Buy Now, Pay Later: New Rules Aim To Curb Risks For Consumers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buy Now, Pay Later: New Rules Aim to Curb Risks for Consumers

Buy Now, Pay Later (BNPL) services exploded in popularity in recent years, offering consumers a seemingly effortless way to purchase goods and services. However, the rapid growth of this sector has also raised significant concerns about consumer debt and financial vulnerability. Recognizing these risks, regulators worldwide are stepping in with new rules aimed at protecting consumers and promoting responsible lending practices. This article explores the evolving landscape of BNPL regulations and what they mean for you.

The Rise and Fall (and Rise Again) of BNPL's Popularity

BNPL services, offered by companies like Klarna, Affirm, and Afterpay (now a part of Square), promised a seamless shopping experience. Their appeal lies in their convenience: customers can spread the cost of purchases over several installments, often with minimal upfront fees. This made them particularly attractive to younger generations and those with limited access to traditional credit.

However, the ease of access also fueled concerns. Many users found themselves juggling multiple BNPL loans, accumulating debt without fully understanding the implications. Missed payments can lead to hefty late fees, damage to credit scores, and even debt collection actions. The lack of stringent regulation in the early days allowed for rapid expansion, but also contributed to a growing problem.

New Regulations: A Shift Towards Consumer Protection

Recognizing the potential for harm, regulatory bodies are taking action. The specific regulations vary by country, but several key themes emerge:

- Increased Transparency: New rules are mandating greater transparency regarding fees, interest rates, and repayment schedules. Consumers need clear and concise information upfront to make informed decisions.

- Credit Checks: Some jurisdictions are requiring BNPL providers to conduct credit checks before approving loans, ensuring that borrowers can realistically afford their repayments. This helps prevent over-indebtedness.

- Debt Collection Practices: Regulations are also focusing on responsible debt collection practices, limiting the aggressive tactics employed by some providers.

- Affordability Assessments: Several regulators are pushing for stricter affordability assessments to ensure that loans are only offered to those who can realistically repay them. This often involves assessing income and existing debt levels.

What These Changes Mean for Consumers

The changes brought about by these new regulations are designed to benefit consumers in several ways:

- Better Financial Literacy: The increased transparency provided by these rules empowers consumers to make more informed choices and avoid accumulating unsustainable debt.

- Reduced Risk of Over-Indebtedness: By implementing credit checks and affordability assessments, the risk of consumers taking on more debt than they can manage is significantly reduced.

- Fairer Debt Collection Practices: Regulations surrounding debt collection ensure that consumers are treated fairly and avoid harassment tactics.

Looking Ahead: A More Responsible BNPL Landscape

The future of BNPL hinges on responsible lending and effective regulation. While the convenience offered by these services remains attractive, the new regulations are a necessary step towards protecting consumers from the potential pitfalls. As the regulatory landscape continues to evolve, consumers can expect a more responsible and transparent BNPL market, fostering a healthier financial ecosystem.

Call to Action: Learn more about the BNPL regulations in your region by visiting your country's financial regulator website. Understanding your rights and responsibilities is crucial when using Buy Now, Pay Later services. Remember to budget carefully and only use BNPL services when you can comfortably manage the repayments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Buy Now, Pay Later: New Rules Aim To Curb Risks For Consumers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Autonomous Vehicles Ubers Uk Driverless Car Launch Delayed Until 2027

May 20, 2025

Autonomous Vehicles Ubers Uk Driverless Car Launch Delayed Until 2027

May 20, 2025 -

Massive Bitcoin Etf Investments Whats Driving The Market Trend

May 20, 2025

Massive Bitcoin Etf Investments Whats Driving The Market Trend

May 20, 2025 -

Freaky Friday Reunion Jamie Lee Curtis On Her Bond With Lindsay Lohan

May 20, 2025

Freaky Friday Reunion Jamie Lee Curtis On Her Bond With Lindsay Lohan

May 20, 2025 -

Bucharest Mayor Nicusor Dan Wins Romanias Presidential Election

May 20, 2025

Bucharest Mayor Nicusor Dan Wins Romanias Presidential Election

May 20, 2025 -

Israeli Strikes On Gaza Final Northern Hospital Hit Raising Humanitarian Crisis Concerns

May 20, 2025

Israeli Strikes On Gaza Final Northern Hospital Hit Raising Humanitarian Crisis Concerns

May 20, 2025

Latest Posts

-

Market Rally Continues Six Day Win Streak For S And P 500 Amidst Moodys Rating Action

May 21, 2025

Market Rally Continues Six Day Win Streak For S And P 500 Amidst Moodys Rating Action

May 21, 2025 -

Big Changes Ahead Creator Greenlights New Peaky Blinders Series

May 21, 2025

Big Changes Ahead Creator Greenlights New Peaky Blinders Series

May 21, 2025 -

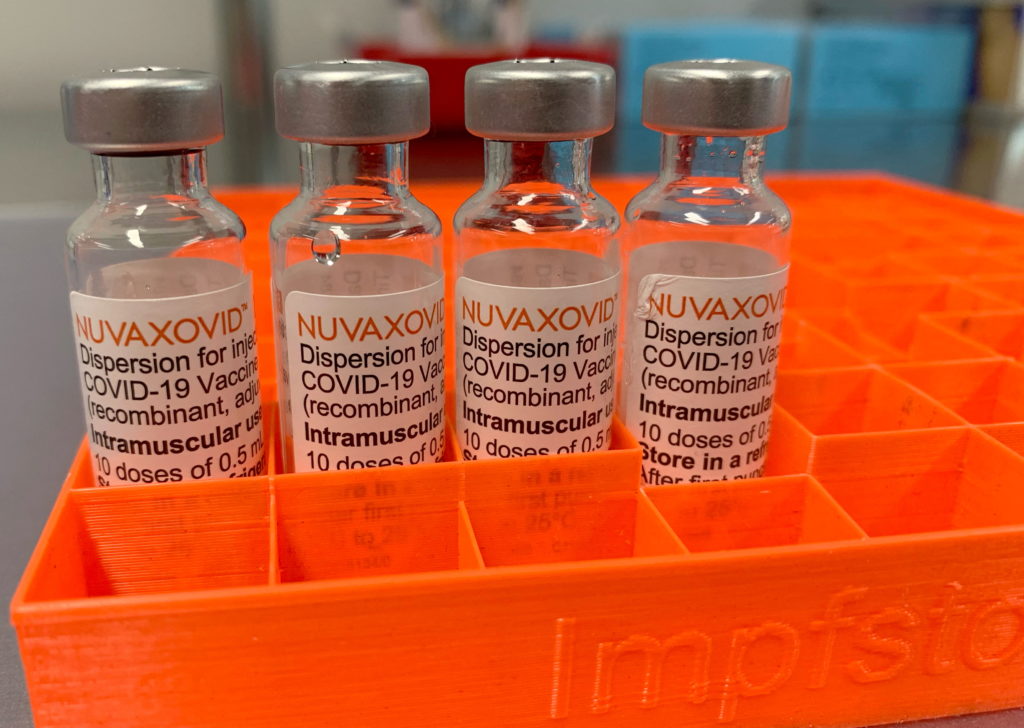

Novavax Covid 19 Vaccine Fda Approval Comes With Strict Conditions

May 21, 2025

Novavax Covid 19 Vaccine Fda Approval Comes With Strict Conditions

May 21, 2025 -

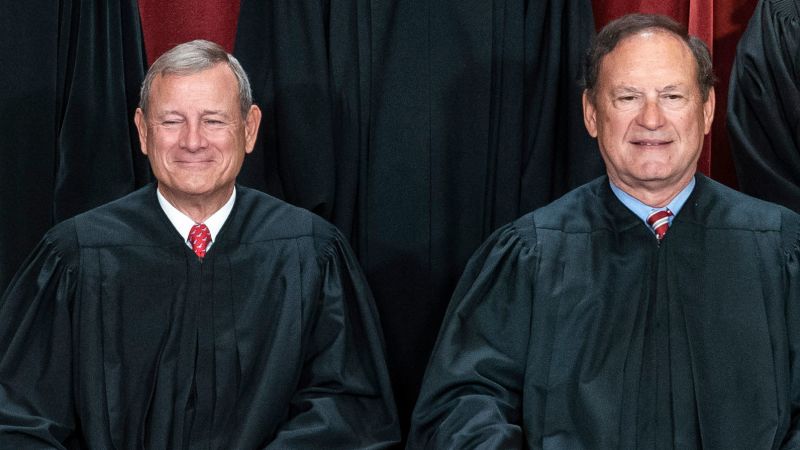

Assessing Justices Alito And Roberts Influence After Two Decades

May 21, 2025

Assessing Justices Alito And Roberts Influence After Two Decades

May 21, 2025 -

Massive Bitcoin Etf Investment 5 B Influx And Its Market Implications

May 21, 2025

Massive Bitcoin Etf Investment 5 B Influx And Its Market Implications

May 21, 2025