Bitcoin ETF Investment: $5 Billion+ Influx And Future Market Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investment: A $5 Billion+ Influx Reshapes the Future Market Outlook

The world of finance is buzzing. The recent approval of the first Bitcoin exchange-traded fund (ETF) in the United States has unleashed a tidal wave of investment, exceeding $5 billion in inflows and fundamentally altering the market landscape. This unprecedented surge signifies a pivotal moment for Bitcoin's mainstream adoption and presents both exciting opportunities and potential challenges for investors.

A Historic Milestone: The Approval of Bitcoin ETFs

For years, the cryptocurrency community eagerly awaited regulatory approval for a Bitcoin ETF. This landmark decision by the Securities and Exchange Commission (SEC) finally opened the doors for institutional and individual investors to access Bitcoin through a familiar and regulated investment vehicle. This significantly reduces the barriers to entry, making Bitcoin more accessible than ever before. The immediate impact has been dramatic, with billions pouring into these new ETFs.

$5 Billion+ and Counting: Unprecedented Investment Influx

The sheer scale of investment is staggering. Industry analysts report that inflows into Bitcoin ETFs have already surpassed $5 billion in a relatively short period. This massive influx of capital represents a significant vote of confidence in Bitcoin's long-term potential as a store of value and a hedge against inflation. This level of investment signifies a shift in the perception of Bitcoin, moving it further into the mainstream financial system.

What Drives This Investment Boom?

Several factors contribute to this explosive growth:

- Increased Regulatory Clarity: The SEC's approval provides a much-needed stamp of legitimacy, reassuring institutional investors concerned about regulatory uncertainty.

- Ease of Access: ETFs offer a convenient and regulated pathway for investment, appealing to both seasoned investors and newcomers.

- Diversification: Bitcoin ETFs provide a way to diversify investment portfolios, offering exposure to a burgeoning asset class.

- Inflation Hedge: Many investors see Bitcoin as a potential hedge against inflation, particularly in times of economic uncertainty.

Future Market Outlook: Navigating the Uncertainties

While the current outlook is undeniably positive, navigating the future requires careful consideration. The price volatility inherent in Bitcoin remains a significant risk. Moreover, regulatory landscapes can shift, potentially impacting the performance of Bitcoin ETFs.

Potential Challenges and Risks:

- Volatility: Bitcoin's price remains notoriously volatile. Investors should be prepared for potential price swings.

- Regulatory Changes: Future regulatory decisions could impact the ETF market, introducing uncertainty.

- Market Manipulation: The potential for market manipulation, though mitigated by the regulated ETF structure, remains a concern.

Opportunities and Growth Potential:

Despite the risks, the long-term potential for Bitcoin and its associated ETFs remains substantial. Continued institutional adoption, increased regulatory clarity, and growing technological advancements all point towards a potentially bright future.

Conclusion: A New Era for Bitcoin Investment?

The $5 billion+ influx into Bitcoin ETFs marks a significant turning point. While challenges remain, the approval and subsequent investment demonstrate a growing acceptance of Bitcoin within the mainstream financial world. This opens exciting possibilities for future growth, but investors should remain vigilant and conduct thorough due diligence before investing in this volatile yet potentially rewarding asset class. Learn more about and stay updated on the latest market trends.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investment: $5 Billion+ Influx And Future Market Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

La Final Perdida De America Un Analisis Del Enfrentamiento Con Antonio Mohamed

May 20, 2025

La Final Perdida De America Un Analisis Del Enfrentamiento Con Antonio Mohamed

May 20, 2025 -

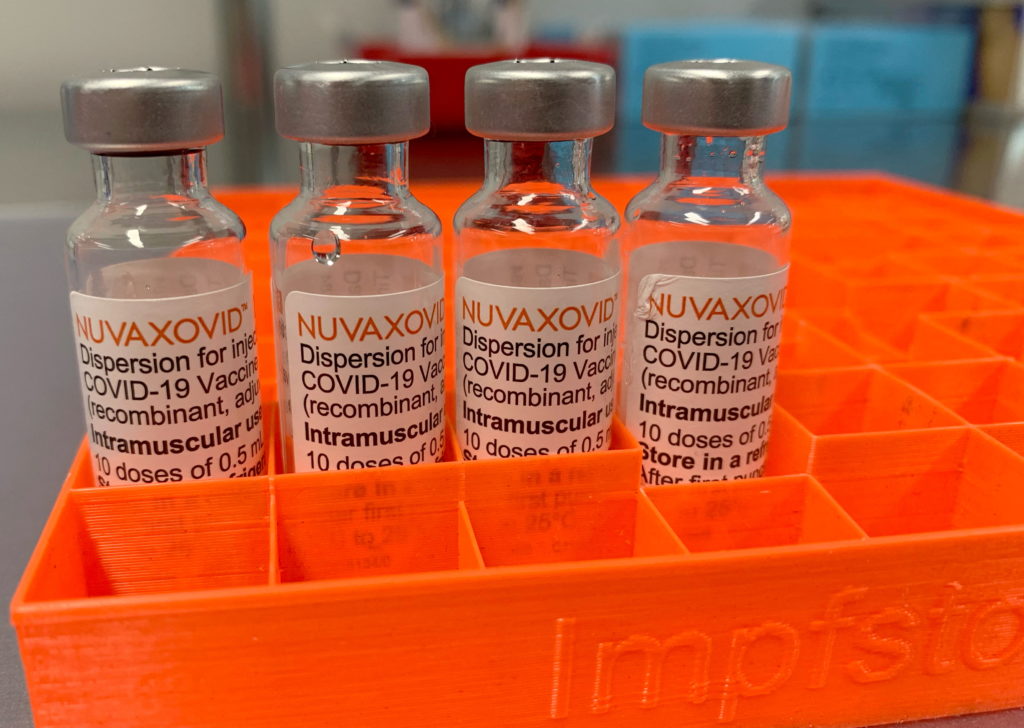

Novavax Covid 19 Vaccine Gets Fda Nod With Unconventional Usage Constraints

May 20, 2025

Novavax Covid 19 Vaccine Gets Fda Nod With Unconventional Usage Constraints

May 20, 2025 -

Brett Favres Fall A J Perez Discusses Threats And The Impact On Espns Untold

May 20, 2025

Brett Favres Fall A J Perez Discusses Threats And The Impact On Espns Untold

May 20, 2025 -

Saturday Mlb Home Run Picks Free Predictions And Expert Analysis For May 17th

May 20, 2025

Saturday Mlb Home Run Picks Free Predictions And Expert Analysis For May 17th

May 20, 2025 -

Joe Bidens Health Update Prostate Cancer Diagnosis And Next Steps

May 20, 2025

Joe Bidens Health Update Prostate Cancer Diagnosis And Next Steps

May 20, 2025

Latest Posts

-

Lineker Exit Bbc Faces Fallout After Match Of The Day Controversy

May 20, 2025

Lineker Exit Bbc Faces Fallout After Match Of The Day Controversy

May 20, 2025 -

Tense Standoff Eu Brexit Negotiations Enter Final Fraught Stages

May 20, 2025

Tense Standoff Eu Brexit Negotiations Enter Final Fraught Stages

May 20, 2025 -

Cyberattack Exposes Sensitive Data Including Criminal Records From Legal Aid

May 20, 2025

Cyberattack Exposes Sensitive Data Including Criminal Records From Legal Aid

May 20, 2025 -

U S Treasury Yield Slip Federal Reserves 2025 Rate Cut Outlook

May 20, 2025

U S Treasury Yield Slip Federal Reserves 2025 Rate Cut Outlook

May 20, 2025 -

Should Your Child Stop Sucking Their Thumb Or Pacifier Expert Advice

May 20, 2025

Should Your Child Stop Sucking Their Thumb Or Pacifier Expert Advice

May 20, 2025