

House Of The Dragons Emmy Snub Did The Prequel Fail To Impress

Jul 17, 2025 -

De Chambeau Reveals Why Your Local Public Course Is Surprisingly Difficult

Jul 17, 2025

De Chambeau Reveals Why Your Local Public Course Is Surprisingly Difficult

Jul 17, 2025 -

Physician Associates Time For A New Job Title

Jul 17, 2025

Physician Associates Time For A New Job Title

Jul 17, 2025 -

Check Your Deodorant Over 67 000 Units Recalled From Walmart Dollar Tree And Amazon

Jul 17, 2025

Check Your Deodorant Over 67 000 Units Recalled From Walmart Dollar Tree And Amazon

Jul 17, 2025