$200 Million Pours Into Ethereum Funds Following Pectra Upgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$200 Million Floodgates Open: Ethereum Funds Surge After Shanghai Upgrade

The Ethereum network is experiencing a significant influx of capital following the highly anticipated Shanghai upgrade, with over $200 million pouring into various Ethereum-focused investment funds in just the first week. This dramatic surge highlights growing investor confidence in the network's future and the potential of staked ETH.

The Shanghai upgrade, completed on April 12th, 2023, marked a pivotal moment for Ethereum. For the first time, users could withdraw their staked Ether (ETH) along with accumulated staking rewards. This long-awaited feature addressed a key concern for many investors who had been hesitant to stake their ETH due to the previously illiquid nature of their holdings. This unlocking of staked ETH has unlocked a wave of new investment opportunities.

The Impact of Unlocking Staked ETH:

Before the Shanghai upgrade, the process of staking ETH involved locking it up for an indefinite period. While earning staking rewards, investors couldn't access their principal. This liquidity constraint limited the appeal of staking for some. The upgrade fundamentally changed this dynamic. Now, investors can participate in staking, knowing they can access their funds when needed, boosting participation and attracting new capital.

- Increased Liquidity: The ability to withdraw staked ETH dramatically improves liquidity within the Ethereum ecosystem. This encourages further investment and participation in decentralized finance (DeFi) applications built on the Ethereum network.

- Boosted Investor Confidence: The successful and seamless execution of the Shanghai upgrade has significantly boosted investor confidence. This is reflected in the substantial increase in investment in Ethereum funds.

- Enhanced Network Security: With increased participation in staking, the security of the Ethereum network is further strengthened, making it even more resilient against potential attacks.

Where is the Money Going?

The $200 million influx is not concentrated in a single fund, but rather spread across a range of investment vehicles, including:

- Index Funds: These funds offer diversified exposure to the broader Ethereum ecosystem, including various DeFi tokens and related projects.

- Staking Funds: Funds specifically focused on ETH staking are seeing a considerable increase in assets under management (AUM), as investors seek to benefit from staking rewards while maintaining liquidity.

- Liquid Staking Protocols: Projects such as Lido and Rocket Pool, which offer liquid staking solutions, have also experienced a significant increase in user deposits. These protocols allow users to stake their ETH and receive liquid tokens that can be used elsewhere in the DeFi ecosystem. (Learn more about liquid staking ).

Looking Ahead:

The influx of $200 million is a strong indicator of the positive sentiment surrounding Ethereum following the Shanghai upgrade. As more investors become comfortable with the increased liquidity and the enhanced security of the network, we can expect further growth in the coming months. The long-term implications of this upgrade remain to be seen, but the immediate impact is clearly significant. The future of Ethereum looks bright, particularly for investors who see the value in its expanding ecosystem.

Keywords: Ethereum, Shanghai upgrade, staked ETH, ETH withdrawal, DeFi, liquid staking, cryptocurrency investment, blockchain, investor confidence, crypto market, Ethereum funds

Call to Action: Stay informed about the latest developments in the Ethereum ecosystem by following reputable news sources and participating in relevant online communities. Remember to always conduct thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $200 Million Pours Into Ethereum Funds Following Pectra Upgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pacifier Weaning When Should Your Child Stop A Parents Guide

May 21, 2025

Pacifier Weaning When Should Your Child Stop A Parents Guide

May 21, 2025 -

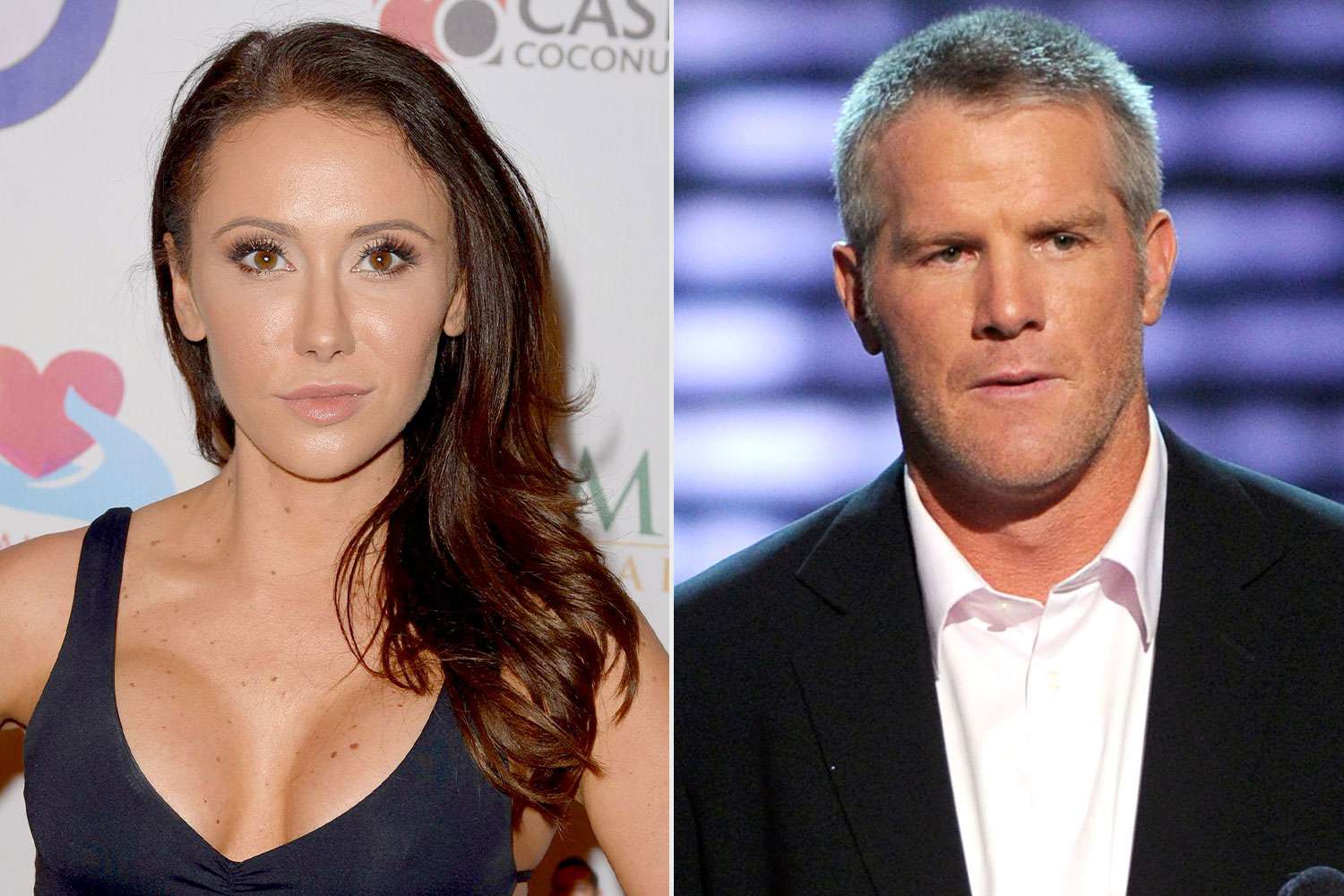

Jenn Sterger Details The Emotional Toll Of The Brett Favre Sexting Scandal

May 21, 2025

Jenn Sterger Details The Emotional Toll Of The Brett Favre Sexting Scandal

May 21, 2025 -

Institutional Money Fuels Bitcoin Etf Boom 5 Billion And Counting

May 21, 2025

Institutional Money Fuels Bitcoin Etf Boom 5 Billion And Counting

May 21, 2025 -

Railroad Bridge Accident Leaves Two Adults Dead Children Injured And Missing

May 21, 2025

Railroad Bridge Accident Leaves Two Adults Dead Children Injured And Missing

May 21, 2025 -

Federal Reserves 2025 Rate Cut Projection Implications For U S Treasury Market

May 21, 2025

Federal Reserves 2025 Rate Cut Projection Implications For U S Treasury Market

May 21, 2025

Latest Posts

-

Down To The Wire The Final Hours Of Eu Uk Brexit Negotiations

May 21, 2025

Down To The Wire The Final Hours Of Eu Uk Brexit Negotiations

May 21, 2025 -

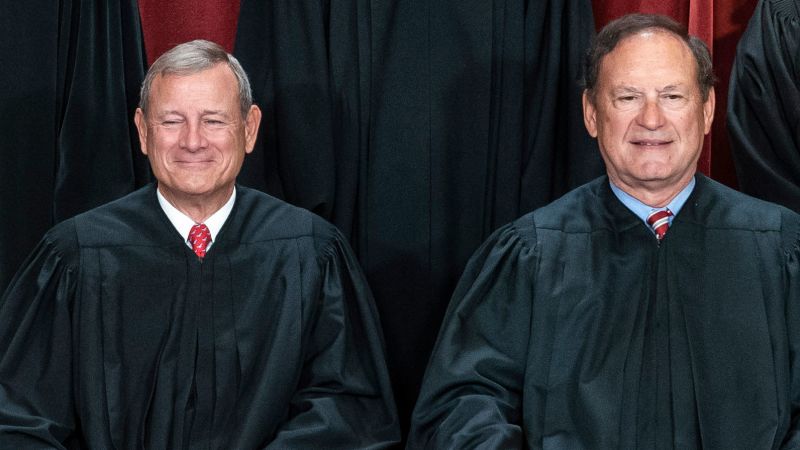

Supreme Court Justices Alito And Roberts A 20 Year Retrospective

May 21, 2025

Supreme Court Justices Alito And Roberts A 20 Year Retrospective

May 21, 2025 -

Elite Swimmers Harrowing Account Emotional Distress From Coachs Harsh Methods

May 21, 2025

Elite Swimmers Harrowing Account Emotional Distress From Coachs Harsh Methods

May 21, 2025 -

Watch A Powerful Wwi Drama With Daniel Craig Cillian Murphy And Tom Hardy

May 21, 2025

Watch A Powerful Wwi Drama With Daniel Craig Cillian Murphy And Tom Hardy

May 21, 2025 -

5 B Poured Into Bitcoin Etfs Whats Behind The Investment Boom

May 21, 2025

5 B Poured Into Bitcoin Etfs Whats Behind The Investment Boom

May 21, 2025