Analyzing Amazon's (AMZN) Stock Performance And Future Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Amazon's (AMZN) Stock Performance and Future Outlook: A Deep Dive

Amazon (AMZN), a titan of e-commerce and cloud computing, has experienced a rollercoaster ride in recent years. While its dominance in online retail remains undeniable, analyzing its stock performance and predicting its future outlook requires a nuanced understanding of its diverse business segments and the broader economic landscape. This article delves into the key factors shaping AMZN's trajectory, providing insights for investors and market observers alike.

Amazon's Recent Stock Performance: A Mixed Bag

Amazon's stock price has shown significant volatility. While it experienced substantial growth in the early stages of the pandemic, fueled by increased online shopping, recent performance has been more moderate. Several factors have contributed to this: increased competition, macroeconomic headwinds, and concerns about profitability in certain sectors. Understanding these challenges is crucial for evaluating AMZN's future potential.

Key Factors Influencing Amazon's Stock:

-

E-commerce Dominance, but Growing Competition: While Amazon still commands a significant share of the e-commerce market, competition from players like Walmart, Shopify, and increasingly sophisticated direct-to-consumer brands is intensifying. This necessitates ongoing investment in logistics, technology, and customer experience to maintain its edge.

-

AWS: The Steady Growth Engine: Amazon Web Services (AWS), Amazon's cloud computing arm, remains a powerhouse, generating significant revenue and profits. Its consistent growth provides a crucial buffer against fluctuations in other segments. However, increasing competition in the cloud space from Microsoft Azure and Google Cloud Platform requires continuous innovation and investment.

-

Advertising Revenue: A Rising Star: Amazon's advertising business is rapidly expanding, capitalizing on its massive user base and detailed customer data. This segment presents a significant growth opportunity and contributes substantially to overall profitability.

-

Macroeconomic Factors and Inflation: Rising inflation and interest rates have impacted consumer spending and overall economic sentiment, affecting Amazon's sales growth and impacting investor confidence. Navigating this macroeconomic environment is key to future success.

-

Profitability Concerns: Investors are closely scrutinizing Amazon's profitability across its various segments. While AWS consistently delivers strong margins, other areas, such as grocery delivery and physical retail, face ongoing challenges in achieving profitability.

Amazon's Future Outlook: Opportunities and Challenges

Despite the challenges, Amazon possesses several compelling advantages:

-

Brand Recognition and Loyalty: Amazon enjoys unparalleled brand recognition and customer loyalty, providing a strong foundation for future growth.

-

Technological Innovation: Amazon's commitment to research and development fuels innovation across its various businesses, giving it a competitive edge.

-

Strategic Acquisitions: Strategic acquisitions can help expand Amazon's reach into new markets and enhance its existing offerings. Past acquisitions illustrate their ability to integrate and scale new businesses.

However, significant challenges remain:

-

Maintaining Market Share: Sustaining its market dominance in a fiercely competitive landscape requires continuous adaptation and investment.

-

Labor Relations: Managing labor relations effectively is crucial, particularly in light of increasing scrutiny on worker conditions and compensation.

-

Regulatory Scrutiny: Amazon faces increasing regulatory scrutiny regarding antitrust concerns and data privacy. Navigating this complex regulatory environment is paramount.

Conclusion: A Long-Term Perspective

While Amazon's stock price may experience short-term volatility, its long-term prospects remain promising. Its diversified business model, technological prowess, and strong brand recognition provide a robust foundation for future growth. However, investors should carefully consider the challenges outlined above and adopt a long-term perspective when assessing AMZN's investment potential. Further research and monitoring of key financial indicators are recommended before making any investment decisions. Consult with a financial advisor for personalized advice.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Amazon's (AMZN) Stock Performance And Future Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analysis Of Pdd Holdings Q1 2025 Financial Performance Revenue Profitability And Growth

May 28, 2025

Analysis Of Pdd Holdings Q1 2025 Financial Performance Revenue Profitability And Growth

May 28, 2025 -

From Ultimo To Controversy The Complex Story Of Michelle Mone

May 28, 2025

From Ultimo To Controversy The Complex Story Of Michelle Mone

May 28, 2025 -

79 Years Later Remains Of Four Wwii Bomber Crew Members Recovered And Identified

May 28, 2025

79 Years Later Remains Of Four Wwii Bomber Crew Members Recovered And Identified

May 28, 2025 -

Sirius Xm Holdings Stock Performance Weighing The Risks And Rewards For Investors

May 28, 2025

Sirius Xm Holdings Stock Performance Weighing The Risks And Rewards For Investors

May 28, 2025 -

Inside Harvard Problems Progress And My Preference Over Trumps Policies

May 28, 2025

Inside Harvard Problems Progress And My Preference Over Trumps Policies

May 28, 2025

Latest Posts

-

Sloane Stephens The Physical Toll Of Professional Tennis And Arm Fatigue

Jun 01, 2025

Sloane Stephens The Physical Toll Of Professional Tennis And Arm Fatigue

Jun 01, 2025 -

Expert Predictions Djokovic Swiatek And More French Open Day 7

Jun 01, 2025

Expert Predictions Djokovic Swiatek And More French Open Day 7

Jun 01, 2025 -

Betting Odds And Analysis Zverev Vs Cobolli Griekspoor Vs Quinn At Roland Garros

Jun 01, 2025

Betting Odds And Analysis Zverev Vs Cobolli Griekspoor Vs Quinn At Roland Garros

Jun 01, 2025 -

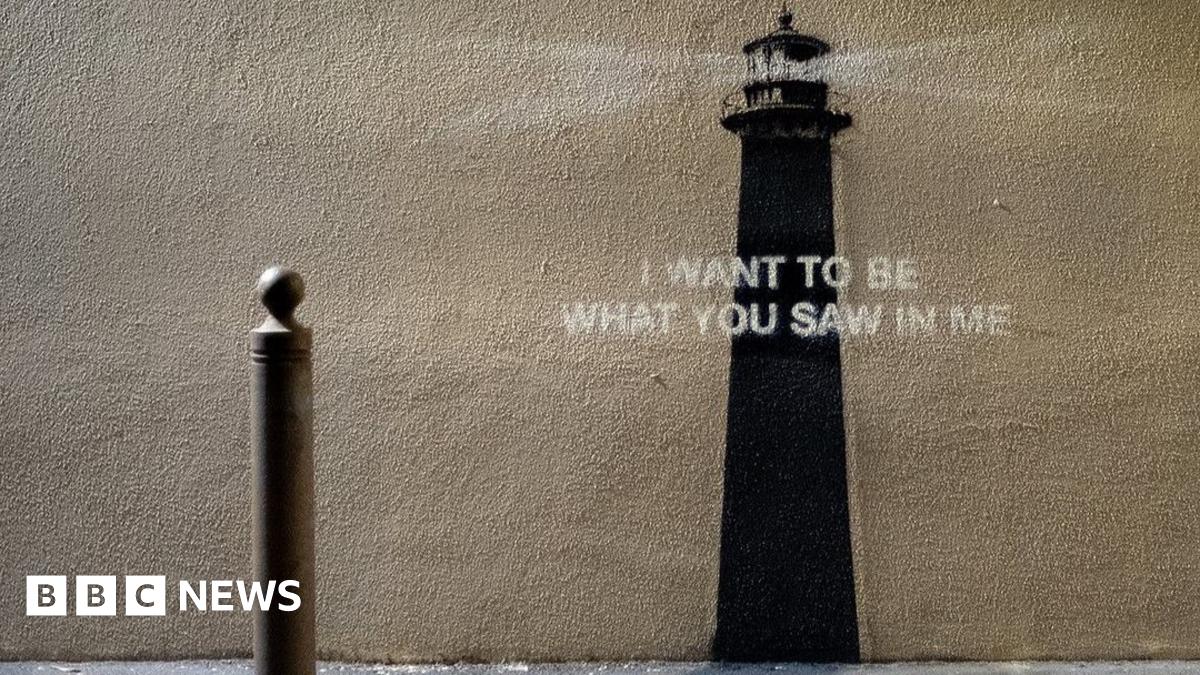

Banksy Unveils Cryptic New Piece Location A Riddle

Jun 01, 2025

Banksy Unveils Cryptic New Piece Location A Riddle

Jun 01, 2025 -

3 000 Year Old Mayan City Pyramids Canals And A Lost Civilization Revealed

Jun 01, 2025

3 000 Year Old Mayan City Pyramids Canals And A Lost Civilization Revealed

Jun 01, 2025