5% 30-Year Treasury Yield: The Aftermath Of Moody's US Rating Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

5% 30-Year Treasury Yield: Navigating the Aftermath of Moody's US Rating Cut

The financial world is reeling after Moody's Investors Service downgraded the United States' credit rating, a move that sent shockwaves through global markets. One immediate consequence? The 30-year Treasury yield climbed above 5%, a significant milestone with broad implications for investors and the economy. This article delves into the aftermath of Moody's decision and explores the meaning of this 5% yield, its potential impact, and what it signifies for the future.

Moody's Downgrade: A Deeper Dive

Moody's cut the US government's credit rating from Aaa to Aa1, citing concerns about the country's fiscal trajectory and the persistent political gridlock hindering efforts to address the rising national debt. This decision, while not entirely unexpected, triggered significant market volatility. The downgrade highlights growing anxieties about the US's ability to manage its debt load over the long term, impacting investor confidence and influencing borrowing costs. [Link to Moody's press release].

The Significance of the 5% 30-Year Treasury Yield

The surge in the 30-year Treasury yield above 5% is a key indicator of investor sentiment. This yield reflects the return investors expect for lending money to the US government for three decades. A higher yield typically suggests increased risk perception – in this case, stemming from the Moody's downgrade and concerns about rising inflation and interest rates.

-

Increased Borrowing Costs: This higher yield translates to increased borrowing costs for the US government, making it more expensive to finance its debt. This could lead to further pressure on the federal budget.

-

Impact on Mortgages and other loans: The rise in long-term Treasury yields often influences mortgage rates and other long-term loan rates. Homebuyers and businesses might face higher borrowing costs, potentially slowing economic growth.

-

Investor Flight to Safety (or not): While some might view Treasuries as a safe haven during times of uncertainty, the rising yield suggests that some investors are less confident in the long-term stability of US government debt.

What Does This Mean for the Future?

The long-term consequences of Moody's downgrade and the 5% 30-year Treasury yield remain to be seen. Several factors will play a crucial role in shaping the future economic landscape:

-

Federal Reserve Policy: The Federal Reserve's future actions on interest rates will heavily influence market conditions. Balancing inflation control with economic growth will be a crucial challenge.

-

Political Landscape: The ability of US lawmakers to address the nation's fiscal challenges will be pivotal. Reaching bipartisan consensus on deficit reduction measures could restore some investor confidence.

-

Global Economic Conditions: Global economic uncertainty could further exacerbate market volatility, impacting the demand for US Treasuries.

Navigating the Uncertainty:

For investors, this period of uncertainty necessitates a cautious approach. Diversification remains crucial, with a careful assessment of risk tolerance and investment goals. Consulting with a financial advisor can provide personalized guidance in navigating this complex market environment.

Conclusion:

The 5% 30-year Treasury yield marks a significant turning point in the wake of Moody's credit rating downgrade. While the immediate impact is apparent, the long-term consequences will depend on the interplay of various economic and political factors. Staying informed and adapting investment strategies based on the evolving situation is paramount for investors and businesses alike. Remember to consult with a financial professional for personalized advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on 5% 30-Year Treasury Yield: The Aftermath Of Moody's US Rating Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Uk Driverless Cars 2027 Deadline Looms Uber Challenges The Timeline

May 20, 2025

Uk Driverless Cars 2027 Deadline Looms Uber Challenges The Timeline

May 20, 2025 -

Juego De Voces 2025 Quienes Seran Los Invitados Especiales De La Final

May 20, 2025

Juego De Voces 2025 Quienes Seran Los Invitados Especiales De La Final

May 20, 2025 -

Bali Seeks International Help To Improve Tourist Conduct

May 20, 2025

Bali Seeks International Help To Improve Tourist Conduct

May 20, 2025 -

Slight Decrease In U S Treasury Yields Following Feds Rate Cut Projection

May 20, 2025

Slight Decrease In U S Treasury Yields Following Feds Rate Cut Projection

May 20, 2025 -

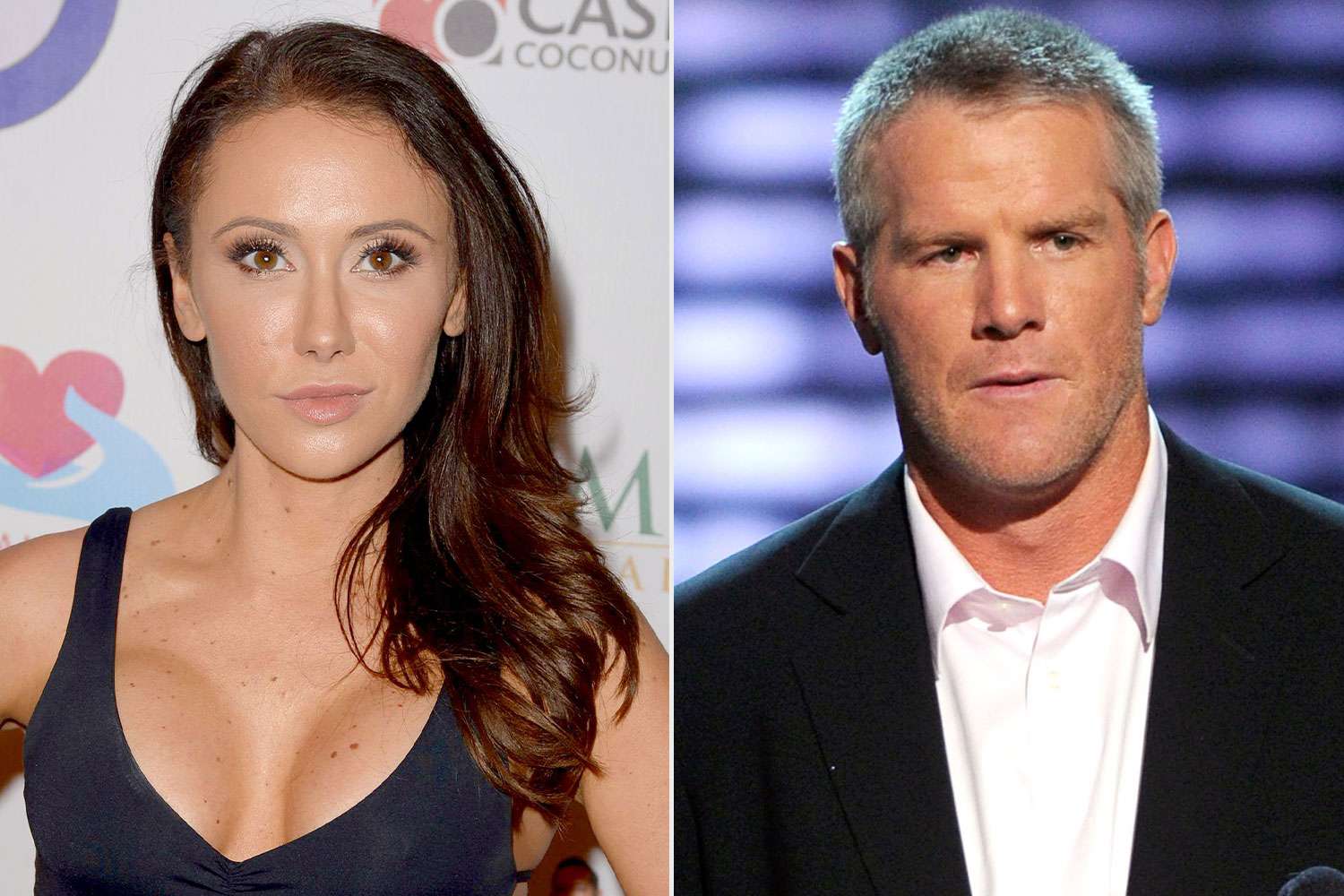

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On Mistreatment

May 20, 2025

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On Mistreatment

May 20, 2025

Latest Posts

-

Violence Against Women Recent Murders Of Colombian Model And Mexican Influencer Highlight Urgent Need For Change

May 20, 2025

Violence Against Women Recent Murders Of Colombian Model And Mexican Influencer Highlight Urgent Need For Change

May 20, 2025 -

Buy Now Pay Later Enhanced Consumer Protections Under New Rules

May 20, 2025

Buy Now Pay Later Enhanced Consumer Protections Under New Rules

May 20, 2025 -

Uber Claims Driverless Car Readiness Uk Rollout Unlikely Before 2027

May 20, 2025

Uber Claims Driverless Car Readiness Uk Rollout Unlikely Before 2027

May 20, 2025 -

Post Pectra Upgrade Ethereum Attracts 200 Million In New Investments

May 20, 2025

Post Pectra Upgrade Ethereum Attracts 200 Million In New Investments

May 20, 2025 -

10 Minutes Without A Pilot Lufthansa Flight Incident Report Highlights Co Pilots Collapse

May 20, 2025

10 Minutes Without A Pilot Lufthansa Flight Incident Report Highlights Co Pilots Collapse

May 20, 2025