Bitcoin ETF Investment Soars Past $5 Billion: Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin ETF Investment Soars Past $5 Billion: Market Analysis

The long-awaited arrival of Bitcoin ETFs in the US has sent shockwaves through the financial world, with investment exceeding $5 billion in a remarkably short timeframe. This unprecedented surge signals a significant shift in investor sentiment and opens exciting new avenues for cryptocurrency adoption.

The approval of the first Bitcoin futures ETFs by the Securities and Exchange Commission (SEC) marked a pivotal moment for the crypto industry. This landmark decision, after years of deliberation and debate, paved the way for mainstream institutional investors to gain exposure to Bitcoin without directly holding the asset. This lowered the barrier to entry significantly, attracting a wave of new investors seeking diversification and potential high returns.

What Fueled This Explosive Growth?

Several factors contributed to the rapid increase in Bitcoin ETF investment, exceeding expectations:

-

Increased Institutional Interest: The availability of Bitcoin ETFs through established brokerage platforms has made it significantly easier for institutional investors, such as hedge funds and pension funds, to allocate capital to Bitcoin. This influx of institutional money has been a major driver of the surge.

-

Regulatory Clarity (Sort Of): While the SEC's approval wasn't a blanket endorsement of spot Bitcoin ETFs, the green light for futures-based ETFs provided a much-needed sense of regulatory clarity, encouraging more conservative investors to enter the market. The ongoing debate surrounding spot Bitcoin ETFs adds further intrigue and potential for future growth.

-

Diversification Strategy: Many investors see Bitcoin as a hedge against inflation and a potential diversification tool within their existing portfolios. The ETF structure offers a convenient and regulated way to achieve this diversification, appealing to risk-averse investors as well.

-

Ease of Access: The ease of buying and selling Bitcoin ETFs through traditional brokerage accounts is a major advantage. This contrasts sharply with the complexities associated with directly buying and storing Bitcoin, removing a key barrier for many potential investors.

Market Analysis and Future Outlook:

The $5 billion figure represents a significant milestone, but it's crucial to analyze the market with a nuanced perspective. While the growth is impressive, the futures-based nature of the currently available ETFs means investors are indirectly exposed to Bitcoin's price. This introduces a layer of complexity and potential price discrepancies compared to direct spot Bitcoin investments.

The ongoing debate surrounding the approval of spot Bitcoin ETFs remains a key factor affecting future investment. If and when spot ETFs gain SEC approval, we can expect another substantial influx of investment capital, potentially pushing the total market capitalization significantly higher. [Link to article about Spot Bitcoin ETF applications]

Risks and Considerations:

Despite the optimistic outlook, potential investors should remain aware of the inherent risks associated with Bitcoin and the broader cryptocurrency market. These include:

- Volatility: Bitcoin's price is notoriously volatile, subject to significant fluctuations influenced by market sentiment, regulatory changes, and technological developments.

- Security Risks: While ETFs mitigate some security risks associated with directly holding Bitcoin, investors should still research and choose reputable investment platforms.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is constantly evolving, and future changes could impact the performance of Bitcoin ETFs.

Conclusion:

The surpassing of the $5 billion mark in Bitcoin ETF investments represents a major leap forward for cryptocurrency adoption and mainstream acceptance. While challenges and uncertainties remain, the current trend indicates a strong and sustained interest in Bitcoin, driven by institutional participation and the growing demand for regulated access to this digital asset. The future of Bitcoin ETFs remains bright, promising further growth and possibly a significant reshaping of the financial landscape.

Call to Action: Stay informed about the latest developments in the Bitcoin ETF market and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin ETF Investment Soars Past $5 Billion: Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Las Griffith Park A Contender For The Nations Top City Park

May 20, 2025

Las Griffith Park A Contender For The Nations Top City Park

May 20, 2025 -

M And S And Co Op Data Breach Bbcs Exclusive Interview With Hackers

May 20, 2025

M And S And Co Op Data Breach Bbcs Exclusive Interview With Hackers

May 20, 2025 -

Eurovision 2025 Close Finish Sees Austria Win Uk In 19th Place

May 20, 2025

Eurovision 2025 Close Finish Sees Austria Win Uk In 19th Place

May 20, 2025 -

Prostate Cancer Diagnosis For President Joe Biden Official Confirmation

May 20, 2025

Prostate Cancer Diagnosis For President Joe Biden Official Confirmation

May 20, 2025 -

Balis Tourism Crisis A Call For International Collaboration On Safety And Responsible Travel

May 20, 2025

Balis Tourism Crisis A Call For International Collaboration On Safety And Responsible Travel

May 20, 2025

Latest Posts

-

Market Rally Continues Six Day Win Streak For S And P 500 Amidst Moodys Rating Action

May 21, 2025

Market Rally Continues Six Day Win Streak For S And P 500 Amidst Moodys Rating Action

May 21, 2025 -

Big Changes Ahead Creator Greenlights New Peaky Blinders Series

May 21, 2025

Big Changes Ahead Creator Greenlights New Peaky Blinders Series

May 21, 2025 -

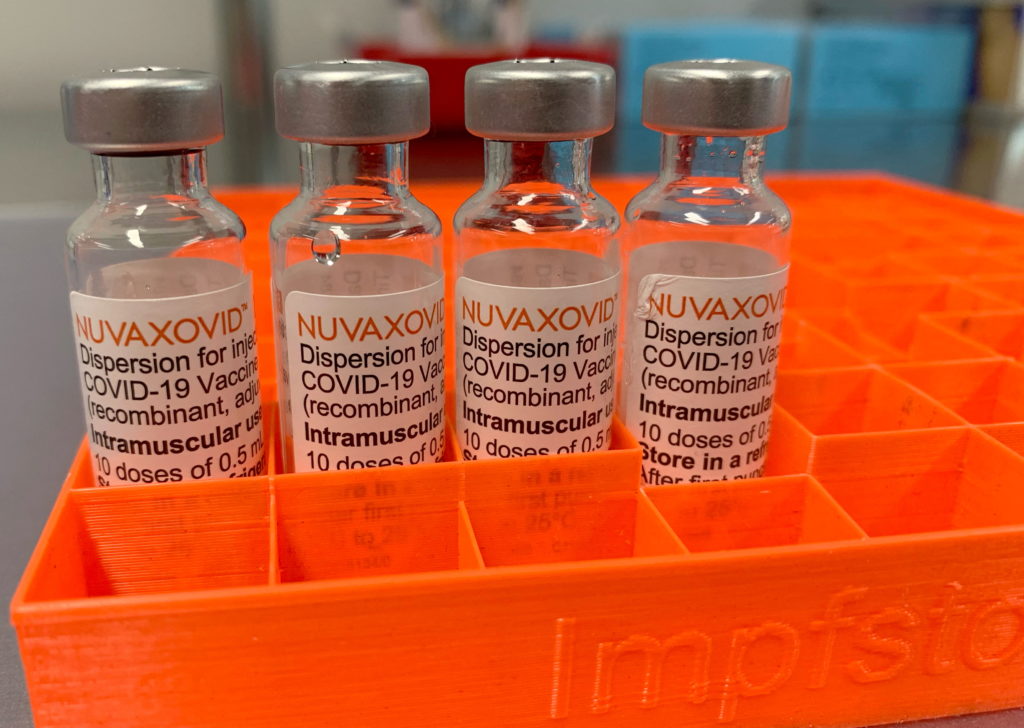

Novavax Covid 19 Vaccine Fda Approval Comes With Strict Conditions

May 21, 2025

Novavax Covid 19 Vaccine Fda Approval Comes With Strict Conditions

May 21, 2025 -

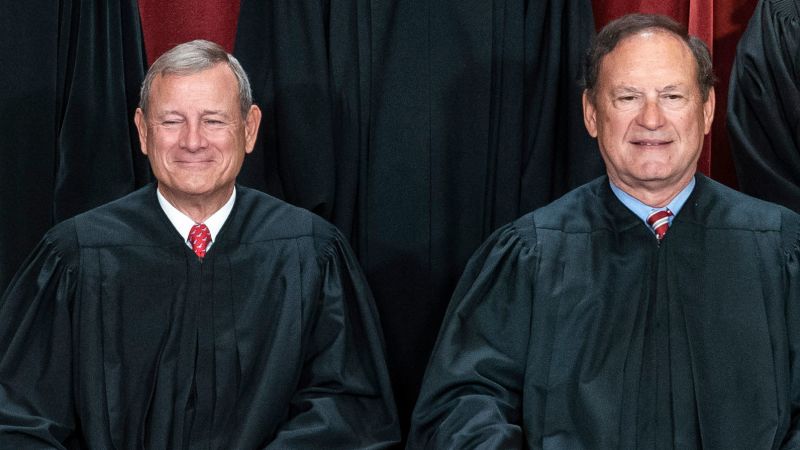

Assessing Justices Alito And Roberts Influence After Two Decades

May 21, 2025

Assessing Justices Alito And Roberts Influence After Two Decades

May 21, 2025 -

Massive Bitcoin Etf Investment 5 B Influx And Its Market Implications

May 21, 2025

Massive Bitcoin Etf Investment 5 B Influx And Its Market Implications

May 21, 2025