$236.55 Million Investment: Two Sigma's Bet On Bank Of America (BAC)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

$236.55 Million Investment: Two Sigma's Big Bet on Bank of America (BAC)

Two Sigma, the quantitative investment firm, has made a significant move, revealing a substantial stake in Bank of America (BAC). This $236.55 million investment signals a vote of confidence in the financial giant and sparks intrigue within the market. The move highlights growing optimism surrounding the banking sector, particularly amidst recent economic uncertainty. But what does this investment mean for Bank of America, and what are the potential implications for investors?

This article delves into the details of Two Sigma's investment, analyzing its potential motivations and the broader implications for Bank of America's future.

Two Sigma's Strategic Move: A Deeper Dive

Two Sigma, known for its data-driven investment strategies, isn't typically associated with such large, publicly declared stakes in individual companies. Their investment in BAC, reported in recent regulatory filings, represents a significant departure from their usual investment profile, suggesting a strong belief in Bank of America's long-term prospects. This sizable investment, totaling $236.55 million, underscores the firm's confidence in BAC's ability to navigate the current economic landscape and deliver robust returns.

This isn't just a passive investment; it signifies Two Sigma's belief in Bank of America's potential for growth and profitability. Their sophisticated quantitative models likely identified compelling undervalued aspects of BAC, possibly including:

- Strong Earnings Potential: Bank of America has consistently demonstrated strong earnings performance, driven by factors such as rising interest rates and increased loan demand.

- Efficient Cost Management: The bank has been actively working on improving its efficiency and reducing costs, which are crucial for profitability in the financial services sector.

- Robust Risk Management: Two Sigma's investment might also reflect confidence in Bank of America's risk management capabilities, particularly important in the current volatile market.

- Technological Advancements: Bank of America's investments in technology and digital banking services could have played a role in attracting Two Sigma’s attention.

What This Means for Bank of America (BAC) Stock

Two Sigma's investment provides a significant boost to Bank of America's stock. The substantial financial commitment acts as a powerful endorsement, potentially influencing other investors to reconsider their positions and potentially increasing demand for BAC shares. This increased demand can lead to higher stock prices, benefiting existing shareholders.

However, investors should always remember that stock prices fluctuate, and past performance is not indicative of future results. While Two Sigma's investment is positive news, it's crucial to conduct thorough research before making any investment decisions. Consider consulting a financial advisor to assess your individual risk tolerance and investment goals.

The Broader Implications for the Banking Sector

Two Sigma's substantial investment in Bank of America could also have wider implications for the banking sector as a whole. It could be viewed as a positive indicator, signaling renewed confidence in the industry’s future. This could lead to increased investor interest in other major banking institutions. However, it's important to note that the banking sector remains subject to various economic and regulatory factors that could impact performance.

Conclusion: A Positive Signal, But Proceed with Caution

Two Sigma's $236.55 million investment in Bank of America is undoubtedly a significant development. It represents a strong vote of confidence in BAC's future performance and potentially offers a positive outlook for the broader banking sector. However, investors should conduct thorough research and seek professional financial advice before making any investment decisions related to Bank of America or other financial institutions. The market remains dynamic, and careful consideration of individual risk tolerance is paramount.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on $236.55 Million Investment: Two Sigma's Bet On Bank Of America (BAC). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

73 Arrests Multiple Stabbings Mar Memorial Day Weekend In Coastal Town

May 27, 2025

73 Arrests Multiple Stabbings Mar Memorial Day Weekend In Coastal Town

May 27, 2025 -

Why I M Keeping My Amazon Shares After A Huge 560 Profit

May 27, 2025

Why I M Keeping My Amazon Shares After A Huge 560 Profit

May 27, 2025 -

From Oar To Hope A Fathers 2 2 Million Fundraising Challenge

May 27, 2025

From Oar To Hope A Fathers 2 2 Million Fundraising Challenge

May 27, 2025 -

George Floyd Cherished Memories Shared By Family And Friends

May 27, 2025

George Floyd Cherished Memories Shared By Family And Friends

May 27, 2025 -

560 Return On Amazon A Case Study In Long Term Stock Holding

May 27, 2025

560 Return On Amazon A Case Study In Long Term Stock Holding

May 27, 2025

Latest Posts

-

Jerusalem Explodes Ultra Nationalist March Triggers Violent Confrontations

May 28, 2025

Jerusalem Explodes Ultra Nationalist March Triggers Violent Confrontations

May 28, 2025 -

Propane Leak Causes Truck Explosion Multiple Homes Damaged

May 28, 2025

Propane Leak Causes Truck Explosion Multiple Homes Damaged

May 28, 2025 -

Trumps Furious Attack On Harvard Dissecting The Maga Fundraising Fraud

May 28, 2025

Trumps Furious Attack On Harvard Dissecting The Maga Fundraising Fraud

May 28, 2025 -

Liverpool Fc Parade Key Facts And Ongoing Investigations

May 28, 2025

Liverpool Fc Parade Key Facts And Ongoing Investigations

May 28, 2025 -

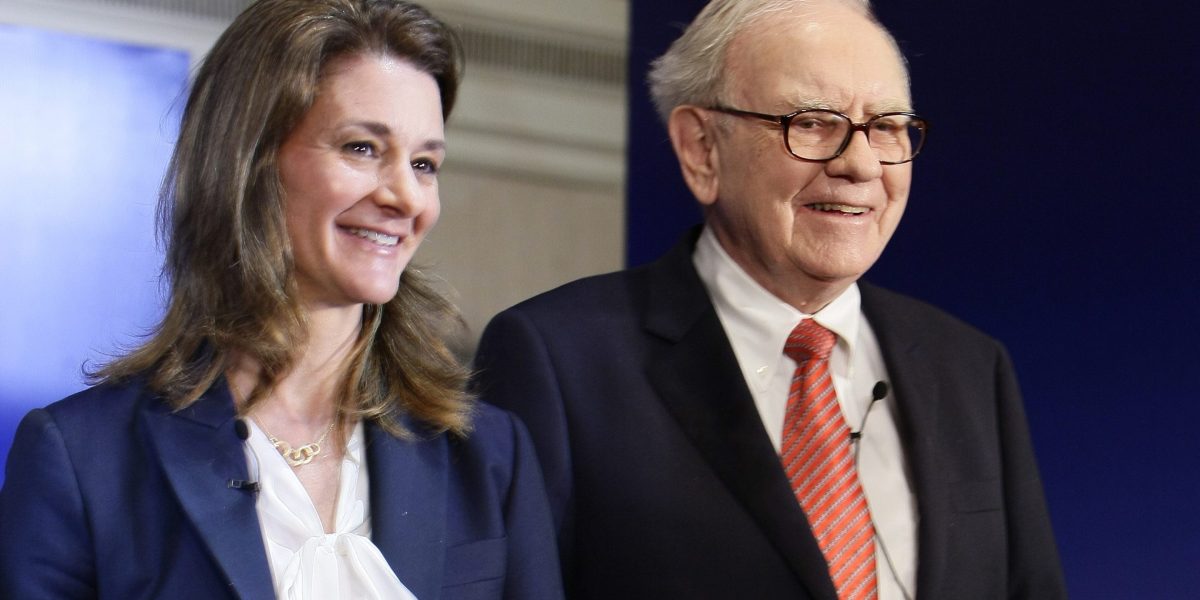

600 Billion Pledge The Future Of Billionaire Philanthropy After Gates And Buffett

May 28, 2025

600 Billion Pledge The Future Of Billionaire Philanthropy After Gates And Buffett

May 28, 2025