Buy Now, Pay Later: Enhanced Regulations To Protect Shoppers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buy Now, Pay Later: Enhanced Regulations to Protect Shoppers from Spiraling Debt

Buy Now, Pay Later (BNPL) services have exploded in popularity, offering consumers a seemingly effortless way to purchase goods and services. However, the rapid growth of this sector has also highlighted significant consumer protection concerns, leading to calls for stricter regulations. Recent regulatory changes aim to address these issues and prevent shoppers from falling into a cycle of debt.

The Rise of BNPL and its Associated Risks:

The convenience of BNPL is undeniable. With a simple online application and often minimal credit checks, consumers can spread the cost of purchases over several weeks or months. This makes larger purchases more accessible and allows for better budgeting, at least in theory. However, the ease of access also presents serious risks:

- Overspending: The ease of use can lead to impulsive purchases and overspending, exceeding a consumer's budget. The seemingly small payments can mask the overall cost, making it easier to accumulate debt.

- Debt Accumulation: Multiple BNPL loans from different providers can quickly spiral out of control, resulting in significant debt burdens. Missing payments can lead to late fees, impacting credit scores.

- Lack of Transparency: Some BNPL providers lack transparency regarding fees and interest rates, leading to unexpected costs and financial hardship. Understanding the true cost of a purchase can be difficult.

- Impact on Credit Scores: While some BNPL providers don't report to credit bureaus, others do, and missed payments can negatively affect a consumer's credit score, impacting future borrowing opportunities.

Enhanced Regulations: A Step Towards Better Consumer Protection:

Recognizing these risks, regulators in many countries are implementing stricter rules governing the BNPL industry. These changes often include:

- Increased Transparency: New regulations mandate clearer disclosure of fees, interest rates, and repayment terms, empowering consumers to make informed decisions.

- Credit Checks and Affordability Assessments: Some jurisdictions are requiring more rigorous credit checks and affordability assessments before approving BNPL loans, preventing consumers from taking on more debt than they can handle.

- Debt Collection Practices: Regulations are being introduced to control aggressive debt collection practices and protect consumers from harassment.

- Stronger Oversight and Enforcement: Regulatory bodies are increasing their oversight of BNPL providers to ensure compliance and take action against those engaging in unfair or deceptive practices.

What Consumers Can Do to Protect Themselves:

While regulations are crucial, consumers also have a role to play in managing their BNPL usage responsibly:

- Budget Carefully: Only use BNPL for purchases you can comfortably afford to repay. Create a budget and track your spending meticulously.

- Compare Providers: Compare fees, interest rates, and repayment terms from different BNPL providers before choosing one. Look for transparent and reputable companies.

- Avoid Overreliance: Don't use BNPL for multiple purchases simultaneously. Limit your use to a manageable number of loans.

- Pay on Time: Always make payments on time to avoid late fees and damage to your credit score.

The Future of BNPL:

The future of the BNPL industry depends on a balance between innovation and responsible lending. While these enhanced regulations represent a significant step towards protecting consumers, ongoing monitoring and further adjustments will be necessary to ensure the long-term sustainability and ethical operation of this rapidly evolving sector. The focus should remain on empowering consumers with the knowledge and tools they need to make informed decisions and avoid the pitfalls of irresponsible borrowing. By fostering a culture of responsible lending and informed consumerism, we can harness the benefits of BNPL while mitigating its risks.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buy Now, Pay Later: Enhanced Regulations To Protect Shoppers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

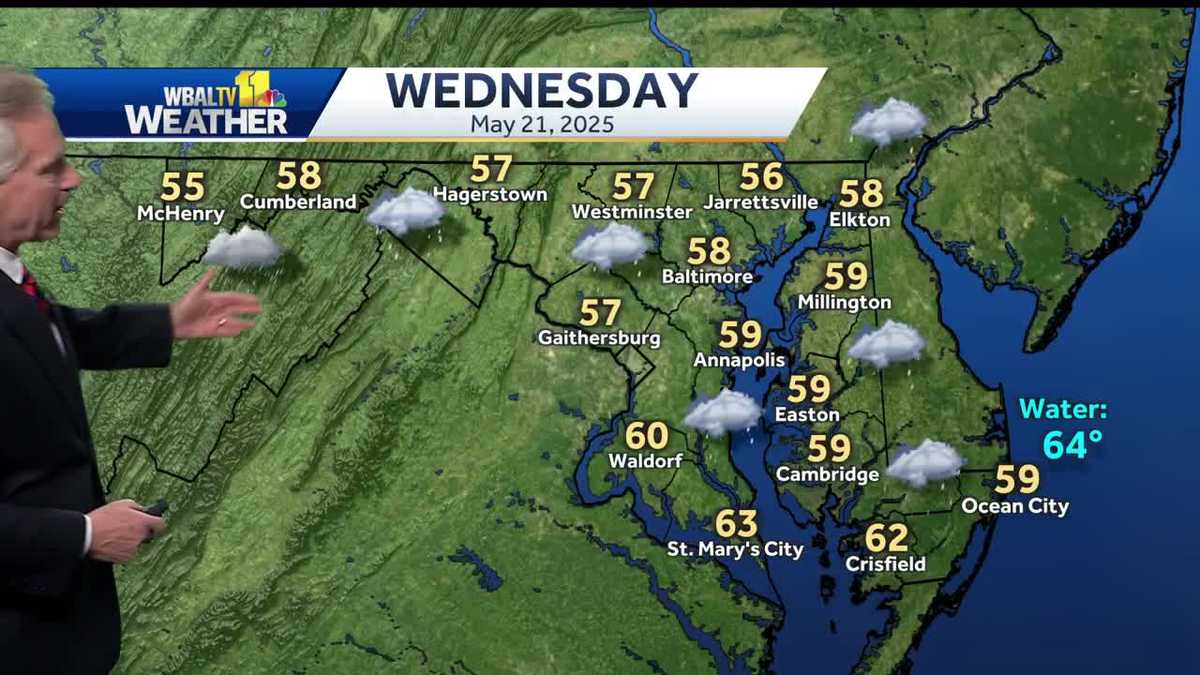

Rain Cold Temperatures Expected Across Region Wednesday

May 21, 2025

Rain Cold Temperatures Expected Across Region Wednesday

May 21, 2025 -

Brexit Showdown Eu And Uk In Tense Talks As Deadline Looms

May 21, 2025

Brexit Showdown Eu And Uk In Tense Talks As Deadline Looms

May 21, 2025 -

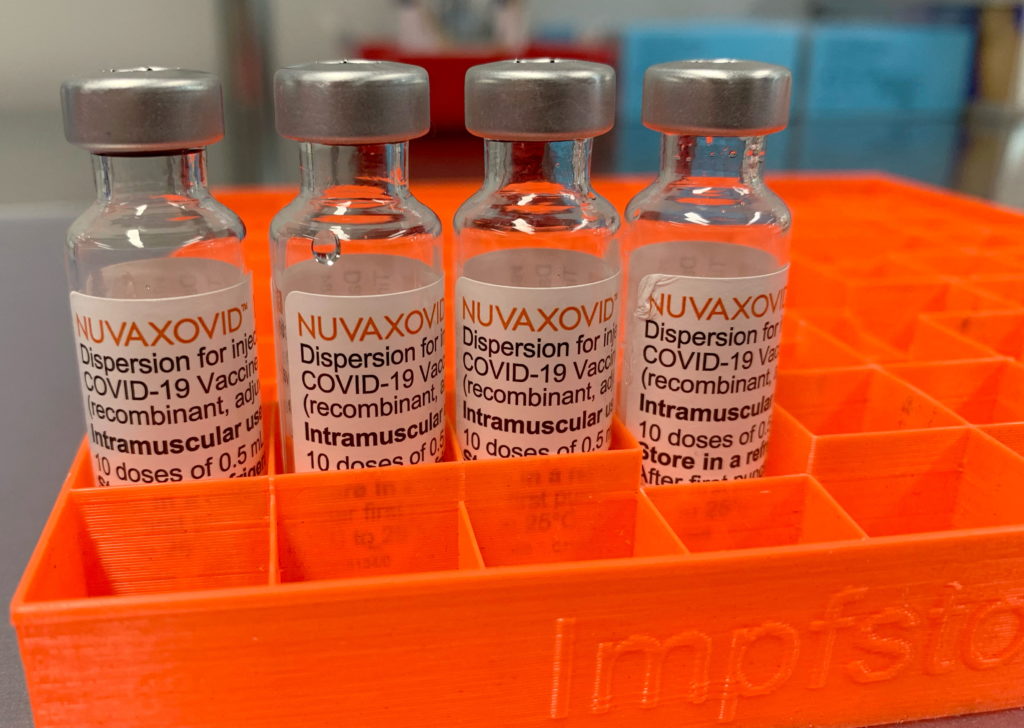

Novavax Covid 19 Vaccine Gets Fda Approval Understanding The Usage Restrictions

May 21, 2025

Novavax Covid 19 Vaccine Gets Fda Approval Understanding The Usage Restrictions

May 21, 2025 -

Jamie Lee Curtis Lindsay Lohan Has Always Kept It Real With Me

May 21, 2025

Jamie Lee Curtis Lindsay Lohan Has Always Kept It Real With Me

May 21, 2025 -

Us Treasury Yields Dip As Federal Reserve Hints At Single 2025 Rate Cut

May 21, 2025

Us Treasury Yields Dip As Federal Reserve Hints At Single 2025 Rate Cut

May 21, 2025

Latest Posts

-

Police Investigate Church Break In Report Of Defecation

May 21, 2025

Police Investigate Church Break In Report Of Defecation

May 21, 2025 -

Trump Doj And James A Complex Web Of Legal Battles

May 21, 2025

Trump Doj And James A Complex Web Of Legal Battles

May 21, 2025 -

Diplomatic Tensions Rise As Allies Demand End To Israels Gaza Operation

May 21, 2025

Diplomatic Tensions Rise As Allies Demand End To Israels Gaza Operation

May 21, 2025 -

New Orleans Jailbreak Fourth Inmate Captured As District Attorneys Staff Seek Safety

May 21, 2025

New Orleans Jailbreak Fourth Inmate Captured As District Attorneys Staff Seek Safety

May 21, 2025 -

Police Teenagers Arrested For Urinating And Defecating In Santa Rosa Church

May 21, 2025

Police Teenagers Arrested For Urinating And Defecating In Santa Rosa Church

May 21, 2025