Billionaire CEO Sounds Alarm: Fed Actions Threaten The Economy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Billionaire CEO Sounds Alarm: Fed Actions Threaten the Economy

The aggressive interest rate hikes by the Federal Reserve are causing ripples of concern, with prominent business leaders voicing their apprehension about a potential economic downturn. One such voice belongs to [Billionaire CEO's Name], CEO of [Company Name], who recently warned that the Fed's actions could trigger a significant economic crisis. His stark warning has sent shockwaves through financial markets, prompting renewed scrutiny of the central bank's monetary policy.

The statement, made during a [mention the context - e.g., press conference, interview on CNBC], highlighted the CEO's concerns about the impact of rising interest rates on businesses and consumers alike. He argued that the Fed's current approach, aimed at curbing inflation, is overly aggressive and risks triggering a recession. This isn't just idle speculation; [Billionaire CEO's Name]'s company is a major player in [mention industry], providing a valuable perspective on the real-world effects of these policies.

<h3>Rising Interest Rates: A Double-Edged Sword</h3>

While high inflation undoubtedly poses a serious threat to economic stability, [Billionaire CEO's Name] contends that the Fed's response might be exacerbating the problem. The rapid increase in interest rates makes borrowing more expensive for businesses, hindering investment and potentially leading to job losses. This, in turn, can dampen consumer spending, further slowing economic growth.

He pointed to several key indicators to support his claim, including:

- Decreasing consumer confidence: Surveys show a decline in consumer confidence, indicating reduced willingness to spend.

- Slowing business investment: Companies are becoming more hesitant to invest in expansion projects due to higher borrowing costs.

- Rising unemployment claims: A slight but noticeable uptick in unemployment claims hints at potential job losses in the near future.

<h3>The Fed's Tightrope Walk</h3>

The Federal Reserve is walking a tightrope, attempting to tame inflation without triggering a recession. The central bank's mandate is to maintain price stability and full employment, a delicate balancing act that has become increasingly challenging in the current economic climate. Critics, including [Billionaire CEO's Name], argue that the Fed is prioritizing inflation control at the expense of economic growth and employment.

The concern isn't just limited to the US. Global markets are closely watching the Fed's moves, as interest rate hikes in the US can have a significant ripple effect on economies worldwide. This interconnectedness adds another layer of complexity to the situation.

<h3>What Lies Ahead?</h3>

The coming months will be crucial in determining the effectiveness of the Fed's policy. Economists are divided on the likely outcome, with some predicting a "soft landing" – a slowdown in growth without a full-blown recession – while others foresee a more significant economic contraction.

[Billionaire CEO's Name]'s warning serves as a powerful reminder of the potential risks associated with aggressive monetary policy. It underscores the need for careful consideration and a nuanced approach to addressing inflation, one that balances the need for price stability with the importance of maintaining economic growth and minimizing job losses. The ongoing situation calls for continued monitoring of key economic indicators and a watchful eye on the Fed's next moves.

What are your thoughts on the Fed's approach to inflation? Share your opinions in the comments below.

(Note: Replace bracketed information with accurate details. Consider adding links to relevant news articles, economic reports, and the company's website.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Billionaire CEO Sounds Alarm: Fed Actions Threaten The Economy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Onde Assistir Franca X Islandia Data Horario E Provaveis Times Das Eliminatorias

Sep 10, 2025

Onde Assistir Franca X Islandia Data Horario E Provaveis Times Das Eliminatorias

Sep 10, 2025 -

Uk Government Explores Visa Suspension For Countries Without Deportation Deals

Sep 10, 2025

Uk Government Explores Visa Suspension For Countries Without Deportation Deals

Sep 10, 2025 -

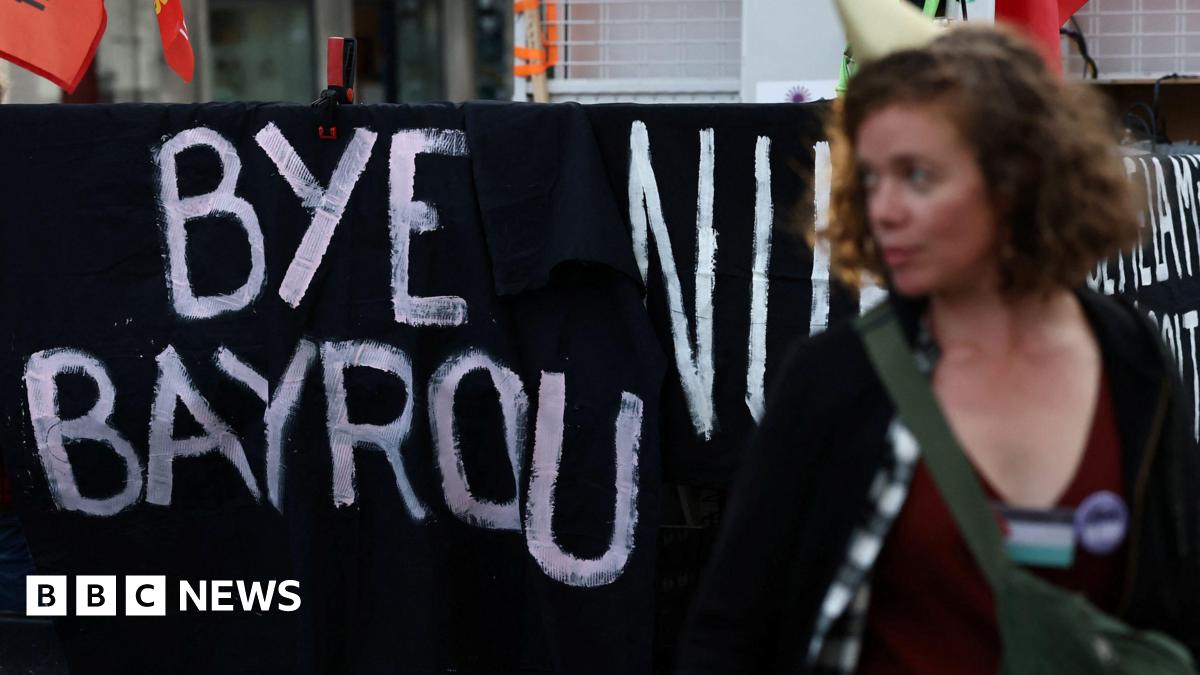

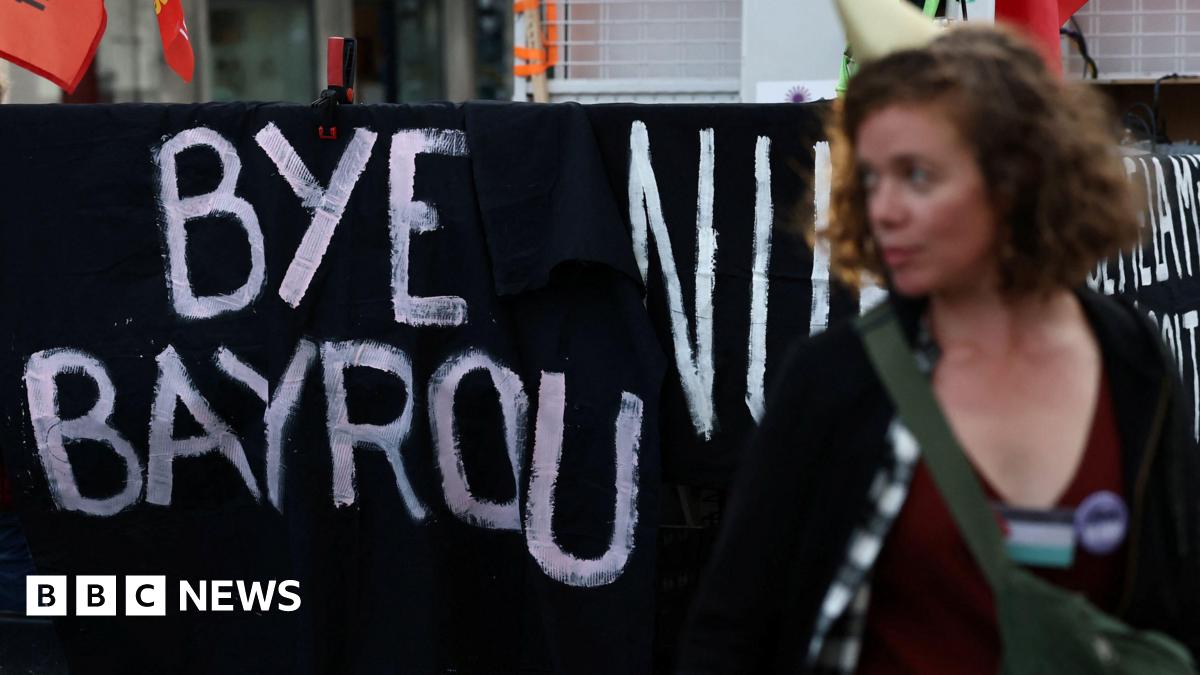

Instability Rocks France Parliaments No Confidence Vote Topples Prime Minister

Sep 10, 2025

Instability Rocks France Parliaments No Confidence Vote Topples Prime Minister

Sep 10, 2025 -

Instability In France Aftermath Of Prime Ministers Dismissal

Sep 10, 2025

Instability In France Aftermath Of Prime Ministers Dismissal

Sep 10, 2025 -

Budapeste Aguarda A Grande Expetativa Pelo Jogo De Cristiano Ronaldo

Sep 10, 2025

Budapeste Aguarda A Grande Expetativa Pelo Jogo De Cristiano Ronaldo

Sep 10, 2025

Latest Posts

-

Will Trump Send National Guard To Chicago Latest News And Analysis

Sep 10, 2025

Will Trump Send National Guard To Chicago Latest News And Analysis

Sep 10, 2025 -

Thunder Secure Giddeys Future Impact On Okcs Roster And Playoff Hopes

Sep 10, 2025

Thunder Secure Giddeys Future Impact On Okcs Roster And Playoff Hopes

Sep 10, 2025 -

French Parliament Votes Out Prime Minister Triggering Political Uncertainty

Sep 10, 2025

French Parliament Votes Out Prime Minister Triggering Political Uncertainty

Sep 10, 2025 -

Fed Under Fire Prominent Ceo Issues Stark Warning On Economic Future

Sep 10, 2025

Fed Under Fire Prominent Ceo Issues Stark Warning On Economic Future

Sep 10, 2025 -

Billionaire Ceo Feds Monetary Policy Is A Dangerous Attack

Sep 10, 2025

Billionaire Ceo Feds Monetary Policy Is A Dangerous Attack

Sep 10, 2025